It was a roaring Black Friday according to Adobe Analytics, which reported that consumers spent roughly $11.8 billion, setting a new record and easily beating last year’s figure of $10.8 billion.

There are several ways to interpret the spending data, such as continued consumer strength and strong overall demand for the upcoming holiday season, both of which bode very favorably for the economy.

Amazon AMZN and Shopify SHOP are among those that benefit significantly from the shopping-filled period. Let’s take a closer look at each.

Attention Shifts From AWS

It’s easy to understand why AMZN is consistently a big beneficiary of the holiday shopping season thanks to its e-commerce operations, with millions placing orders throughout the period. In fact, Amazon enjoyed its strongest-ever holiday season last year, with the recent data concerning consumer spending providing a solid read-through of what to expect this period.

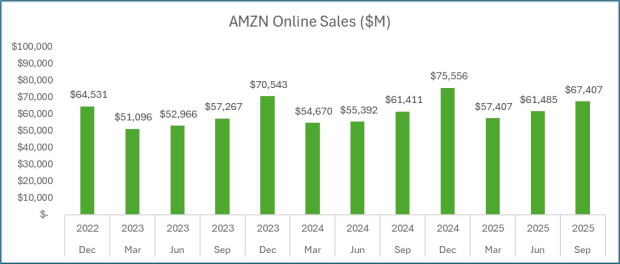

Below is a chart illustrating AMZN’s online sales on a quarterly basis. As you can see, sales spike during the December-holiday period.

Image Source: Zacks Investment Research

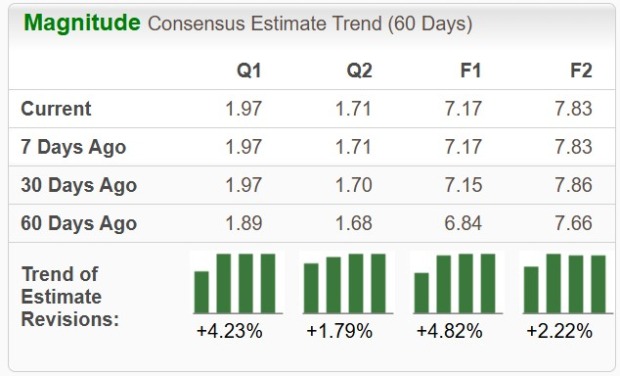

Shares have largely been disappointing in 2025 compared to the rest of the Mag 7 members, up 7% and widely underperforming relative to the S&P 500’s 19% gain. Still, strong quarterly results have led analysts to revise their EPS expectations across the board, with the stock now sporting a favorable Zacks Rank #2 (Buy). The company is expected to see 30% adjusted EPS growth in its current fiscal year on 12% higher sales.

Image Source: Zacks Investment Research

Shopify Reports Record-Breaking Sales Figures

Merchants use Shopify’s comprehensive, multi-channel commerce platform to run business across various sales channels, including web and mobile storefronts, physical retail locations, social media storefronts, and marketplaces. Like AMZN, the recent spending data certainly bodes well for Shopify given its big exposure to the consumer.

And this was confirmed by the company in a recent news release. Here are a few of the highlights from the Black Friday and Cyber Monday (BFCM) weekend –

- $14.6 billion in global sales from merchants, a 27% increase in sales from 2024

- 81+ million consumers worldwide bought from Shopify-powered brands

- 15,800+ entrepreneurs made their first sale on Shopify

- More than 94.9k merchants had their highest-selling day ever on Shopify

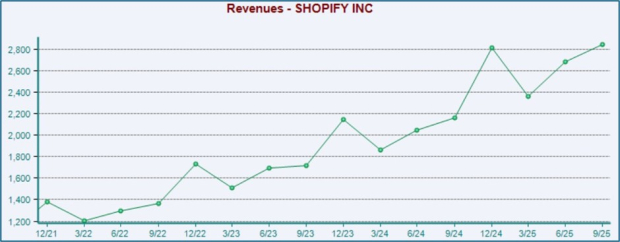

The company has overall been an incredible growth story in its short history, also reflecting one of the lone pandemic-era stocks that truly survived and thrived. Below is a chart illustrating its sales on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Recent spending data surrounding the Black Friday and Cyber Monday shopping periods have alluded to a healthy consumer, undoubtedly boding well for not only specific stocks but the broader economy as well.

And concerning two mega-winners from the period, Shopify SHOP and Amazon AMZN reflect precisely that. The story surrounding Amazon has, for some time now, centered on AWS, but its e-commerce operations obviously can’t be overlooked. Shopify has been an incredible story that began during the pandemic era, with its success only continuing.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company’s customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).