The year 2024 proved very eventful for the semiconductor companies in the U.S. tech sector. It rewarded those, including Nvidia Corp NVDA and Broadcom Inc AVGO, that successfully tapped the artificial intelligence wave while punishing those that failed, like Intel Corp INTC.

A third of the ten global companies worth over $1 trillion came from the chip industry, Bloomberg reports.

Also Read: Nvidia Completes Run:ai Buyout: Details

In 2024, Broadcom joined Taiwan Semiconductor Manufacturing Co TSM and Nvidia in the coveted Trillion club.

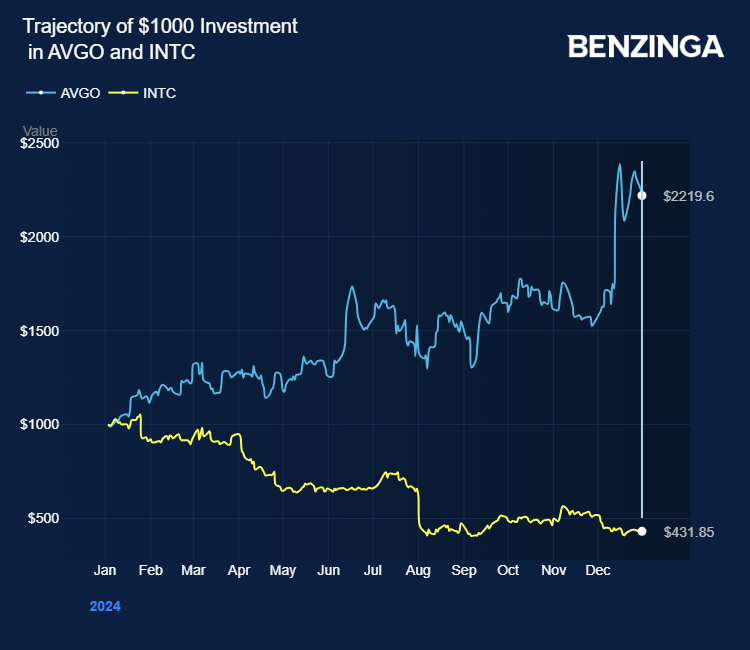

Broadcom stock surged 114%, while Intel plunged 58% in the last 12 months, underscoring the strategies that worked or failed for the companies.

Broadcom develops custom chips for U.S. Big Tech companies like Alphabet Inc GOOG GOOGL, Google, Meta Platforms Inc META, and Microsoft Corp MSFT.

Contract chipmaker Intel lost out on mobile chips to Qualcomm Inc QCOM, Arm Holdings plc ARM, and Apple Inc AAPL, CNBC reports.

Nvidia proved to be another nemesis for Intel after the former’s GPUs, targeted at video games, have transformed into critical hardware for developing AI models. Advanced Micro Devices, Inc AMD also started snatching market share in the PC and server CPU markets by tapping Taiwan Semiconductor, which proved a triple whammy for Intel.

All of which rendered Intel’s CPU, formerly the most significant and expensive part of a server, redundant in an AI server. Nvidia GPUs meant for 2025 do not need an Intel CPU.

Meanwhile, Broadcom emerged as the second most valuable chip company after Nvidia, which reached a $3.4 trillion valuation thanks to the AI frenzy, gaining 179% in the last 12 months.

Once the most valuable chipmaker, Intel saw its valuation tumble from a $300 billion market cap in 2020 to $85 billion in 2024, prompting it to downsize its workforce, fire veteran CEO Pat Gelsinger, and potentially divest core parts of its business. Nvidia replaced it in the Dow Jones Industrial Average.

Investors continue to reward Broadcom for its more straightforward and affordable XPUs than Nvidia’s GPUs.

On the company’s earnings call, Broadcom chief Hock E. Tan shared plans to double shipments of its XPUs to its three hyperscale providers, including Google and, reportedly, TikTok parent ByteDance and Meta.

Tan expects the companies to incur $60 billion—$90 billion in XPU capital expenditures in the next two years. Broadcom expects AI revenue to constitute 65% of its revenue in the first quarter from 40% in the fourth quarter.

Tan projected a decade-long sustained AI demand backed by Big Tech ambitions, citing investments by OpenAI and Elon Musk’s xAI. Rosenblatt’s Hans Mosesmann expects Broadcom’s custom-chip (ASIC) AI abilities and surging AI demand to boost rivalry with AMD and Nvidia.

In 2025, Intel will release a new AI chip dubbed Falcon Shores.

Intel had divulged plans to turn its foundry business into an independent unit and does not expect meaningful sales from outside customers until 2027.

Goldman Sachs’ Toshiya Hari, Benchmark’s Cody Acree, Needham’s N. Quinn Bolton, Oppenheimer’s Rick Schafer, and KeyBanc’s John Vinh flagged Intel’s competitive pressures and margin challenges on the back of modest revenue growth.

Investors can gain exposure to the semiconductor sector through VanEck Semiconductor ETF SMH and iShares Semiconductor ETF SOXX.

Price Actions: At last check Thursday, AVGO stock was up 2.45% at $237.51 premarket, while INTC stock was up 1.20%.

Also Read:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.