Historically, Coca-Cola KO and PepsiCo PEP have been popular stocks among hedge funds and institutional investors.

Speaking to the credibility of Coca-Cola and Pepsi stock, both are owned by renowned institutional investors such as Vanguard Group and BlackRock BLK.

That said, let’s see which of these iconic beverage makers may be the better investment as we begin 2025.

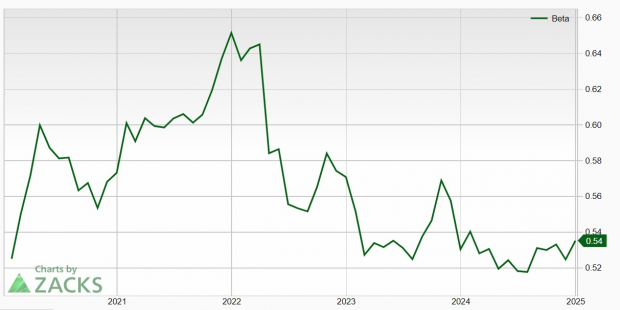

Low Beta Ratios

Thanks to their stability during economic downturns, Coca-Cola and Pepsi stock are often sought out for defensive safety in the portfolio.

With Beta being a measure of risk commonly used to compare the volatility of stocks, KO and PEP have beta ratios under the base S&P 500 Index’s value of 1.0. As shown in the chart below, Pepsi does have the edge with a calculated beta score of 0.54 with Coca-Cola at 0.61.

Image Source: Zacks Investment Research

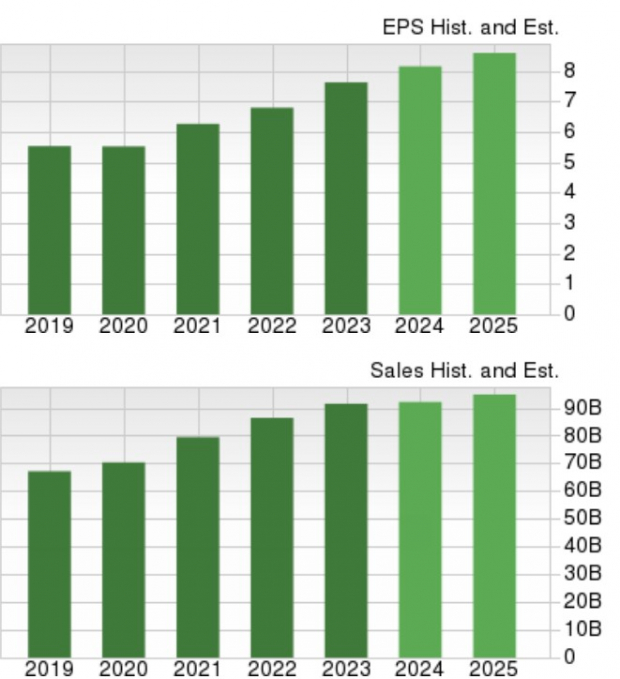

Growth & Outlook

Attributed to its reach in the consumer snacking market, Pepsi also has the edge in regards to growth. As the operator of iconic snack brands such as Frito-Lay and Sun Chips, Pepsi’s total sales are expected to be up 1% in fiscal 2024 and are projected to rise another 3% in FY25 to $94.8 billion.

Even better, Pepsi’s annual earnings are slated to increase 7% in FY24 and are forecasted to expand another 5% in FY25 to $8.59 per share.

Image Source: Zacks Investment Research

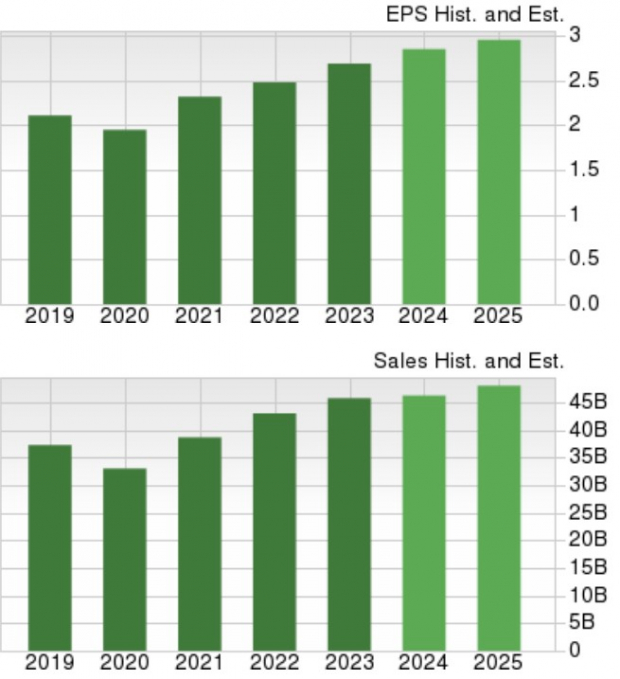

Pivoting to Coca-Cola, its top line is projected to increase by 1% in FY24 and is expected to expand another 4% in FY25 to $48.02 billion. Coca-Cola is now expected to post 6% EPS growth in FY24 with annual earnings projected to increase another 3% in FY25 to $2.96 per share.

Image Source: Zacks Investment Research

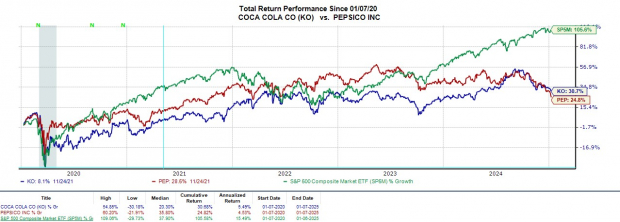

Performance & Valuation Comparison

Over the last year, Coca-Cola stock has had the edge in terms of performance with KO having a total return of +4% when including dividends. This has noticeably lagged the benchmark S&P 500’s +27% but has topped Pepsi’s -11%.

Unfortunately, over the last five years, the performance of these consumer staples titans has also vastly trailed the broader market’s total return of +105%.

Image Source: Zacks Investment Research

At their current levels, KO and PEP do trade at slight discounts to the benchmark’s forward P/E multiple at 20.5X and 17X respectively. Notably, Pepsi stock trades near the optimum level of less than 2X sales versus Coca-Cola’s 5.6X.

Image Source: Zacks Investment Research

Dividend Comparison

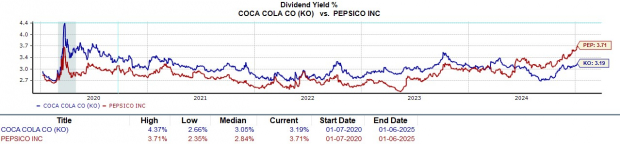

Bolstering its more attractive valuation is that Pepsi’s 3.71% annual dividend yield tops Coca-Cola’s 3.19%. However, both have payouts that trounce the S&P 500’s 1.2% average.

Image Source: Zacks Investment Research

Takeaway

For now, Coca-Cola and Pepsi stock land a Zacks Rank #3 (Hold). While Pepsi shares have a clear advantage in regards to several financial metrics, Coca-Cola stock may be viable to long-term investors as well.

Still, there could be better options among the consumer staples sector at the moment although investors may want to be mindful of these beverage giants in the event of increased market volatility in 2025.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

CocaCola Company (The) (KO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report