Here’s a quick recap of the crypto landscape for Wednesday (August 6) as of 9:00 a.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrencymarket news

Bitcoin and Ethereum price update

Bitcoin (BTC) was priced at US$114,217, down by 0.8 percent over the last 24 hours. Its highest valuation on Wednesday was US$112,770, while its lowest valuation was US$114,830.

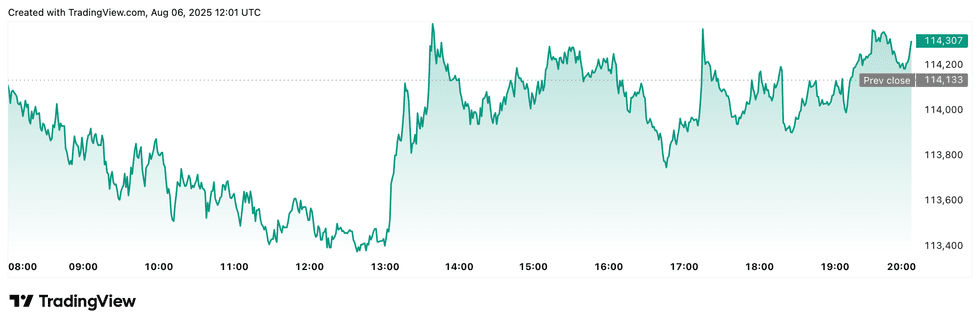

Chart via TradingView.

Bitcoin price performance, August 6, 2025.

Bitcoin is showing signs of support between US$117,000 and US$118,000, with technical analysts suggesting a possible rebound toward resistance levels at US$120,250 and beyond, if bullish momentum builds.

However, sentiment remains cautious amid ongoing interest rate uncertainty, macroeconomic pressures and exchange-traded fund (ETF) outflows, all of which are weighing on near-term price action.

Ethereum (ETH) was priced at US$3,619.63, down by 1.4 percent over the past 24 hours. Its lowest valuation on Wednesday was US$3,557.78, and its highest was US$3,673.

Altcoin price update

- Solana (SOL) was priced at US$164.44, down by 3.9 percent over 24 hours. Its lowest valuation on Wednesday was US$161.45, and its highest was US$170.84.

- XRP was trading for US$2.95, down by 3.8 percent in the past 24 hours. Its lowest valuation of the day was US$2.91, and its highest valuation was US$3.06.

- Sui (SUI) is trading at US$3.41, down 4.2 percent over the past 24 hours. Its lowest valuation of the day was US$3.34, and its highest was US$3.55.

- Cardano (ADA) was trading at US$0.7274, down by 3.2 percent over 24 hours. Its lowest valuation on Wednesday was US$0.7117, and its highest was US$0.751.

Today’s crypto news to know

Bitcoin ETFs see four days of outflows as stagflation fears ramp up

Spot Bitcoin ETFs in the US recorded net outflows for the fourth day in a row, shedding nearly US$200 million on Tuesday alone. The Fidelity Wise Origin Bitcoin Fund (BATS:FBTC) and iShares Bitcoin Trust ETF (NASDAQ:IBIT) were the biggest sources of withdrawals, contributing to a total outflow of US$1.46 billion since July 31.

The trigger appears to be concerns around stagflation after weaker-than-expected US service sector data.

The ISM Non-Manufacturing Purchasing Managers Index points to slowing growth, declining employment and rising prices, a toxic mix for risk assets like cryptocurrencies and tech stocks.

Meanwhile, bets on US Federal Reserve rate cuts are growing, but uncertainty remains high.

SBI files Japan’s first Bitcoin-XRP ETF application

Japanese financial giant SBI Holdings (TSE:8473) has filed for an ETF that would include both Bitcoin and XRP, aiming to offer regulated dual-crypto exposure in Japan. The proposed product, revealed in SBI’s Q2 earnings report, would allow investors to track the performance of both assets in a single fund, a rare pairing in the global ETF space.

If approved, this would mark the first time XRP is included in a regulated ETF product in Japan, as it continues to face institutional barriers in the US due to its regulatory history.

A second ETF proposal, the Digital Gold Crypto ETF, would blend over 50 percent exposure to traditional gold ETFs with crypto assets backed by gold. This hybrid structure targets more conservative investors looking for crypto upside with commodity stability.

SEC clarifies — liquid staking is not a securities offering

In a major development for the crypto industry, the US Securities and Exchange Commission’s (SEC) Division of Corporation Finance said that certain types of liquid staking do not constitute the sale of securities.

Specifically, tokenized staking receipt products, such as staked ETH derivatives, are not considered investment contracts unless they’re bundled into schemes that meet the legal definition. This clarification provides a green light for platforms offering protocol-level staking services without requiring registration. Liquid staking allows users to earn rewards while still being able to trade or use a representative token, maintaining asset flexibility.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.