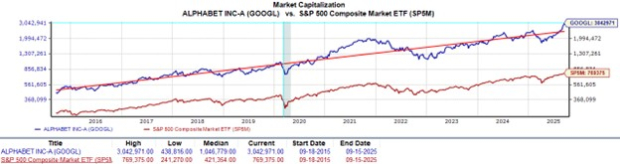

As the fourth company on the U.S. stock exchanges to hit a $3 trillion market cap, Alphabet GOOGL stock hit another all-time high of $253 a share in Tuesday’s trading session (post-split basis).

Following a 20-1 stock split in July of 2022, GOOGL is now up more than +120%. The recent surge has been attributed to momentum building off a favorable antitrust ruling that spared Alphabet from major regulatory penalties regarding monopoly probes into its dominant search and related advertising businesses.

However, with GOOGL previously trading over $2,000 before the split, investors may be on the fence about taking profits or whether they should still buy or hold Alphabet stock.

Image Source: Zacks Investment Research

Alphabet’s Growth Catalysts

Serving as a further growth catalyst for Alphabet has been the tech giant’s momentum in AI development, especially with its foundational voice assistant and large language model (LLM) Gemini. Additionally, robust growth in Google Cloud and YouTube revenue has continued to fuel Alphabet’s expansion.

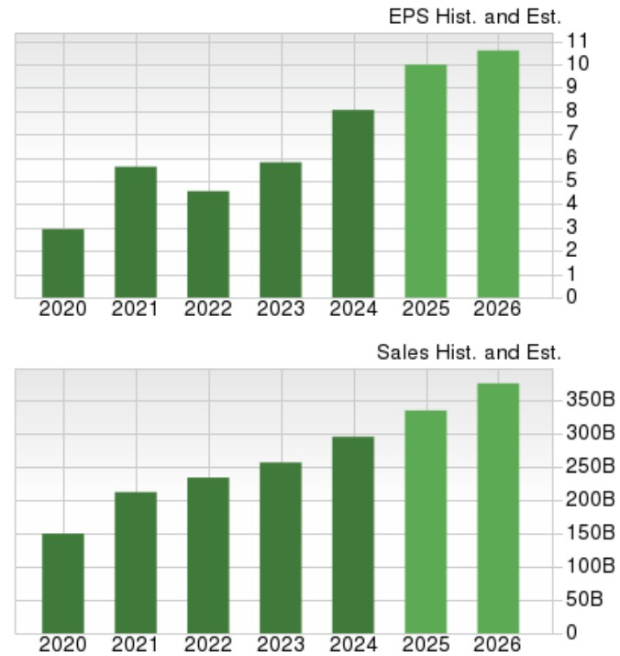

Zacks’ projections currently call for Alphabet’s total sales to rise 13% in fiscal 2025, with its top line projected to expand another 12% in FY26 to $375.31 billion. On the bottom line, Alphabet’s annual earnings are expected to spike 24% this year to $9.99 per share compared to EPS of $8.04 in FY24. Plus, FY26 EPS is projected to increase another 6%.

Image Source: Zacks Investment Research

$3 Trillion Market Cap Valuation Comparisons

Regarding the elite $3 trillion market cap club, which also includes Apple AAPL, Microsoft MSFT, and Nvidia NVDA, Alphabet has the cheapest valuation of the group at 25.1X forward earnings, with the others above 30X. Alphabet also edges Apple for the most reasonable price to forward sales multiple, at just over 8X.

Image Source: Zacks Investment Research

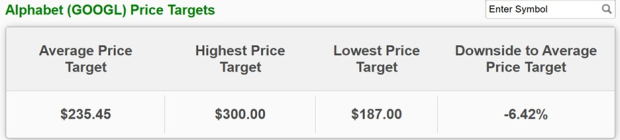

Average Zacks Price Target & Analyst Upgrades

Despite blowing past its Average Zacks Price Target of $235.45 a share, it’s noteworthy that some analysts have raised their price targets for Alphabet stock to $300. Notably, this includes analysts at Evercore ISI and Pivotal Research, who cited the company’s resounding court victory in the U.S. antitrust case as a stabilizing catalyst to its business outlook.

Image Source: Zacks Investment Research

Bottom Line

While it’s certainly tempting to take profits in Alphabet stock if needed, holding on to GOOGL could still be advantageous, although there may be better buying opportunities ahead after such a sharp year-to-date rally. Soaring over +30% in 2025, Alphabet stock currently lands a Zacks Rank #3 (Hold).

3 Stocks Poised to Lead the AI Software Race

The software market is expected to witness a remarkable growth trajectory worldwide. Advancements in AI, increased demand for cybersecurity, and the rapid expansion of automation and robotics is offering investors an opportunity to unlock significant growth right now.

Which software stocks will soar? Which will fizzle out? Find out in our urgent special report, Software is Eating the World. It examines where the software industry stands now and reveals three favorite software stocks to own

Access the report free today >>

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).