The Rise of China’s Economic Stimulus

China’s recent economic stimulus measures have sent ripples through global markets. The People’s Bank of China (PBoC) has taken decisive action by cutting the reserve requirement ratio (RRR) for banks and reducing key repo rates.

This strategic move is anticipated to inject an estimated $140 billion into the Chinese economy. The primary objective? To foster increased lending activities that will, in turn, stimulate growth.

Optimism Amidst Volatility

Despite initial market fluctuations, specific U.S.-listed Chinese stocks are emerging as top choices among analysts. Let’s delve into three large-cap stocks exhibiting robust potential and currently holding Buy ratings from analysts.

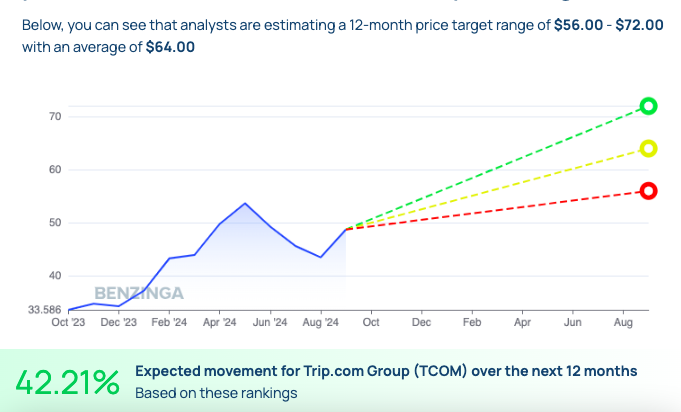

Image Source: Benzinga Stock Report – TCOM

Trip.com Group: Riding the Recovery Wave

Leading the pack is Trip.com Group, China’s premier online travel agency. The stock has seen a remarkable 43% surge over the past year, with an impressive 44% gain year-to-date.

Analysts hold a positive outlook on Trip.com’s prospects as China’s travel industry rebounds, especially considering the country’s relatively low passport issuance rates. The revival of international travel is expected to drive higher-margin growth for Trip.com.

Analysts project a price range of $56 to $72 for Trip.com over the next 12 months, with an average target of $64, depicting a substantial 42.21% upward potential.

Image Source: Benzinga Stock Report – JD

JD.com: Empowering E-Commerce

Next in line is JD.com, a key player in China’s e-commerce landscape. JD.com’s robust logistics and fulfillment infrastructure have propelled its 22% growth this year.

Analysts are bullish on JD.com’s future, predicting a target range of $28 to $47, with an average of $37.50. This forecast hints at a potential uptick of 36.97% over the coming year, cementing its status as a promising sector pick.

Alibaba Group: Resilience in Diversification

Completing the trio is Alibaba Group, a powerhouse in global e-commerce operations. Despite facing hurdles in recent times, Alibaba’s diverse business portfolio spanning online marketplaces to cloud computing continues to captivate analysts.

With a year-to-date rise of 21%, analysts foresee a price target spectrum of $85 to $130 for Alibaba, averaging at $107.50. This projection signifies a 29.78% potential upswing, solidifying Alibaba as a reliable long-term investment.

As China’s economic machinery kicks into high gear fueled by the latest stimulus measures, Trip.com, JD.com, and Alibaba stand poised to leverage the country’s resurgence and economic expansion.

Remember to stay informed to make wise investment decisions.

Image Source: Shutterstock