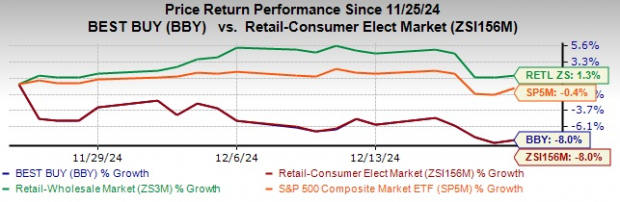

Best Buy‘s BBY stock has lost 8% over the past month, which is in line with the Zacks Retail – Consumer Electronics industry. Meanwhile, the Retail-Wholesale sector has risen 1.3% and the S&P 500 Index has declined 0.4%. As of Dec. 20, Best Buy’s shares closed at $85.55, trading 17.5% below its 52-week high of $103.71 reached on Aug. 29, 2024.

BBY Stock Past-Month Performance

Image Source: Zacks Investment Research

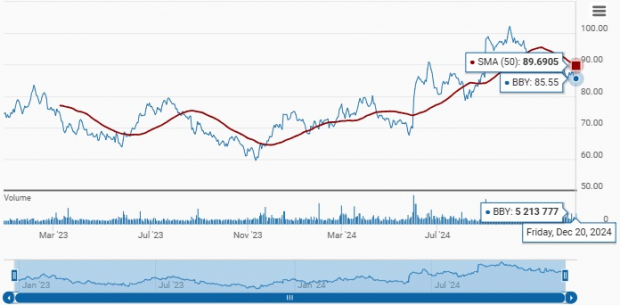

Best Buy’s stock has fallen below critical technical thresholds, including its 50-day moving average of $89.69. This moving average is an important indicator for gauging market trends and momentum. The breach of this threshold heightens investor concerns about the stock’s short-term outlook and signals the potential for downside if these levels are not reclaimed.

BBY Trades Above 50-Day Moving Averages

Image Source: Zacks Investment Research

What’s Hurting BBY Stock?

Best Buy faces multiple headwinds that make it a less compelling investment opportunity in the near term. Increasing competition from major players like Amazon AMZN, Walmart WMT and Target TGT has intensified pressure on Best Buy.

BBY’s declining revenue trajectory raises red flags. In the third quarter of fiscal 2025, the company reported a 2.9% drop in enterprise revenues. Domestic revenues, which comprise the bulk of its total revenues, fell 3.3%, reflecting muted consumer demand in pivotal product categories like appliances, home theater and gaming. International operations present additional challenges, with revenues in this segment declining 1.6%. The persistent slide in comparable sales further underscores Best Buy’s difficulties in stabilizing its top line amid growing competition and cautious consumer spending.

Inflationary pressures, election-related distractions and consumer hesitancy have led to inconsistent demand, particularly in non-essential categories. BBY’s reliance on promotional events to stimulate sales only intensifies this volatility. While promotional strategies, including aggressive trade-in offers, have driven foot traffic, the same came at the expense of profitability. Management expects the product margin to be under pressure in the fourth quarter of fiscal 2025.

Adding to the complexity, underperformance in high-margin categories like gaming, home theater and appliances signals deeper structural issues. These segments, traditionally key profit drivers, have struggled to gain traction even during promotional periods, exacerbating revenue challenges and limiting profitability recovery avenues.

Best Buy’s cautious guidance raises concerns. Management projected comparable sales for the fiscal fourth quarter between flat and a 3% decline, with full-year sales guidance revised downward to $41.1-$41.5 billion from the $41.3-$41.9 billion mentioned earlier. This tempered forecast reflects the company’s expectation of continued volatility in consumer spending patterns.

What Could Help Best Buy Stock Rebound?

Best Buy’s potential rebound hinges on several key factors rooted in its strong fundamentals and growth initiatives. The company’s robust performance in computing and tablet categories stands out as a driver, with a 5.2% comparable sales growth in the third quarter of fiscal 2025. This was led by a 7% rise in laptop sales, the strongest rise since April 2021, driven by consumer demand for AI-enhanced devices and innovation-driven upgrades.

The company’s paid membership program has been a cornerstone of profitability, contributing to a gross margin expansion of 60 basis points in the fiscal third quarter. Enhanced membership tiers and improved service offerings have driven higher renewal rates and increased member spending, bolstering long-term customer loyalty.

Best Buy’s omnichannel strategy has further solidified its market leadership. With online sales accounting for 31% of domestic revenues, rapid fulfillment capabilities, and seamless integration between digital and physical channels, the company has created a customer-centric shopping experience. Enhanced app features and the introduction of tools like the AI-powered “Gift Finder” have not only driven engagement but also improved operational efficiency.

BBY’s ongoing store refresh initiatives have driven engagement and category-specific improvements. Updates to sections like mobile phones and smart home devices, coupled with modular merchandising solutions, have enhanced the in-store experience. Additionally, expanding into smaller-format stores tailored to specific market needs demonstrates adaptability and strategic growth in underserved regions. Notably, the company has opened a 15,000-square-foot location in Bozeman, MT.

International expansion through the Best Buy Express collaboration with Bell Canada has diversified its footprint, allowing entry into 61 Canada markets. Early positive feedback indicates the potential for incremental revenue growth, leveraging Best Buy’s expertise in electronics and services.

Estimate Trend for BBY

Reflecting a more cautious outlook for Best Buy, the Zacks Consensus Estimate for earnings per share has experienced downward revisions. Over the past 30 days, the consensus estimate for the current and next fiscal has slipped 10 cents and 22 cents to $6.18 and $6.66 per share, respectively.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Unlocking BBY’s Valuation

In terms of the price-to-earnings (P/E) ratio, Best Buy is currently trading at a premium to its industry and the sector. The stock has a forward 12-month P/E ratio of 12.95 compared with the forward 12-month P/E ratio of 11.69 for the industry. Given its premium valuation, investors may need to carefully assess whether the company’s growth prospects justify the higher multiple in light of current challenges.

Image Source: Zacks Investment Research

Should You Invest in BBY Stock?

Given the current challenges that Best Buy faces, investors may want to exercise caution before considering it a viable investment option. The company’s ongoing revenue decline, underperformance in high-margin categories and reliance on promotional strategies raise concerns. The breach of critical technical levels and tempered guidance reflect challenges.

While there are some positive initiatives in play, they appear insufficient to offset headwinds for now. Currently, BBY carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report