Here’s a quick recap of the crypto landscape for Monday (April 14) as of 9:00 a.m. UTC.

Bitcoin and Ethereum price update

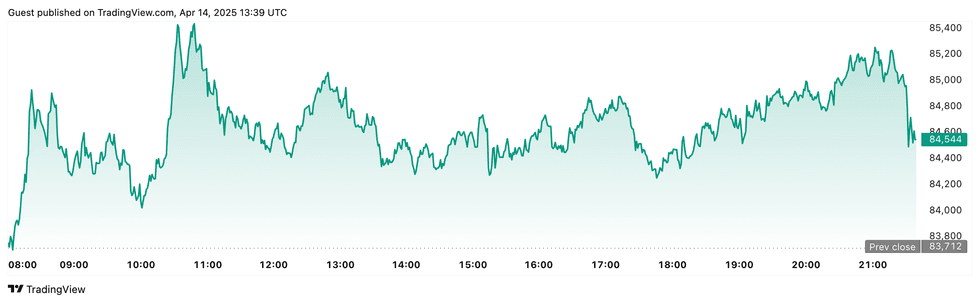

At the time of this writing, Bitcoin (BTC) was priced at US$84,723.08 and up 0.7 percent in 24 hours. The day’s range has seen a low of US$83,197.27 and a high of U$85,315.17.

Chart via TradingView

Bitcoin performance, April 11, 2025.

Bitcoin’s early week positivity follows President Donald Trump’s announcement of a tariff exemption for smartphones and computers, which has helped ease investor concerns over escalating trade tensions. Despite previous volatility due to global trade disputes, market sentiment appears to be stabilizing, with investors showing confidence in Bitcoin’s resilience.

Ethereum (ETH) is priced at US$1,637.91, a 4.5 percent increase over the past 24 hours. The cryptocurrency reached an intraday low of US$1,574.11 and a high of US$1,684.05.

Altcoin price update

- Solana (SOL) is currently valued at US$133.14, up 3.1 percent over the past 24 hours. SOL experienced a low of US$125.80 and a high of US$134.29 on Monday.

- XRP is trading at US$2.14, reflecting a 1.1 percent decrease over the past 24 hours. The cryptocurrency recorded an intraday low of US$2.09 and a high of US$2.18.

- Sui (SUI) is priced at US$2.28, showing a decrease of 0.3 percent over the past 24 hours. It achieved a daily low of US$2.21 and a high of US$2.34.

- Cardano (ADA) is trading at US$0.6428, reflecting a 0.3 percent increase over the past 24 hours. Its lowest price on Monday was US$0.6324, with a high of US$0.6593.

Crypto news to know

Strategy buys $285 million in Bitcoin amid Wall Street volatility

Michael Saylor’s firm, Strategy, capitalized on sharp equity market swings last week, purchasing 3,459 more Bitcoin (BTC) valued at US$285.8 million between April 7–13.

The buy was funded through its at-the-market equity offering as shares fluctuated from -11 percent to +25 percent, demonstrating the firm’s commitment to BTC accumulation even during periods of financial instability.

With this move, Strategy’s Bitcoin holdings now total around US$45 billion, representing about 2.5 percent of the total BTC supply.

The firm also disclosed a forthcoming US$5.9 billion unrealized loss due to new accounting rules requiring market-based valuations for digital assets.

Despite that, Strategy remains on track with its plan to raise US$42 billion through 2027 for continuous Bitcoin acquisitions, reinforcing its identity as a long-term Bitcoin maximalist corporate play.

Metaplanet now 9th largest public Bitcoin holder with new BTC buy

Japanese investment firm Metaplanet . acquired 319 BTC at an average price of US$83,147, bringing its total treasury to 4,525 BTC — making it the ninth largest publicly traded Bitcoin-holding company.

This acquisition is part of its broader treasury strategy to build shareholder value through Bitcoin accumulation, initiated in December 2024.

The company now has a cost basis of US$408.1 million and evaluates its BTC performance using BTC yield, which hit 95.6 percent in Q1 2025.

Backed by sophisticated financial engineering such as bond issuances and stock acquisition rights, Metaplanet has executed over 41 percent of its “210 million plan,” demonstrating significant momentum.

The firm’s bold approach also reflects Japan’s evolving stance toward crypto as a mainstream asset class and could influence similar treasury strategies in Asia.

Google to enforce MiCA rules on crypto ads

Google will begin enforcing stricter ad policies across 27 European countries beginning April 23, requiring all crypto advertisers to comply with the Markets in Crypto-Assets (MiCA) regulation or be licensed under the Crypto Asset Service Provider (CASP) framework.

All crypto exchanges and wallet providers advertising on Google must now also be certified by Google, and meet additional national-level legal obligations, further tightening the regulatory net on digital asset marketing.

This marks a significant shift in how crypto services are promoted in the EU and could weed out illicit players while boosting trust in licensed entities.

Noncompliance will first trigger a warning before eventual account suspensions, giving advertisers a brief grace period to align with the rules.

CeFi Lending Drops 43 percent from 2021 peak, DeFi borrowing soars 959 percent

The crypto lending market remains well below its former highs, down from US$64.4 billion in 2021 to US$36.5 billion at the close of 2024, according to a new report by Galaxy Digital.

This contraction is largely due to the collapse of major centralized finance (CeFi) lenders like Genesis, BlockFi, Celsius, and Voyager, which together lost 82 percent of their lending capacity during the bear market.

However, decentralized finance (DeFi) has made a stunning recovery, with open borrows jumping from US$1.8 billion in late 2022 to US$19.1 billion across 20 platforms and 12 blockchains — a 959 percent increase.

Galaxy attributes this to DeFi’s permissionless nature, transparency, and its resilience during market turmoil that crushed CeFi players.

Today, Tether, Galaxy, and Ledn dominate the surviving CeFi space, accounting for nearly 89 percent of its total activity, while DeFi’s growth hints at a larger shift toward decentralized, non-custodial financial infrastructure in the post-crash era.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.