Valentine’s Day is just around the corner, undoubtedly in the back of many minds as they seek gifts and other experiences relevant to the day.

The holiday doesn’t represent anything notably important concerning the stock market, but several companies could see a short-term sales bump and attention amid a consistently strong consumer backdrop.

Let’s take a closer look at a few companies that could see their top line benefit from the holiday, including a travel stock like Royal Caribbean Cruises RCL and a stock that can benefit from both singles and couples, Netflix NFLX.

Royal Caribbean Sees Record Bookings

Royal Caribbean Cruises is a cruise company that owns and operates three global brands: Royal Caribbean International, Celebrity Cruises, and Azamara Club Cruises. Its recent set of results were underpinned by continued strength in consumer demand, an established trend over the past few years overall.

Concerning headline figures in the release, adjusted EPS of $1.63 exceeded the company’s prior guidance, whereas sales of $3.8 billion grew 11% year-over-year. RCL’s sales growth has been stellar post-pandemic, as we can see in the annual chart below.

Image Source: Zacks Investment Research

The company provided positive guidance for its FY25, with WAVE season bookings off to a record start. Analysts have already dialed their earnings estimates higher following the favorable print, landing the stock into a bullish Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Netflix Keeps Adding Subscribers

Like RCL, Netflix shares have been scorching-hot over the past year on the back of strong quarterly results, gaining nearly 80% compared to the S&P 500’s 23% gain. Its latest set of results added to the positivity, with continued user growth and tailwinds from ad-supported memberships pleasing investors.

The company’s top line strength has remained stellar, as shown in the chart below.

Image Source: Zacks Investment Research

Concerning key metrics, Paid Net Membership Additions throughout the period reached a sizable 18.9 million, crushing our consensus estimate of 9.1 million handily. As shown below, subscriber additions for Netflix have remained rock-solid, exceeding our consensus estimate in seven consecutive releases.

The favorable reads on subscriber additions have fueled the stock’s bullish run over the past year, with margin expansion also brightening its profitability picture.

Image Source: Zacks Investment Research

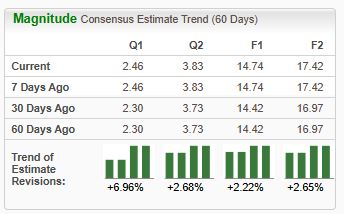

The stock currently sports a favorable Zacks Rank #2 (Buy), with the revisions trend for its current fiscal year moving higher following its latest results.

Image Source: Zacks Investment Research

Bottom Line

With a strong consumer, several companies – Netflix NFLX and Royal Caribbean Cruises RCL – could see their top lines see a small bump from the upcoming Valentine’s Day holiday.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report