Here’s a quick recap of the crypto landscape for Wednesday (March 26) as of 9:00 p.m. UTC.

Bitcoin and Ethereum price update

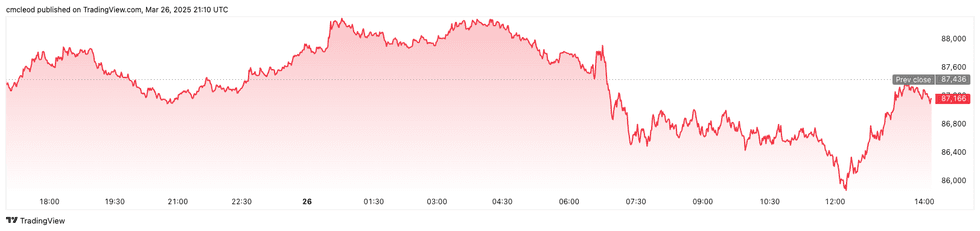

Bitcoin (BTC) is currently trading at US$86,622.95, a 1.7 percent decrease over the past 24 hours. The day’s trading range has seen a low of US$85,862.55 and a high of US$87,812.64.

The crypto market is under pressure following an executive order from US President Donald Trump to issue “secondary tariffs” of 25 percent on countries that purchase oil from Venezuela.

Chart via TradingView.

Bitcoin performance, March 26, 2025.

Ethereum (ETH) is priced at US$2,002.36, a 3.6 percent decrease over 24 hours. The cryptocurrency reached an intraday low of US$1.985.69 and a high of US$2,058.49.

Altcoin price update

- Solana (SOL) is currently valued at US$137.76, down 5.2 percent over the past 24 hours. SOL experienced a low of US$136.39 and a high of US$144.21 on Wednesday.

- XRP is trading at US$2.38, reflecting a 3.3 percent decrease over the past 24 hours. The cryptocurrency recorded an intraday low of US$2.36 and a high of US$2.45.

- Sui (SUI) is priced at US$2.58, showing a 4.6 percent increase over the past 24 hours. It achieved a daily low of US$2.52 and a high of US$2.64.

- Cardano (ADA) is trading at US$0.7285, reflecting a 2.7 percent decrease over the past 24 hours. Its lowest price on Wednesday was US$0.722, with a high of US$0.7632.

Crypto news to know

GameStop’s Bitcoin bet sparks meme stock rally

GameStop (NYSE:GME) shares surged close to 20 percent on Wednesday after the company announced plans to add Bitcoin to its treasury reserve assets, mirroring Michael Saylor’s Strategy (NASDAQ:MSTR). The move comes as GameStop struggles with declining brick-and-mortar sales, having pivoted toward e-commerce under CEO Ryan Cohen.

Speculation around the retailer’s crypto ambitions grew after Cohen was seen with Saylor on social media last month. Analysts warn that GameStop’s exposure to Bitcoin could introduce more volatility to its stock.

The company, however, has been aggressive in cutting costs, doubling its fourth quarter net income to US$131.3 million despite a 30 percent revenue drop.

Microsoft declines after data center news

Shares of crypto miners and Microsoft (NASDAQ:MSFT) closed down after TD Cowen alleged that the tech conglomerate has abandoned plans for new data centers in the US and Europe.

Share prices for Bitcoin miners, including Bitfarms (NASDAQ:BITF), CleanSpark (NASDAQ:CLSK), Core Scientific (NASDAQ:CORZ), Hut 8 (NASDAQ:HUT) and Riot Platforms (NASDAQ:RIOT), dropped between 4 and 12 percent. Microsoft closed down 1.31 percent, while daily losses for the miners fell between 7 and 12 percent.

According to Bloomberg, Google (NASDAQ:GOOGL) and Meta Platforms (NASDAQ:META) have picked up some of the leases Microsoft has allegedly canceled or deferred over the last six months, although neither company has confirmed. In a statement from Microsoft obtained by the publication, the company said “significant investments” have left it “well positioned to meet (its) current and increasing customer demand.”

“While we may strategically pace or adjust our infrastructure in some areas, we will continue to grow strongly in all regions,” the spokesperson said. “This allows us to invest and allocate resources to growth areas for our future.”

Ethereum’s Pectra upgrade launches on testnet

Ethereum’s Pectra upgrade launched on the Hoodi testnet on Wednesday after a series of technical issues delayed the mainnet launch, which was originally slated for sometime in March.

If the launch is successful, Pectra could hit the mainnet by April 25. The Pectra upgrade aims to improve Ethereum’s scalability, staking efficiency and developer capabilities.

USDC launches in Japan

Circle launched its stablecoin, USDC, in Japan on Wednesday. The launch was made possible through a strategic partnership with SBI Holdings (TSE:8473), a Japanese financial firm.

The launch comes after Circle and SBI received regulatory approval from Japan’s Financial Services Agency (FSA) earlier this month. The FSA’s green light paved the way for the companies to introduce USDC to the Japanese market, marking a significant step in the adoption of stablecoins in the country.

Following the regulatory approval, a launch date was announced on Monday (March 24).

At the time of this writing, USDC’s market capitalization was US$60.15 billion.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.