Earnings season is always an exciting time to be an investor, with companies finally pulling the curtain back and unveiling what’s transpired behind closed doors.

As usual, the big banks opened the season, with things shifting into a much higher gear this week.

We’ll hear from the highly-coveted Tesla TSLA on Wednesday after the market’s close. We’re all highly familiar with Tesla, the undisputed leader in EVs and one of the best-performing stocks of the last decade.

But how does the company stack up heading into its quarterly release? Let’s take a closer look.

Can Shares Charge Higher?

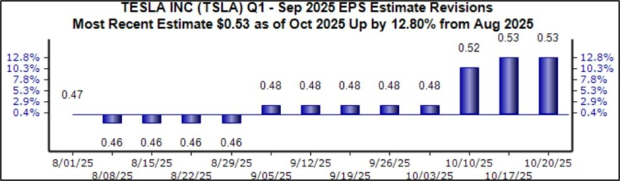

Analysts have been bullish for the quarter to be reported, with the $0.53 per share estimate being revised 13% higher over the last several months. The quarterly estimate suggests a pullback of roughly 27% from the year-ago period.

Image Source: Zacks Investment Research

In addition, our consensus revenue estimate presently stands at $26.4 billion, with the estimate up 5.8% across the same timeframe.

Of course, a key metric for Tesla is the company’s EV production/delivery numbers. The company unveiled its production and delivery numbers recently; Tesla delivered over 497k EVs and produced nearly 447k throughout the period, representing quarterly records.

But what has really driven post-earnings reactions has been the margins picture. TSLA’s margins have been squeezed hard over recent years but have shown stabilization in recent periods.

A positive read on margins will likely lead to a positive post-earnings reaction. Please note that the chart below tracks margins on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Bottom Line

With earnings season ramping up, investors will have plenty of quarterly prints to sort through in the coming days.

And, as expected, many eyes will be on Tesla TSLA when it reveals its quarterly results this week.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).