Here’s a quick recap of the crypto landscape for Monday (November 10) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrencymarket news

Bitcoin and Ether price update

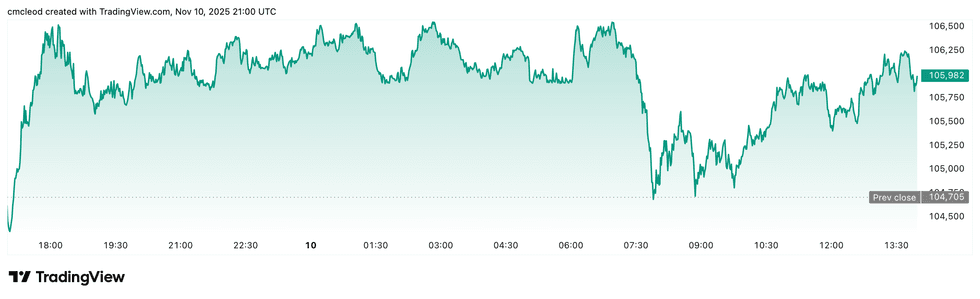

Bitcoin (BTC) was priced at US$105,879, up by 1.2 percent in 24 hours. Its lowest valuation of the day so far was US$104,768, while its highest was US$106,216.

Chart via TradingView.

Bitcoin price performance, November 10, 2025.

The market staged a modest rebound on Monday (November 10), fueled by optimism, fueled by the US Senate’s progress on ending the prolonged shutdown and President Donald Trump’s pledge of a US$2,000 low-income dividend.

Bitcoin is now testing a critical resistance zone above US$106,000.

A key resistance and liquidity cluster sits between US$111,500 and US$115,000, with significant ask orders around US$112,000. Analysts view the US$110,000 to US$112,000 range as a critical area to watch, especially if Bitcoin can push through the US$107,000 resistance.

If Bitcoin breaks above US$115,000, it could trigger a liquidation squeeze, forcing short sellers to cover positions and potentially driving the price up to US$117,000, the next major liquidity cluster.

At the same time, demand through spot Bitcoin ETFs has been uneven. The week into Friday saw multi-day outflows coupled with redemptions that reversed a brief stretch of inflows, creating sell pressure at the margin that were a key amplifier of October’s deleveraging.

In addition to the week’s early developments, market commentator Axel Adler Jr. highlighted President Trump’s announcement on Truth Social regarding a US$2,000 direct-payment program for most Americans. Adler proposed that if some recipients invest these funds in crypto, retail demand for Bitcoin could increase. This would mirror the buying patterns observed during previous stimulus rounds and potentially position retail investors as the next driving force for Bitcoin’s recovery.

Ether (ETH) was priced at US$3,56.33, a 0.3 percent decrease in 24 hours. Its lowest valuation of the day was US$3,513.15, while its highest was US$3,579.73.

Altcoin price update

- Solana (SOL) was priced at US$167.70, up by 1.3 percent over the last 24 hours. Its lowest valuation of the day was US$165.63, while its highest was US$168.05.

- XRP was trading for US$2.57, up by 9.9 percent over the last 24 hours. Its lowest valuation of the day was US$2.51, while its highest was US$2.58.

Derivatives data

The crypto derivatives market showed signs of caution amid volatility.

Recent liquidations hit US$6.79 million in Bitcoin and $4.05 million in Ether, mostly short positions, signaling short-covering that supports underlying resilience. Open interest is steady; Bitcoin slipped 0.03 percent to US$68.69 billion while Ether rose 0.26 percent to US$41.24 billion, reflecting balanced trader engagement.

An RSI of 60.37 indicates moderate bullish momentum without overextension.

Funding rates remain low but positive (0.005 Bitcoin, 0.004 Ether), showing a slight premium paid by longs to shorts, consistent with a balanced market sentiment.

Bitcoin dominance stood at 57.97, while the Fear and Green Index was 29, a slight improvement from last week.

Today’s crypto news to know

Crypto funds face US$1.3 billion in weekly outflows

Digital asset funds logged another week of heavy redemptions, with over US$1.3 billion flowing out of crypto investment products. The decline marks the second straight week of billion-dollar losses as investors remain cautious after a record 40-day US government shutdown and the absence of key economic data.

Bitcoin products led the retreat with US$932 million in outflows, followed by Ether’s US$438 million, signaling widespread risk-off sentiment. Meanwhile, short Bitcoin funds recorded their largest inflows since May, hinting that some traders expect further downside before a rebound.

Coinbase launches platform for retail token sales

Coinbase (NASDAQ:COIN) has launched a new regulated platform enabling US retail investors to participate in primary token offerings under compliance controls, starting with the blockchain protocol Monad’s token sale in mid-November.

According to the announcement, this platform prioritizes fair distribution to smaller investors, imposes token lockups on founders and sets a new standard for retail access to tokens.

The company plans on hosting one token sale per month. In the coming months, Coinbase says it plans to add features to its token sales platform, including limit orders and higher allocations for issuers’ target user bases.

Rumble to acquire Northern Data

Rumble (NASDAQ:RUM) has announced plans to acquire of AI infrastructure company Northern Data in a stock deal valued at approximately US$767 million, according to analysts at Reuters.

This follows a US$775 million investment from stablecoin issuer Tether earlier this year.

The acquisition will add 22,400 Nvidia GPUs and global data center capacity to Rumble’s portfolio, boosting its cloud and AI capabilities while expanding its international footprint. Rumble aims to leverage these assets to accelerate its video, creator and advertising roadmap, according to the press release.

Tether, which has committed to purchasing US$150 million in GPU services from the combined company and investing US$100 million in advertising for Rumble Wallet, sees this partnership as part of building a “Freedom-First” decentralized AI ecosystem that counters Big Tech control.

Leveraged spot trading comes within reach

Acting Chair of the Commodity Futures Trading Commission (CFTC), Caroline Pham, confirmed the agency is in talks with CME Group, Cboe, Nasdaq, ICE Futures, Coinbase Derivatives, Kalshi and Polymarket to implement a framework for leveraged spot trading of Bitcoin and Ethereum. CoinDesk broke this news, citing sources familiar with the matter, with Pham confirming the report via X on Sunday (November 9).

According to the report, all leveraged crypto transactions will fall under the Commodity Exchange Act, requiring execution through a Designated Contract Market, similar to commodities futures. In a statement, Pham said:

“As we continue to work with Congress on bringing legislative clarity to these markets, we are also using existing authorities to swiftly implement recommendations in the President’s Working Group on Digital Asset Markets report. I’m excited about new products that we expect to begin trading in our markets before year’s end, and am working to ensure a smooth transition for President Trump’s nominee for the permanent CFTC chairman.”

BoE proposes framework to regulate stablecoins

A proposed regulatory framework for sterling-denominated systemic stablecoins was published by the Bank of England (BoE) in a consultation paper released on Monday.

The new proposal would mandate that issuers use unremunerated BoE deposits to back a minimum of 40 percent of their liabilities. The remaining liabilities would need to be backed by short-term UK government debt.

Additionally, the proposal suggests setting a cap of 20,000 pounds (US$26,300) on individual stablecoin holdings, with an exemption of 10,000 pounds (US$13,200) for retail businesses.

The BoE seeks feedback until February 10, 2026, aiming to finalize regulations in the second half of the year.

Nasdaq, Cboe, CME to offer spot, leveraged crypto trading

The CFTC is preparing to authorize leveraged spot trading for Bitcoin and Ethereum across several regulated US exchanges, marking a major step toward integrating crypto with mainstream markets.

Acting Chair Caroline Pham confirmed on X that the agency is in talks with CME Group, Cboe, Nasdaq, ICE Futures, Coinbase Derivatives, Kalshi and Polymarket to roll out the new trading framework.

The plan would place all leveraged crypto transactions under the Commodity Exchange Act, requiring execution through a Designated Contract Market, which is the same system governing commodities futures.

Analysts expect the move to draw global trading volume away from offshore exchanges like Binance and Bybit, which have long dominated the leveraged space.

Japan’s FSA moves to license crypto custodians

Japan’s Financial Services Agency (FSA) is drafting new registration rules for third-party custody and trading service providers following last year’s DMM Bitcoin hack, which exposed more than 48 billion yen (US$312 million) in losses.

Under the proposal, all custodians and external system operators would need to register with regulators before servicing licensed exchanges. The plan also mandates that exchanges use only FSA-approved partners to minimize operational risks. Currently, Japan’s crypto framework requires exchanges to segregate and cold-store user funds but imposes no oversight on outsourced management systems — a loophole exploited in the DMM breach.

The attack was traced to Ginco, a Tokyo-based software firm that managed DMM’s trading infrastructure.

Most members of the Financial System Council’s working group have backed the proposal, which is expected to be submitted to the Diet in the 2026 legislative session.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.