In a bold and strategic move, legendary hedge fund Coatue Management LLC has significantly increased its position in Nvidia Corp, reflecting unwavering confidence in the chip giant’s future prospects.

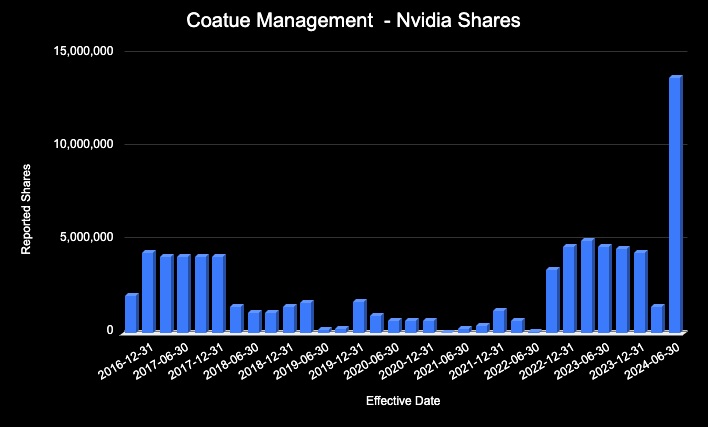

During the second quarter of 2024, Coatue boosted its stake in Nvidia by an astounding 893%, soaring from 1.39 million shares at the end of Q1 to a remarkable 13.75 million shares by the end of Q2, signaling the fund’s aggressive outlook on Nvidia.

Chart created by author using data from SEC 13F filings

Coatue’s Mega-Buy: Delving into the Strategic Move

Coatue’s substantial stock purchase mirrors Nvidia’s dominance in the semiconductor sector, especially in areas like artificial intelligence and high-performance computing. This near-tenfold increase in stake, with an investment value of approximately $1.7 billion, underlines Coatue’s unwavering belief in Nvidia’s growth trajectory.

A Shift from Disbelief to Dominance

Interestingly, Coatue had previously reduced its holdings in Nvidia, showcasing a change of heart with this latest move. The significant leap from 1.39 million to 13.75 million shares represents one of the most substantial strategic reversals for the fund. The pivotal question now is whether this daring bet will yield significant returns as Nvidia rides the wave of AI and gaming demand.

A Landmark Moment for Coatue

This isn’t merely an increase; it’s a historic milestone for Coatue. The 893% surge in ownership underscores the hedge fund’s bold confidence in Nvidia’s market leadership. With Nvidia at the forefront of the AI boom, Coatue’s move reflects expectations of enduring, long-term sectoral growth.

Nvidia: The Cornerstone of Coatue’s Portfolio?

With this decisive step, Nvidia now holds a substantial weight in Coatue’s portfolio, comprising 6.61% of the fund’s total holdings. This marks a significant uptick from just 4.91% in the previous quarter, highlighting Nvidia’s pivotal role in Coatue’s investment strategy.

Looking Towards the Future

While Coatue’s bet on Nvidia is bold, it’s also strategic. Nvidia’s dominant presence in key growth sectors like AI, data centers, and gaming suggests that the stock could witness further upside in the ensuing months.

For Coatue, this nearly tenfold increase in stake might be just the opening gambit in a more substantial play on the tech giant’s future.