Decoding Brokerage Recommendations for Progressive (PGR)

Investors often look to Wall Street analysts for guidance before deciding to Buy, Sell, or Hold a stock. The numbers seem to suggest a harmonious symphony with folks dressed in suits standing in unison, but do their recommendations truly hold water?

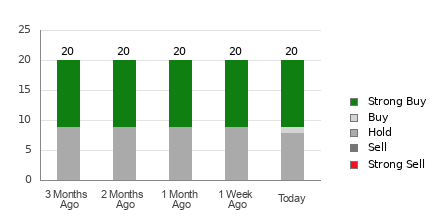

Current Brokerage Recommendations for Progressive

Progressive currently carries an Average Brokerage Recommendation (ABR) of 1.85, indicating a consensus between Strong Buy and Buy. This is derived from data collected from 20 brokerage firms, with 11 Strong Buy and one Buy suggestions encompassing 60% of all recommendations.

Brokerage Recommendation Trends for PGR

But, should you sprint to the stock exchange based solely on these numbers? Studies reveal a lackluster track record of brokerage tips in forecasting the stocks that will reach for the sky in terms of price.

Why so lukewarm? Analysts, clad in fancy attires, seem to have a rose-tinted view due to the vested interests of the brokerage firms they represent. For every “Strong Sell” proclamation, there are five “Strong Buy” endorsements, indicating a biased outlook that might not serve the interests of retail investors well.

Confirmed by external audits, the Zacks Rank tool offers a shimmer of hope. Unlike its counterpart, the ABR, the Zacks Rank relies on earnings estimates to predict stock performance, divided into five groups (from Zacks Rank #1 – Strong Buy to Zacks Rank #5 – Strong Sell).

The Nuances of ABR and Zacks Rank

While both ABR and Zacks Rank utilize a 1-5 scale, they are as different as chalk and cheese. ABR hinges solely on brokerage recommendations in decimal points, while Zacks Rank is a numerical rating system pegged on the sway of earnings estimates.

Brokerage analysts traditionally swirl in a cloud of positivity when advising clients, fueled by the cozy relationships with their firms. In contrast, the Zacks Rank unearths insights based on a stock’s earnings estimate trends, a principle that has withstood time’s relentless march.

Moreover, the Zacks Rank allocates its ratings proportionately across all stocks under analyst scrutiny, maintaining a balance among the ranks for all stocks under coverage. This well-oiled machine syncs with current trends due to analysts tinkering with earnings estimates regularly.

Is Progressive (PGR) a Jewel in the Investing Crown?

Delving deeper into Progressive’s earnings estimate revisions reveals a 4.6% uptick in the Zacks Consensus Estimate for the current year, reaching $11.85. This growing optimism among analysts paints a rosy picture for Progressive, evident through the Zacks Rank #2 (Buy) classification.

Therefore, the ABR’s harmonious chorus of Buy recommendations for Progressive could indeed serve as a North Star for potential investors’ voyages into the stock market seas.