Broadcom Inc. AVGO skyrocketed more than 20% during Friday morning trading, hitting all-time highs after its fiscal fourth-quarter earnings blew past Wall Street estimates.

The semiconductor giant’s growth narrative is now turbocharged by a massive artificial intelligence (AI) opportunity, with analysts projecting a multibillion-dollar windfall in the years ahead.

The stock’s surge catapulted Broadcom into the exclusive trillion-dollar market cap club, placing it as the eighth-largest publicly traded company, just behind Tesla Inc. TSLA.

For context, the trillion-dollar elite is rarefied territory, shared only by the “Magnificent Seven” tech giants.

Is Broadcom The Eighth Magnificent Tech Stock?

| Name | Market Cap |

| Apple Inc. AAPL | $ 3.73 trillion |

| Microsoft Corporation MSFT | $ 3.33 trillion |

| NVIDIA Corporation NVDA | $ 3.31 trillion |

| Amazon.com, Inc. AMZN | $ 2.39 trillion |

| Alphabet Inc. GOOG GOOGL | $ 2.35 trillion |

| Meta Platforms, Inc. META | $ 1.57 trillion |

| Tesla, Inc. | $ 1.37 trillion |

| Broadcom Inc. | $ 1.02 trillion |

December To Remember: Broadcom Eyes Record Month Since IPO

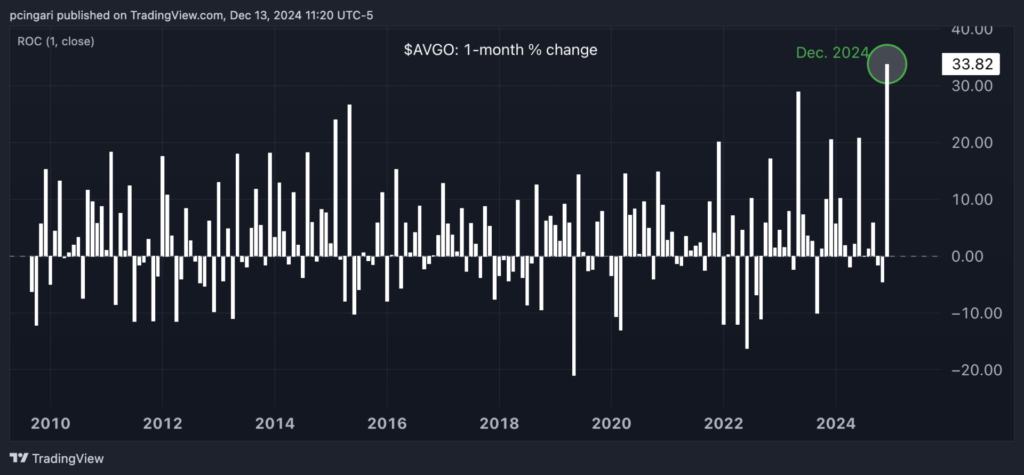

With Friday’s spike, Broadcom’s stock has already rallied 33% in December, marking its strongest monthly performance since going public in 2009.

The semiconductor heavyweight has now climbed an impressive 95% year-to-date, securing the title of the 10th-best-performing stock in the S&P 500 for 2024 thus far.

When considering combined returns for 2023 and 2024, Broadcom ranks seventh in the benchmark index.

Read Also: Nvidia, AMD, Taiwan Semi Gain As Broadcom’s Q4 Performance Sparks Sector-Wide Surge

| Name | Price Chg. % (YTD 2024) | Total Return (2023) | Combined Gains |

|---|---|---|---|

| Palantir Technologies Inc. PLTR | 325.31% | 167.45% | 1,112.89% |

| NVIDIA Corporation | 173.24% | 239.02% | 639.72% |

| Vistra Corp. VST | 279.37% | 70.73% | 508.67% |

| Meta Platforms, Inc. | 75.99% | 194.13% | 341.37% |

| Royal Caribbean Cruises Ltd. RCL | 88.63% | 161.97% | 371.64% |

| Super Micro Computer, Inc. SMCI | 26.46% | 246.24% | 324.29% |

| Broadcom Inc. | 94.99% | 104.18% | 296.19% |

| Axon Enterprise, Inc. AXON | 147.91% | 55.69% | 289.91% |

| Fair Isaac Corporation FICO | 88.05% | 94.46% | 292.80% |

| Arista Networks Inc ANET | 87.89% | 94.07% | 291.65% |

Why Analysts Love Broadcom

Bank of America’s analyst Vivek Arya reiterated a “Buy” rating on Broadcom following the quarterly report, boosting the 12-month price target from $215 to $250 and hinting at a potential 15% upside from current levels.

Arya’s optimism stems from three main drivers:

- AI’s Expanding Footprint: Broadcom’s custom AI chips (ASICs) now serve five major customers, up from three previously. The company’s AI-related revenue could soar to a served available market of $60–$90 billion by 2027—up from an estimated $15–$20 billion in 2023.

- Apple’s Steady Demand: Broadcom is expected to maintain its strong relationship with Apple, despite prior concerns about declining content orders.

- Robust Earnings Growth: Analysts forecast a 15% sales growth and a 20% adjusted earnings-per-share (EPS) growth trajectory through 2026, underpinned by Broadcom’s diversified portfolio spanning silicon and infrastructure software.

“Broadcom’s AI-driven growth potential and diversified base position it as one of the best opportunities in the chip sector,” Arya said in a note, justifying their upward revision of earnings per share in fiscal year 2025 and 2026 by 5% and 3%, respectively.

Read now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs