Quantum computing stocks such as D-Wave Quantum Inc. QBTS gained momentum in December after Alphabet Inc. GOOGL introduced Willow, the quantum computing chip. However, in January, NVIDIA Corporation’s NVDA CEO, Jensen Huang, commented that commercializing quantum computing would likely take at least 15 years, causing D-Wave shares to plummet.

But D-Wave shares surged 46.9% on Friday, reaching a year-to-date gain of 20.8%. So, what’s driving the latest rally, and should we consider buying D-Wave stock now? Let’s delve into it.

Why QBTS Stock Soared on Friday?

During Friday’s trading session, D-Wave shares rose on positive market reception of its earnings report the previous day. D-Wave reported a net loss of 8 cents a share on $2.3 million sales. However, it was the company’s promising forward guidance that drew attention.

D-Wave expects sales of $10 million for the first quarter, way above analysts’ estimate of $2.55 million. D-Wave is optimistic about its first quarter performance mainly due to its partnership with the Julich Supercomputing Centre, which is set to receive a D-Wave Advantage annealing quantum computing system.

Also, D-Wave’s bookings in the fourth quarter have remarkably surged 502% to $18.3 million. This increase in order book restored confidence that the quantum field is progressing steadily. But it’s just not D-Wave’s quarterly report that boosted the stock. A recent scientific breakthrough has also lifted the D-Wave stock. The company claimed that its annealing quantum computer surpassed a top classical supercomputer in solving intricate magnetic materials simulations for materials discovery.

Is This the Right Time to Buy QBTS Stock?

Given its latest breakthrough and positive forward guidance, risk-tolerant investors may hold onto D-Wave stock. The company is investing heavily in quantum computing research and development, a sector projected to add $1.3 trillion to the economy by 2035, per McKinsey. This is because quantum computing can solve problems more efficiently than traditional computing and is vital for training artificial intelligence (AI) algorithms.

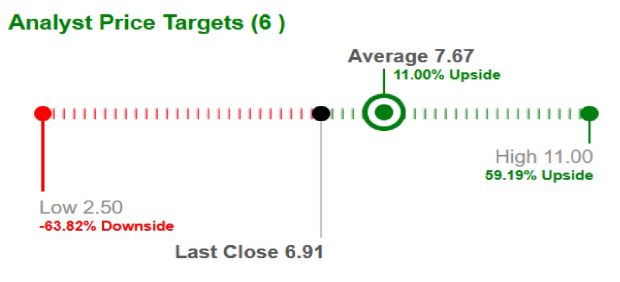

Brokers, too, are optimistic about D-Wave. They have raised the highest price target of D-Wave stock to $11 from the last closing price of $6.91, an upside of 59.2%.

Image Source: Zacks Investment Research

However, let’s admit that quantum computing is still in its nascent stage, and currently, its practical applications are not mature enough for the industry. Moreover, big tech players like Alphabet and Microsoft Corporation MSFT are eyeing the quantum computing landscape, potentially making D-Wave a takeover target, which may worry its shareholders.

Significant challenges also lie ahead for D-Wave as the company reported an EBITDA loss of $56 million in 2024, thus raising doubts about its position as a leader in this emerging quantum computing field. So, risk-averse investors may wait for further encouraging developments before placing a bet on this highly speculative stock.

D-Wave, as of now, has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

D-Wave Quantum Inc. (QBTS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).