Hedge fund billionaire Bill Ackman’s decision to sell his Netflix Inc. NFLX shares during a rough patch in 2022 has become one of the most high-profile missed opportunities today.

What Happened: In January 2022, Ackman revealed that his hedge fund, Pershing Square Capital Management, had purchased more than $1 billion worth of Netflix stock—about 3.1 million shares—when it was trading around $400.

The move came after Netflix stock had fallen more than 65% amid concerns over slowing growth and a tech-sector sell-off. However, the bet soured quickly.

By April, Netflix’s stock plummeted further following a disappointing earnings report and investor uncertainty surrounding its ad-based subscription plans.

See Also: Netflix CEO Says Streaming Company ‘Saved Hollywood’ As Stock Hits New All-Time Highs

Ackman exited the position just three months later, when shares were trading near $225, taking a loss of approximately 40%. In total, Pershing Square’s short-lived Netflix investment cost the firm an estimated $400 million.

At the time, the sale seemed prudent. Netflix’s stock continued to slide, bottoming out near $175 in the following months. But in a surprising turn, both the broader tech sector and Netflix rebounded sharply. As of today, Netflix shares are trading around $1,096.87—a stunning recovery of over 168.085% from Ackman’s highest estimated buy-in.

Had Ackman held onto the position, those 3.1 million shares would now be worth nearly $3.4 billion, turning a brief misstep into one of his most lucrative trades ever.

Why It’s Important: Last week, Netflix Co-CEO Greg Peters reassured investors that the company remains confident, even amid market turbulence and growing recession fears driven by new tariffs.

He went on to say that entertainment has traditionally remained strong during economic downturns, and Netflix continues to see that pattern hold.

Co-CEO Ted Sarandos added that the company is staying focused on factors within its control, stating, “We’re not changing anything in the forecast.”

For the first quarter, Netflix reported revenue of $10.54 billion—a 12.5% year-over-year increase—slightly beating Wall Street’s estimate of $10.52 billion.

Global markets have seen heightened volatility in response to new trade tariffs introduced by President Donald Trump. The S&P 500 is down by 6.54% year-to-date while the Nasdaq-100 has slipped 8.40% during the same period.

Price Action: Netflix shares are up 23.70% year-to-date and have soared 94.21% over the past 12 months, according to Benzinga Pro.

The streaming giant holds a growth score of 69.79% and a momentum rating of 95.93, based on Benzinga Edge Stock Rankings. Click here to see how it compares to other leading entertainment and tech companies.

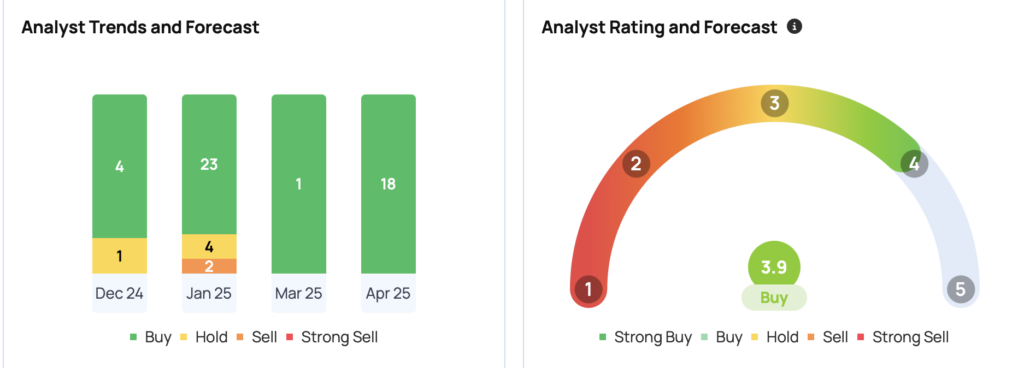

Netflix currently has a consensus price target of $1,082.97 from 32 analysts, with the highest target of $1,514 issued by Rosenblatt on April 21. Recent ratings from Evercore ISI Group, Macquarie, and Wedbush point to an average target of $1,183.33, suggesting an 8.17% potential upside.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs