Two consumer discretionary stocks have caught the eye of investors recently, securing a spot on the Zacks Rank #1 (Strong Buy) list. These stocks, belonging to the cruise line industry, are Norwegian Cruise Line NCLH and Royal Caribbean Cruises RCL.

As the spring and summer seasons herald the peak of travel and leisure activities, Norwegian and Royal Caribbean are showing signs of being undervalued at their current price levels.

Post-Pandemic Recovery & Growth Trajectories

With over three years having passed since the peak of the COVID-19 crisis, the cruise industry’s recovery seems to be gaining momentum.

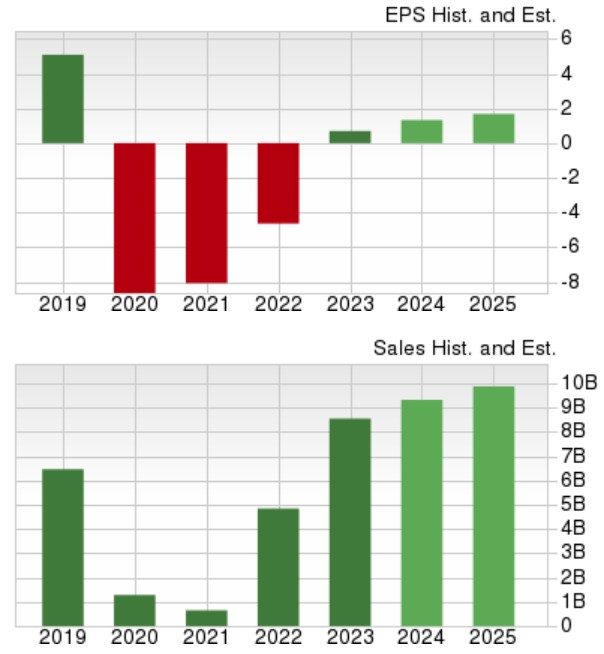

Projections indicate that Norwegian’s total sales are set to increase by 9% in fiscal 2024 and another 6% in FY25, reaching $9.93 billion. Earnings for Norwegian are forecasted to surge by 94% this year to $1.36 per share from $0.70 per share in 2023, with a further estimated growth of 27% to $1.73 per share in FY25.

Although Norwegian’s earnings are still below pre-pandemic levels of $5.09 per share in 2019, the company has already exceeded its pre-COVID sales of $6.46 billion that same year.

Image Source: Zacks Investment Research

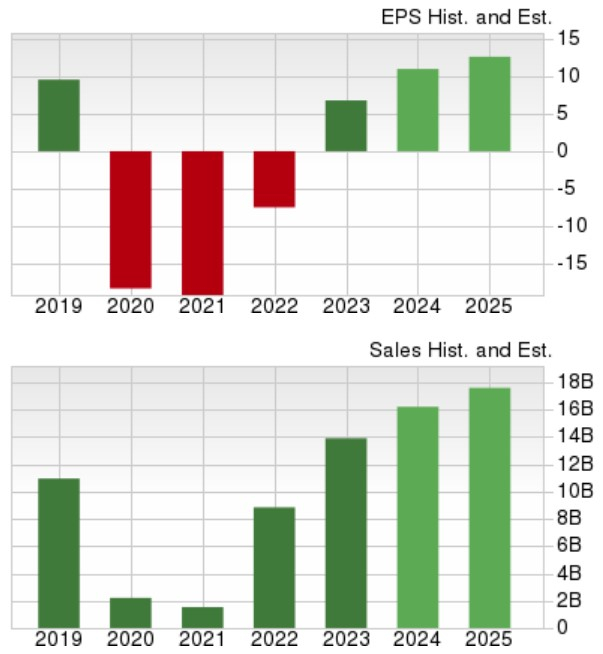

Royal Caribbean, on the other hand, is expected to witness a 16% growth in its top line in FY24, followed by a further 9% increase in FY25 to reach $17.63 billion. The company’s annual earnings are projected to soar by 62% in FY24 to $10.96 per share compared to $6.77 per share last year, with an additional 15% expected growth in FY25. Remarkably, Royal Caribbean is on track to surpass its pre-pandemic earnings of $9.54 per share in 2019 and has already exceeded its pre-COVID sales of $10.95 billion.

Image Source: Zacks Investment Research

Attractive P/E Valuations

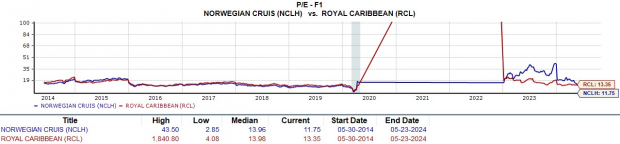

Another aspect making the recovery of Norwegian and Royal Caribbean’s stocks noteworthy is their reasonably low P/E valuations. Norwegian trades at 11.7X forward earnings, with Royal Caribbean at 13.3X, presenting a discount compared to the Zacks Leisure and Recreation Services Industry average of 18.7X and the S&P 500’s 22.1X.

Image Source: Zacks Investment Research

Bottom Line

With their recovery, attractive P/E ratios, and rising earnings estimates, it’s increasingly evident that Norwegian Cruise Line and Royal Caribbean’s stocks are positioned to yield positive returns from their current levels.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks’ free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.