Pinduoduo or Zacks Rank #1 (Strong Buy) stock PDD is a Chinese e-commerce platform that emerged in 2015. Despite its youthful inception compared to giants like Alibaba Group (BABA) or VIP Shop Holdings (VIPS), PDD has swiftly ascended the ranks to become a formidable force in China’s e-commerce landscape.

A Rising E-Commerce Powerhouse: Exploring Temu

Temu, the cornerstone of PDD’s success, is an online marketplace recognized for its vast array of budget-friendly products. Launched in September 2022, this e-commerce platform caters to consumers in both China and the United States. Following a strategic move to advertise during the Super Bowl in 2023, the Temu app swiftly gained traction, solidifying PDD’s foothold in the U.S. e-commerce market.

Evaluating Temu’s Strategy Against Amazon

While Amazon has historically dominated the U.S. e-commerce scene, Temu has carved its niche by appealing to a specific consumer segment. Rather than prioritizing immediate shipping at a slightly higher price, Temu taps into a growing market demographic willing to trade time for savings. By connecting buyers directly with sellers and shipping cost-effective products from China, Temu satisfies a demand for affordability, albeit with longer shipping times than Amazon.

PDD Holdings: A Meteoric Rise in Earnings

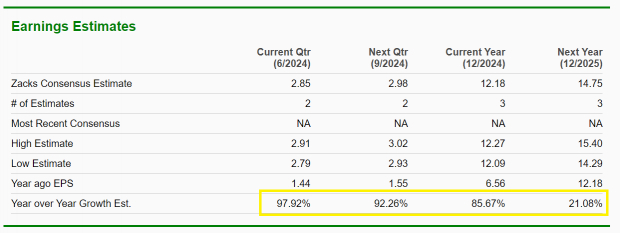

PDD is outpacing most e-commerce peers in earnings growth. Wall Street projects continued momentum, forecasting an impressive 97% EPS growth for the next quarter and an 85% increase for the full year 2024.

Image Source: Zacks Investment Research

PDD’s Track Record of Surpassing Expectations

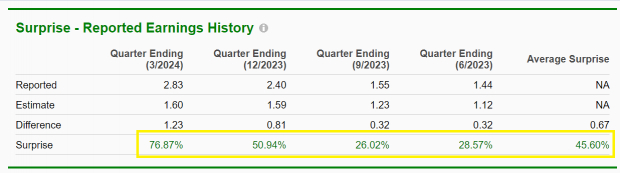

Despite high expectations, PDD consistently outperforms Wall Street projections. Over the past four quarters, the company has exceeded EPS estimates by an average of 45%.

Image Source: Zacks Investment Research

Relative Strength vs. Peers

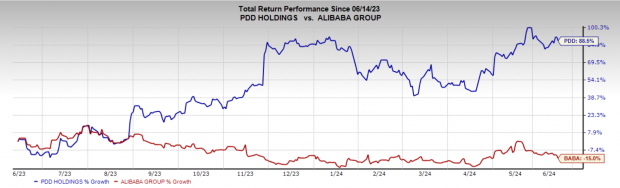

Comparing price performance is a potent indicator in the investor arsenal. PDD boasts an 88.5% rise, while industry counterparts like BABA lag behind (-15%).

Image Source: Zacks Investment Research

The Winning Streak Continues

PDD’s innovative Temu platform not only shields e-commerce aficionados from inflation but also propels the company’s earnings to new heights.

Highest Returns for Any Asset Class

Bitcoin has undeniably been a lucrative investment choice, outperforming other decentralized forms of currency. With staggering returns in past presidential election years—2012: +272.4%, 2016: +161.1%, and 2020: +302.8%—Zacks foresees another bullish surge on the horizon.