Time and again, Broadcom Inc. AVGO has benefitted its shareholders from its growing broadband, wireless and mobile communication businesses. Now, the company’s initiatives to make the most of the burgeoning artificial intelligence (AI) field and the latest stock buyback plan should certainly please income-oriented investors. Let us, thus, look at whether it’s the right time to buy Broadcom shares.

Broadcom Stock – Share Repurchase Plan

Broadcom’s shares were up more than 3% in the extended trading session on Monday after the company announced a share buyback program of up to $10 billion.

The company is expected to repurchase its common stock throughout the year as CEO Hock Tan showed assurance in the semiconductor company and its AI-related investments.

The California-based company that supplies semiconductors to Apple Inc. AAPL snapped a two-day losing streak due to President Trump’s tariffs and finished over 5% higher on Monday.

Stock Buyback – A Good Sign for Broadcom

Broadcom’s $10 billion stock buyback program is a tell-tale sign that management is cheerful about the company’s prospects. Tan said that Broadcom is well-poised to excel in infrastructure software for mission-critical operations. He added that the company is in a position to help hyperscalers innovate with generative AI on their platforms.

A stock buyback, anyhow, indicates the company is healthy. This is because stock buybacks reduce outstanding shares and increase the value of the remaining shares, benefiting stakeholders. Moreover, the decrease in outstanding shares leads to an increase in the stock price. So, it’s expected that Broadcom’s stock price should scale upward in the long run.

Key AVGO Tailwind: XPUs Are Gaining Popularity

While NVIDIA Corporation’s NVDA graphic processing units (GPUs) have gained immense popularity in recent times, AI hyperscalers are also in demand as they can do one type of workload like training AI models very well. Here, Broadcom’s execution processing units (XPUs) step in as they can work on a particular workload and may even outperform NVIDIA’s GPUs.

There is a serious demand for Broadcom’s custom AI accelerator, and the company expects the market size for its XPUs to reach $60 billion to $90 billion in fiscal 2027, way more than 2024’s $12.2 billion. Broadcom is developing the first-of-its-kind 2-nanometer AI XPU as demand for accelerator chips grows due to its innate capability to perform tasks at a lower cost than GPUs.

Is Now the Time to Buy AVGO Stock?

Introducing a share repurchase plan, and XPUs gaining popularity in the coming years should allure anyone to buy Broadcom shares. The company has lately been performing well, with its first-quarter fiscal 2025 revenues coming in at $14.9 billion, up 25% year over year. Its earnings per share (EPS) of $1.60 a share increased 45.5% from a year ago.

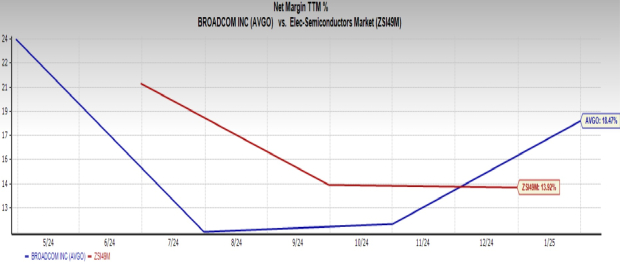

What’s more, the company’s net profit margin is 18.5%, more than the Electronics – Semiconductors industry’s 13.9%, indicating financial stability.

Image Source: Zacks Investment Research

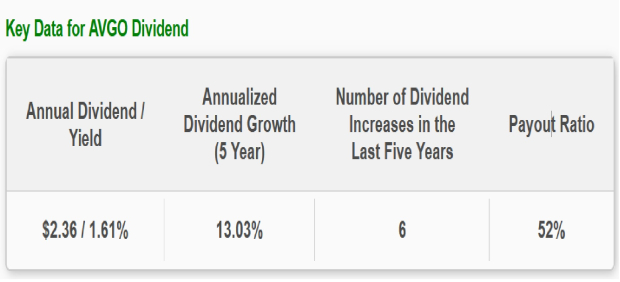

Broadcom also has a sound business model since its dividend payout has increased by 13% over the past five years. Its payout ratio sits at 52%, and the company has sufficient cash balance to pay dividends and spend on share repurchases. The company generated a solid free cash flow of $19.4 billion in fiscal 2024. Check Broadcom’s dividend history here.

Image Source: Zacks Investment Research

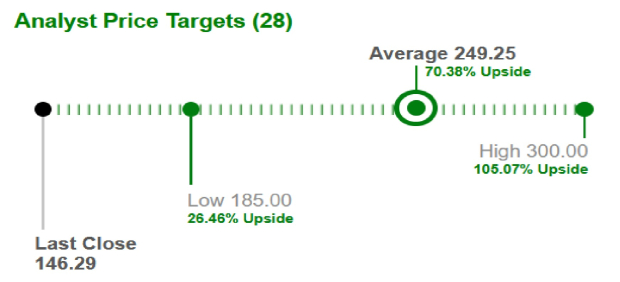

Brokers are, thus, optimistic about the company’s growth potential as they raise AVGO’s average short-term price target by 70.4% to $249.25 from the previous $146.29. The highest target is set at $300, an upside of 105.1%.

Image Source: Zacks Investment Research

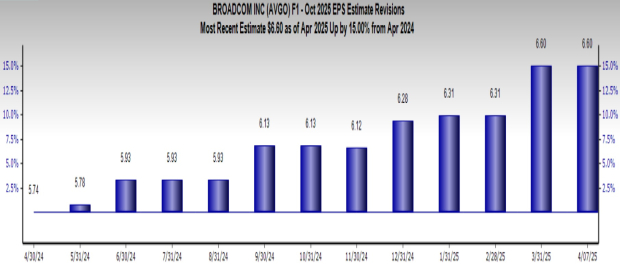

For now, Broadcom has a Zacks Rank #2 (Buy), and the Zacks Consensus Estimate of $6.60 for AVGO’s EPS is up 15% from a year ago. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).