CrowdStrike Holdings Inc. CRWD announced Thursday it signed a distribution agreement with Arrow Electronics, Inc. ARW to provide its Falcon cybersecurity platform.

Investors were not impressed and the stock continues to trend lower Friday.

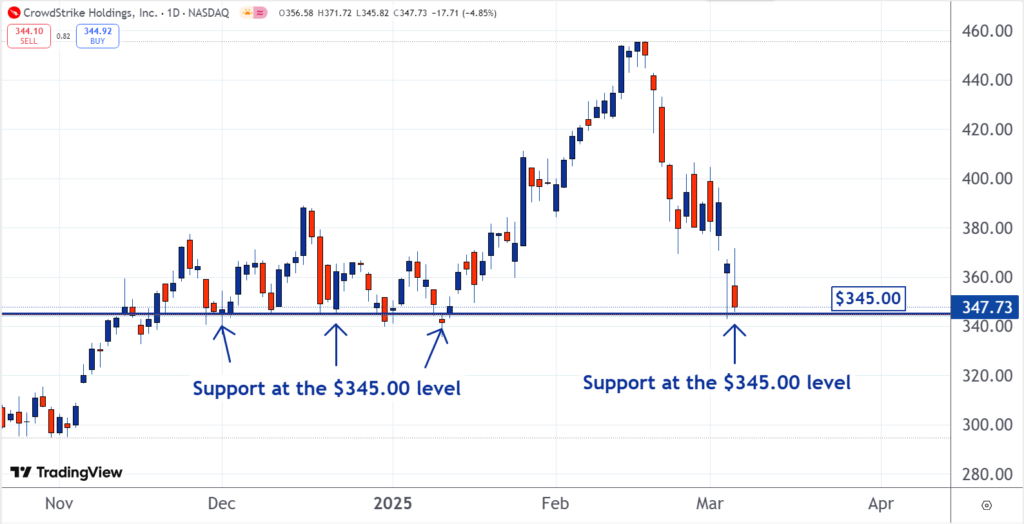

The shares have reached an important support level. The odds are it won’t stay at this level for too long. If the support holds, the stock could reverse and move higher. If the support breaks, a rapid move lower could follow. This is why it’s our Stock of the Day.

Stocks trend lower when there are more shares for sale than there are to buy. Sellers are forced to undercut each other to get their orders executed. This pushes the price lower.

Read Also: Nasdaq Plans 24-Hour Trading To Tap Global Investor Demand

At support levels, there are as many or more shares to be bought than there are to sell. This is why downtrends end or pause when they reach them. As you can see on the chart, there has been support for CrowdStrike around $345.

A support level tends to be like a fork in the road.

If the support holds, some people who wish to buy start to get anxious. They don’t want to miss the trade, but worry someone else will be willing to pay a higher price than they are. They know this is who the sellers will go to.

As a result of this, they increase their bid prices. Other anxious buyers see this and do the same thing. It can result in a snowball effect that pushes the price higher. This is what happened with CrowdStrike from November to January.

But sometimes the support breaks. This means that the shares trade below it. This illustrates an important dynamic.

It shows the investors and traders who created the support with their buy orders have finished or canceled their orders. Sellers need to be aggressive and undercut other sellers if they want to find buyers. This can create a new downtrend.

Some traders are on the sidelines watching. They aren’t sure which way CrowdStrike will go. But when a new trend forms, either up or down, they will jump in.

Read Next:

• Unemployment Rate Ticks Higher In February, US Economy Adds Fewer Jobs Than Expected

Momentum24.43

Growth39.82

Quality44.57

Value89.57

Market News and Data brought to you by Benzinga APIs