Reflecting on the year 2023, it was unequivocally a period of transition for the burgeoning asset class. Previous market cycles’ positioning, leverage, and speculative excesses were stripped away, clearing the ground for new growth in 2023. What has endured and continues is a market displaying enhanced interoperability across protocols and projects, welcoming regulated institutional investors and focusing on increasing real-world applicability.

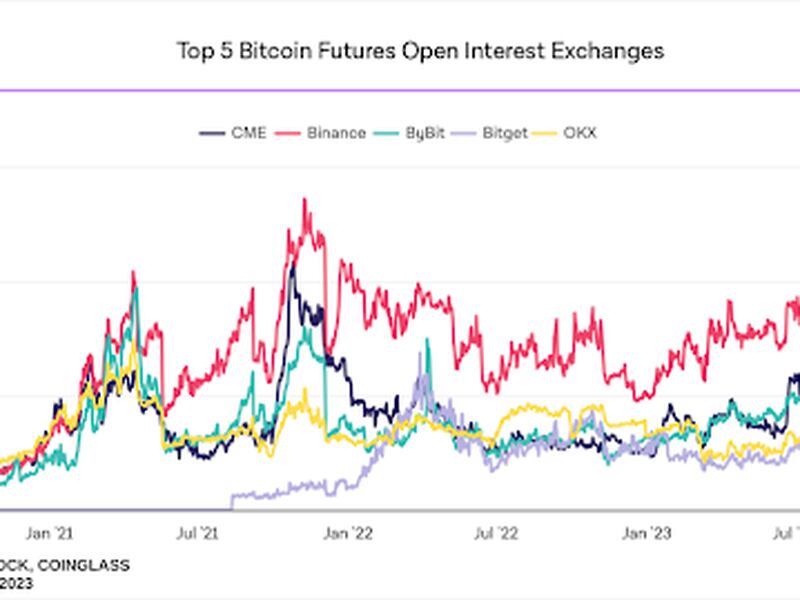

Dominant crypto exchanges such as FTX and Binance underwent leadership changes, as more regulated players like Coinbase, Bullish (now owner of CoinDesk), and EDX assumed leading roles in the market. Traditional futures exchanges like CME observed a surge in volumes for bitcoin and ether-linked futures contracts, surpassing Binance in bitcoin futures open interest.

Renewed efforts in the U.S. to list spot token ETFs were witnessed, with Blackrock surprising the market with its application to the SEC in June. This institutional development bolstered demand for bitcoin as a genuine asset and a hedge against currency debasement in a financial system infused with fiat liquidity and support stimulus, strengthening the narrative for broader digital asset adoption.

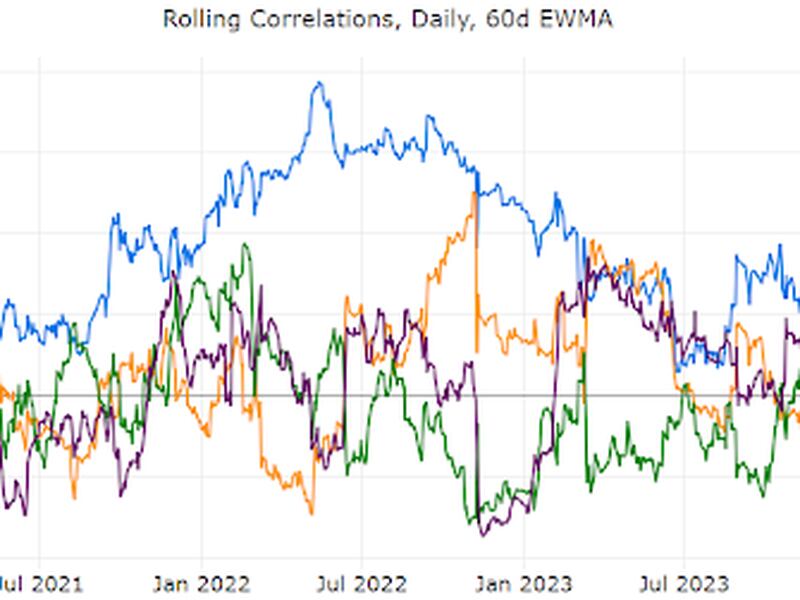

The year 2023 also saw reduced macroeconomic correlations across digital assets. The crypto market was allowed to be distinct from US equities and gold, with lower realized volatility compared to previous years. Surprisingly, ether realized almost the same level of volatility as bitcoin in 2023, deviating from historical norms and aligning more with traditional asset classes.

These developments collectively signal the maturation of the crypto market and its evolution into an institutional landscape. This transition and expansion of the ecosystem to accommodate traditional, regulated market players is poised to define the narrative for the upcoming market cycle.

Anticipated Trends for 2024

Expectations for 2024 involve further maturation of the crypto market to attract institutional investors. This is occurring amidst a phase of robust performance for bitcoin and ether, even as the U.S. undergoes an interest rate hike and decouples from short-term macroeconomic risk factors. This suggests that they are increasingly perceived as unique real assets, akin to gold and oil. These attributes are projected to stimulate demand for bitcoin and ether as liquid alternatives and diversifiers to traditional bonds, reinvigorating traditional stock/bond portfolios.

Forecasts also predict the launch of a spot bitcoin ETF in Q1 of 2024. Although this is a consensus view, it is unlikely that the approval will result in the classic “buy the rumor, sell the news” event. In the medium to long term, the approval will provide a significant new channel for capital influx into the asset class through a familiar and regulated exchange-traded product.

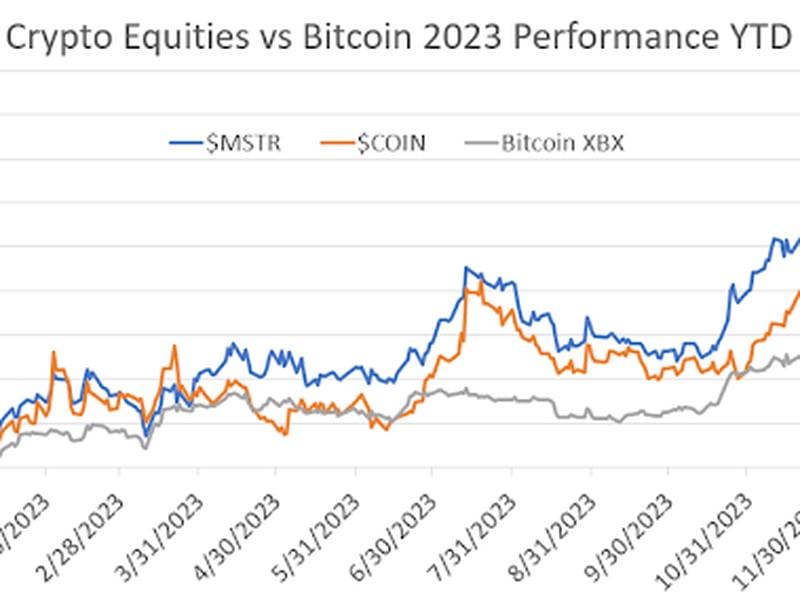

Those skeptical about the pent-up demand for these assets in a more traditional, regulated wrapper should look at the performance of Coinbase and MicroStrategy stock in 2023, both more than doubling the performance of bitcoin over the period.

The anticipated ETF launches will facilitate easier access for a broader range of investors, including Registered Investment Advisors (RIAs), pension funds, and hedge funds, and enable investment banks to develop new products using the ETF vehicle.

These ETF inflows are expected to provide a long-term tailwind for the market, not fully appreciated at present. With an estimated $128 trillion AUM managed by RIAs in 2022 and assuming a 1-2% portfolio allocation to digital assets through a spot ETF product, this could introduce an additional $1 to 2.5 trillion of new capital into the crypto ecosystem. However, it’s important to note that this potential capital influx into the market via ETFs will be limited to bitcoin and ether, potentially further setting them apart from smaller digital assets (i.e. “altcoins”). Nevertheless, appreciation from these mega-cap tokens is expected to permeate the wider ecosystem, benefitting smaller protocols since they represent primary stores of value among crypto-native investors.

In the event of a U.S. economic recession in the latter half of 2024 due to the lagged effects of an accelerated interest rate hike and subsequent rate cuts, digital assets are expected to broadly benefit from anticipated stimulus measures. Bitcoin’s digital scarcity, post the 2024 Halving, would become increasingly appealing in an environment of expanding federal deficits and spending. Ether’s post-merge tokenomics have similarly become increasingly deflationary, enhancing the appeal of Ether in such a scenario.

Against this macroeconomic backdrop, Smart Contract Platform, Decentralized Finance (DeFi), and Computing token sectors are projected to be top performers in 2024. These sectors benefit from increased on-chain activity, intertwined as Smart Contract Platform activities necessitate the use of their native tokens for blockchain transactions, DeFi tokens profit from trading volumes and lending transaction fees, and Computing sector’s price oracle tokens, like Chainlink, supply necessary price data feeds across the blockchain ecosystem.

The Computing sector also encompasses protocols and projects focused on decentralized computing and AI themes, bolstered by the ChatGPT, AI-driven narrative, leading the sector to outperform all others in 2023.

Despite the potential advantages of a recession and interest rate cut scenario for digital assets, it would be exposed to periods of low liquidity and deleveraging. Therefore, it’s believed that portfolio construction and position sizing will play a more critical role in 2024 than forecasting market direction. Utilizing CoinDesk’s Bitcoin and Ether Trend Indicators (BTI and ETI, respectively) is advisable for making allocation decisions across the asset class.

Investors should also consider their risk tolerance and time commitment when investing in digital assets. For a more passive exposure, major tokens like Bitcoin and Ethereum, in their expected regulated ETF wrappers, may be safer choices for many seeking beta exposure to the asset class. Additional yield can also be generated on top of ether positions through staking, with annualized staking rates and benchmark staking indices provided by CoinDesk’s Composite Ether Staking Rate (CESR).

For those seeking passive exposure to smaller tokens and protocols with greater growth potential diversified indices with limits on bitcoin and ether exposure to manage idiosyncratic token risk while tilting towards altcoins, which tend to benefit from the middle to later stages of a crypto bull market, may be the most viable option.

Summing up, we have emerged from the crypto winter with a more resilient ecosystem than the previous cycle and with narratives that will likely support the new market cycle well into 2024.

Keen to get next year’s outlook now? Check out coindeskmarkets.com or contact us to sign up for the CoinDesk Indices weekly research insights newsletter, “Vibe Check.”