Here’s a quick recap of the crypto landscape for Friday (April 4) as of 9:00 a.m. UTC.

Bitcoin and Ethereum price update

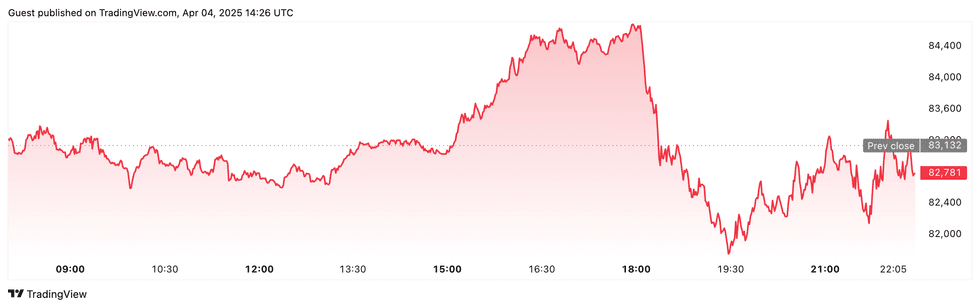

At the time of this writing, Bitcoin (BTC) was changing hands at US$84,375.94, up 0.6 percent in 24 hours. The day’s range has brought a low of US$81,332.85 and a high of US$84,630.70.

Chart via TradingView

Bitcoin performance, April 4, 2025.

Bitcoin’s price declined below US$82,000 following President Donald Trump’s announcement of new global tariffs, which unsettled financial markets and reduced investor appetite for riskier assets. The broader cryptocurrency market also suffered, with the total market capitalization dropping approximately 6 percent to around US$2.6 trillion

Ethereum (ETH) is priced at US$1,827.59, a 0.5 percent increase over 24 hours. The cryptocurrency reached an intraday low of US$1,756.99 and a high of US$1,832.02.

Altcoin price update

- Solana (SOL) is currently valued at US$118.33, up 2.3 percent over the past 24 hours. SOL experienced a low of US$112.64 and a high of US$119.76 on Friday.

- XRP is trading at US$2.09, reflecting a 5.0 percent increase over the past 24 hours. The cryptocurrency recorded an intraday low of US$1.97 and a high of US$2.13.

- Sui (SUI) is priced at US$2.28, showing a 1.7 percent decrfinease over the past 24 hours. It achieved a daily low of US$2.14 and a high of US$2.29.

- Cardano (ADA) is trading at US$0.6600, reflecting a 3.2 percent increase over the past 24 hours. Its lowest price on Wednesday was US$0.6159 with a high of US$0.6649.

Crypto news to know

China announces 34 percent tariff on US goods, Bitcoin drops to US$82K

Global markets took a hit as China retaliated against U.S. tariffs, imposing a sweeping 34 percent levy on all American goods. The move follows President Donald Trump’s decision to raise overall tariffs on Chinese imports to 54 percent, escalating tensions between the world’s two largest economies.

Bitcoin, which had climbed to US$84,600 earlier in the day, dropped to $82,000 in response to worsening risk sentiment, while other major cryptocurrencies, including Ethereum (ETH), Solana (SOL), and Dogecoin (DOGE), saw gains erased. U.S. stock futures also slumped, with the S&P 500 (INDEXSP:.INX) and Nasdaq (INDEXNASDAQ:.IXIC) both dropping over 2 percent.

Despite the immediate negative reaction, BitMEX co-founder Arthur Hayes argues that Bitcoin could ultimately benefit from the financial instability created by escalating trade wars.

Hayes predicts that the US dollar will weaken as foreign investors pull money out of US assets, leading to increased interest in Bitcoin as a safe-haven asset alongside gold.

He also suggests that China’s tariffs could force the Federal Reserve to ease monetary policy through interest rate cuts, further bolstering Bitcoin’s appeal as an inflation hedge.

OSL launches crypto wealth platform for high-net-worth investors in Hong Kong

Hong Kong-based OSL Group has introduced OSL Wealth, a new digital asset management service tailored for institutional and high-net-worth investors.

This platform offers a comprehensive suite of crypto-focused financial products, including tokenized treasury instruments, real-world asset (RWA) solutions, structured crypto products, and algorithmic investment strategies. By integrating its existing over-the-counter (OTC) trading, crypto exchange operations, and prime brokerage services, OSL aims to provide a seamless solution for managing digital assets in a regulated environment.

Eugene Cheung, Chief Commercial Officer of OSL Hong Kong, described the launch as a major step in bridging the gap between traditional finance and digital assets.

“With our expertise in crypto asset management, we’re providing professional investors with a robust gateway to the crypto market,” he said.

OSL operates under a license from Hong Kong’s Securities and Futures Commission (SFC) and offers insured custodial services, reinforcing its reputation as a secure and compliant platform.

Eric Trump taps crypto after Trump organization’s “cancellation”

Eric Trump has revealed in a CNBC report that his family’s business pivoted toward cryptocurrency following what he describes as “unprecedented financial deplatforming.”

After the Trump Organization faced legal scrutiny and banking restrictions—including the closure of over 300 accounts by Capital One—the Trump brothers turned to digital assets as an alternative financial system.

This led to the creation of World Liberty Financial, a US dollar-backed stablecoin venture, and American Bitcoin, a new Bitcoin mining company co-founded with Hut 8 CEO Asher Genoot.

According to Eric Trump, the shift to crypto was as much about financial opportunity as it was about resistance.

He claims that during what he calls a “war on the industry,” major banks were shutting down accounts simply for holding Bitcoin, and regulatory agencies were targeting crypto firms through aggressive lawsuits.

Now, with Donald Trump back in the White House, the administration has taken a more crypto-friendly stance, including signing an executive order to establish a strategic Bitcoin reserve and pardoning Silk Road founder Ross Ulbricht.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.