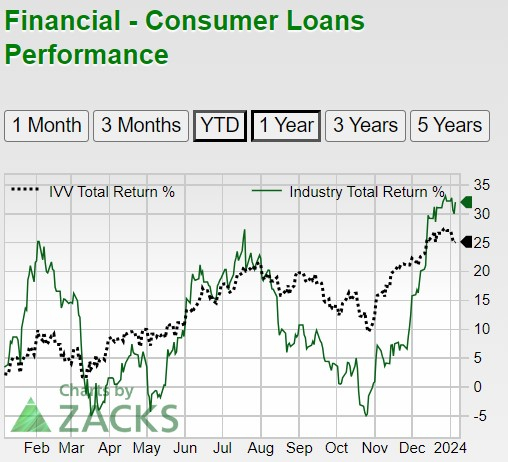

A resurgence in consumer loan stocks has captivated market attention, with the Zacks Financial-Consumer Loans Industry delivering a resounding total return of +32% over the last year, dividends included.

Two influential figures in this domain, Capital One Financial (COF) and Discover Financial Services (DFS), have emerged as formidable players. As the industry gradually recovers from the shockwaves of the collapse of Silicon Valley Bank and other regional institutions, investors are eyeing potential opportunities within the consumer loan sector.

Overview & Attractive Valuations

For much of 2023, both Capital One and Discover appeared significantly undervalued, largely due to the fallout from the Silicon Valley Bank collapse, triggering panic selling across the broader financial sector. However, the two companies continue to hold sway with their dominance in consumer lending, offering personal loans, credit products, and, in Discover’s case, home loans. Notably, Capital One shifted focus to auto loans after discontinuing its mortgage services in 2017.

While Capital One and Discover’s shares have rebounded recently, they still trade at an attractive 9.6X and 8.9X forward earnings, respectively. Both trade well below the S&P 500’s 19.6X and closer to the Zacks Financial-Consumer Loans Industry average of 7.5X.

In terms of price-to-sales, Capital One’s P/S ratio of 1.3X and Discover’s 1.6X are below the optimal level of less than 2X, and the S&P 500’s 4.2X, with their industry average at 0.9X.

Outlook Comparison

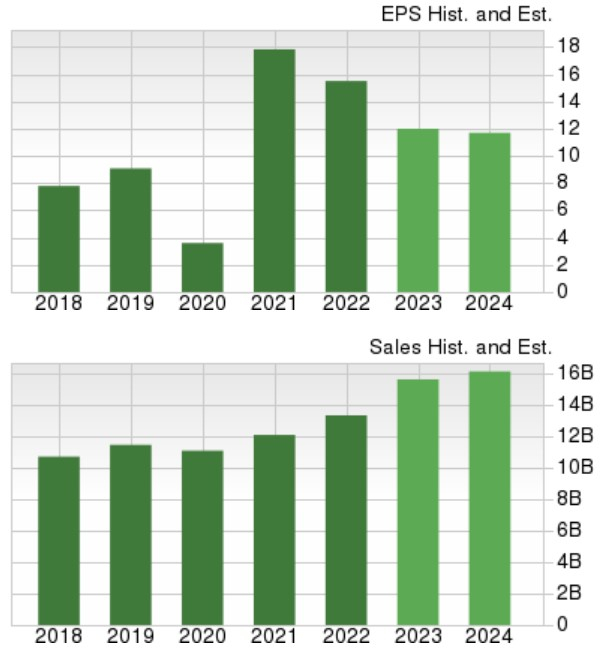

Both Capital One and Discover have demonstrated resilient sales growth, despite the dampening effects of high inflation on their bottom lines post-pandemic. For FY23, Capital One is expected to close with earnings of $12.79 per share, down from $17.71 per share in 2022. However, FY24 EPS is projected to rebound by 8% to $13.78 per share, with total sales forecasted to rise 4% to $38.36 billion this year.

Discover’s annual earnings for FY23 are anticipated at $12.27 per share, compared to $15.50 per share in 2022. Fiscal 2024 earnings are expected to stabilize and rise over 1% to $12.47 per share, with total sales projected to increase by 6% to $16.66 billion.

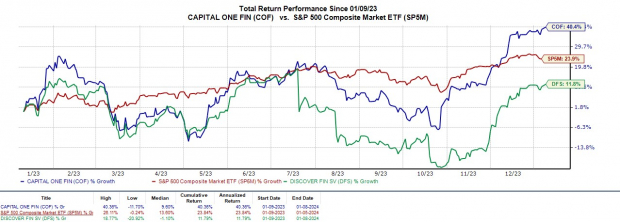

Recent Total Return Performance

Capital One’s +40% total return has outperformed its Zacks subindustry’s +32% and the benchmark’s +24% over the past year, while Discover’s +12% has lagged behind.

Despite Discover’s price performance trailing the broader market, its 2.5% annual dividend yield surpasses the S&P 500’s 1.4% and its industry average of 2.2%, while Capital One’s yield sits at a respectable 1.81%.

Takeaway

Capital One Financial and Discover Financial Services’ stocks both hold a Zacks Rank #3 (Hold). Their enticing valuations signal potential upside, contingent on favorable fourth-quarter results, with Discover set to report on January 17 and Capital One on January 25.