Tech stocks are on a roll, maintaining their position of market dominance, as they build upon a stellar performance from last year, ushering in the New Year with a display of resolute momentum. This surge is fueled by an array of favorable macroeconomic developments, specifically the mounting confidence in the Fed’s commitment to easing policy, neutralizing inflationary pressures while safeguarding the economy.

Additionally, the Tech sector’s buoyancy is buoyed by the emerging optimism surrounding the impact of artificial intelligence (AI). This phenomenon has sparked comparisons to the late 1990s, signifying a collective realization that the worst of Tech spending impediments may be receding.

Performance Indicators

As many Tech companies prepare to disclose their December-quarter results this week, investors eagerly await insights into business spending trends, particularly in the cloud domain. A pivotal factor in Tech’s brightened earnings projection for 2023 is the efficacy of cost management, which has contributed to margin stability. Clear visibility on top-line patterns will nurture the favorable trend in earnings projections and reinforce the sector’s remarkable stock market momentum.

The ongoing AI debate, marked by notable revenue impacts from industry players such as Nvidia and Microsoft, raises anticipation about the transformative potential of this innovation and its prospective productivity enhancement.

The stock market is essentially a forward-looking mechanism. Consequently, the realization of viable AI-driven business models in the future would vindicate the current market enthusiasm.

Foremost amongst these tech titans slated to report earnings this week are Alphabet and Microsoft after the market close on Tuesday (1/30), followed by Meta Platforms, Amazon, and Apple after the close on Thursday (02/01). Tesla has already reported, with Nvidia’s results expected by the end of February.

Market Performance

An examination of the one-year stock performance of the Zacks Technology sector, Microsoft, Amazon, Alphabet, Meta, and Apple discloses significant gains. Notably, the Technology sector surged by +46.1%, outperforming the S&P 500 index, which clocked a gain of +20.7%.

Apple, while not reflecting the same marked performance as its cohort members, still managed to stand out. Attention surrounding the company is centered on its China prospects, with potential concerns emanating from the watch line also influencing market sentiment.

Digital advertising, traditionally considered a stronghold for Alphabet and Meta, has seen Amazon assert a formidable presence in this domain. The stability in advertising expenditure, observed over the past few quarters, prompts interest in how these companies envision trends amid the current macroeconomic ambiguities.

These themes are also pertinent to Snap, which is scheduled to report Q4 results in the ensuing week (February 6th).

AI and Business Models

All the aforementioned companies wield significant influence in the AI space. The intensified rivalry between Microsoft and Alphabet underlines the pertinence of AI monetization through new and established business models. Earnings calls are expected to shed light on their AI strategies.

Corporate Projections

Current consensus projections for the ‘Big 7 Tech Players’ depict anticipated earnings growth of +38.6% and revenue upsurge of +12.4% year over year. Notably, these forecasts have exhibited a steadfast uptrend in recent months.

Expectations for the Technology sector as a whole indicate a forecasted +19.3% year-over-year earnings surge and a +7.1% revenue escalation in Q4.

Notably, the Zacks Tech sector’s earnings growth transitioned into positive territory only in the second quarter of 2023, signaling an imminent emergence from the growth slump induced by the pandemic.

Bottom-Line Insights

Analysis of the ‘Big 7 players’ and the broader sector suggests that the most daunting phase of the growth challenge has now receded. This outlook is underscored by an upward trajectory in profitability, with substantial gains forecasted for the present year and beyond.

Q4 Earnings Show Modest Growth: An Investor’s Perspective

As illustrated in the data, the expected Q4 earnings for 2023 are anticipated to rise by +1.1%, with a parallel increase of +2.4% in revenues. This performance follows the previous period, wherein a +3.8% growth in earnings was observed for 2023 Q3, after three consecutive quarters of decreasing earnings.

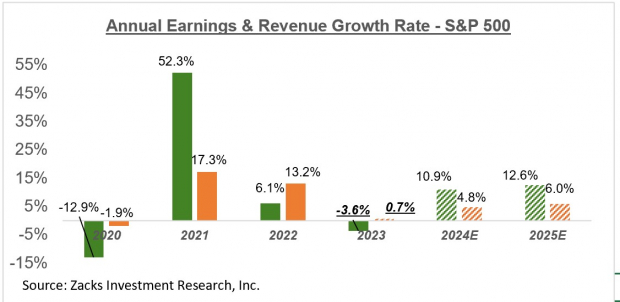

Annual Earnings Picture

There are expectations of an upsurge in Q4 earnings based on the annual analysis, providing a favorable outlook for the investors.

Image Source: Zacks Investment Research

Q4 Earnings Season Scorecard

Reportedly, 124 S&P 500 members, totaling 24.8% of the index’s complete membership, have released their Q4 results, with improvements expected from additional 300 companies and 106 S&P 500 members scheduled to report this week.

Results up till January 26th indicate a decline of -0.4% in total Q4 earnings as compared to the previous year, coupled with a +3.4% revenue increase, featuring impressive beats in both EPS and revenue estimates.

Historical Context of Earnings and Revenue Growth

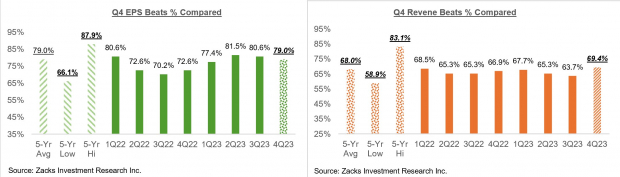

The comparison charts below provide a historical context for the Q4 earnings and revenue growth rates, offering insight for investors.

Image Source: Zacks Investment Research

The comparison charts below put the Q4 EPS and revenue beats percentages in a historical context, enabling investors to gauge performance.

Image Source: Zacks Investment Research

Investor Opportunities

Amid this scenario, investors may benefit from exploring prospects in the market. Delve into the weekly Earnings Trends report for a comprehensive examination of the ongoing earnings scenario and future prospects.

5 Stocks Set to Double

Uncover potential investment opportunities with Zacks-recommended stocks that have demonstrated substantial growth. These under-the-radar stocks present an exciting opportunity for investors to get in on the ground floor.

Reveal These 5 Potential Home Runs Today >>