Industrial Sector Dips Amongst Stormy Market Conditions

Boeing (NYSE:BA), a prominent player in the aviation industry, found itself at the forefront of a turbulent week for stocks.

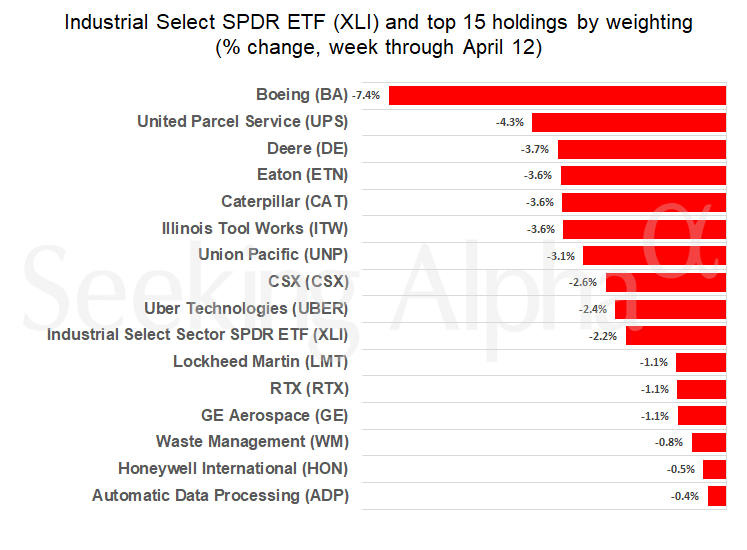

The Industrial Select Sector SPDR ETF (NYSEARCA:XLI), housing some of the largest U.S. sector companies, experienced a setback of 2.2% during the same period.

Market Rumbles in Sync: A Week of Declines Across Benchmarks

The general market sentiment was one of decline as reflected in benchmark indices: the S&P 500 declined by 1.5%, the Dow Industrials Average fell by 2.4%, and the Nasdaq Composite slid by 1.6%.

Inflation Worries and Geopolitical Tensions Add to Market Turmoil

The unexpectedly rapid rise in consumer prices during March raised concerns among investors regarding persistent inflationary pressures and the Federal Reserve’s potential reluctance to ease borrowing rates.

Geopolitical tensions in the Middle East, particularly threats exchanged between Iran and Israel following an incident in Syria, led to spikes in oil prices. Iran’s subsequent offensive intensified concerns.

Market Response to Economic Indicators

The yield on the 10-year Treasury note surged to 4.499% from 4.377% in the previous week, reflecting market nervousness.

Additionally, gold futures secured a 1.3% gain during the week, hitting a new high on Friday.

Boeing’s Plummet and Production Woes

Boeing (BA) encountered a dismal week with a 7.4% drop, extending its year-to-date loss to a staggering 35%, culminating in touching a 52-week low on Friday.

The aerospace and defense giant reported its lowest quarterly deliveries of commercial planes since mid-2021, including a reduced number of its popular 737 narrowbody jets.

The Federal Aviation Administration’s production restrictions in response to safety concerns further impeded Boeing. The limitation to 38 jets per month resulted from a door plug incident on an Alaska Airlines-operated 737 Max. Despite the setback, Boeing managed to deliver 24 of the aircraft in March.