Datadog DDOG delivered impressive third-quarter results, demonstrating robust growth and strategic execution. The company reported revenues of $690 million, marking a substantial 26% year-over-year increase and exceeding the high end of its guided range besides beating the Zacks Consensus Estimate by 4.15%.

The company reported third-quarter 2024 non-GAAP earnings of 46 cents, which increased 27.8% from the year-ago quarter and beat the Zacks Consensus Estimate by 17.95%.

With approximately 29,200 customers, up from 26,800 a year ago, Datadog continues to expand its market presence while maintaining strong profitability, generating $204 million in free cash flow with a 30% margin.

Platform Adoption Shows Remarkable Traction

The company’s platform strategy is resonating strongly with customers, as evidenced by increasing multi-product adoption rates. An impressive 83% of customers now use two or more products, while 49% utilize four or more products. Most notably, 26% of customers have adopted six or more products, up from 21% a year ago, indicating strong platform stickiness and expansion opportunities.

AI Integration Drives Future Growth

Datadog is positioning itself at the forefront of the AI revolution, with about 3,000 customers currently using one or more Datadog AI integrations. The company’s LLM observability products are gaining traction, with hundreds of customers already implementing these solutions. Early adopters report significant efficiency gains, reducing LLM-related investigation times from days to minutes.

Enterprise Customer Success and Global Expansion

The company secured several major wins in the third quarter, including a seven-figure deal with a leading Indian e-commerce company and significant expansions with a European airline and a major AI model provider. These wins demonstrate Datadog’s ability to serve diverse industries and geographical markets while addressing critical business needs.

DDOG’s Competitive Landscape and Valuation

Datadog operates in a competitive observability and monitoring market, facing rivals like New Relic, Dynatrace and Splunk. While Datadog has differentiated itself through its unified platform and multi-cloud integrations, its competitors also offer robust solutions and have established customer bases. Additionally, tech giants like Microsoft and Amazon have their monitoring tools, potentially posing a threat to DDOG’s market share.

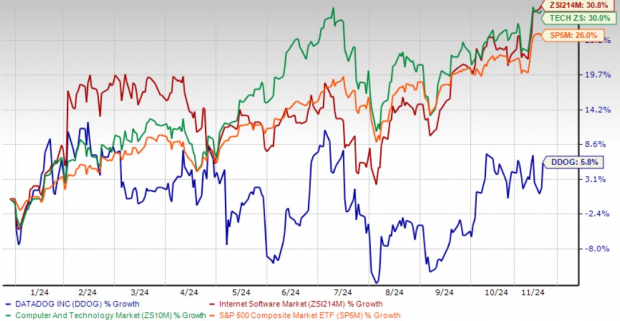

Shares of Datadog have climbed 5.8%, underperforming the Zacks Computer and Technology sector’s rise of 30%.

Year-to-date Performance

Image Source: Zacks Investment Research

Additionally, the company’s valuation may be a concern for some investors, as the stock trades at a premium compared to the broader Zacks Internet – Software industry. As of the latest data, Datadog’s forward 12-month P/S ratio hovers around 13.89, reflecting investors’ high growth expectations. This valuation is justified by Datadog’s strong revenue growth, expanding customer base and increasing product adoption.

DDOG’s P/S F12M Ratio Depicts Stretched Valuation

Image Source: Zacks Investment Research

Investment Thesis: Why Investors Should Consider Buying

With a net revenue retention rate in the mid-110s and gross revenue retention in the mid-to-high 90s, Datadog demonstrates strong customer loyalty and expansion potential.

The company’s fourth consecutive recognition as a leader in the Gartner Magic Quadrant for Observability Platforms validates its technological superiority. At the heart of Datadog’s strategy is its ability to provide comprehensive visibility across multi-cloud infrastructures. By integrating deeply with Amazon AMZN-owned Amazon Web Services, Alphabet GOOGL-owned Google Cloud and Microsoft MSFT Azure, Datadog enables organizations to monitor, analyze and optimize their entire cloud ecosystem from a single platform. This unified approach is particularly valuable as businesses increasingly adopt hybrid and multi-cloud strategies to enhance flexibility and avoid vendor lock-in.

Growing AI-native customers now represent more than 6% of ARR, which increased from 2.5% year over year, positioning Datadog to benefit from the AI boom.

With 15 products exceeding $10 million in ARR and continuous platform enhancements, Datadog shows strong product-market fit and innovation capability.

Outlook and Recommendation

For investors considering Datadog, the company’s guidance for fourth-quarter 2024 projects revenues between $709-$713 million, representing 20-21% year-over-year growth. For 2024, the company projects revenues between $2.656 billion and $2.660 billion and non-GAAP earnings per share in the range of $1.75-$1.77.

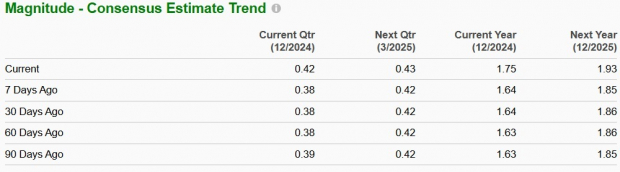

The Zacks Consensus Estimate for 2024 revenues and earnings is pegged at $2.66 billion and $1.75 per share, respectively. This indicates a year-over-year improvement of 24.9% in the top line and 32.5% in the bottom line. The earnings estimate has moved north by 6.7% over the past 30 days.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

With stable business conditions, strong customer adoption and strategic positioning in high-growth areas like AI, Datadog presents an attractive investment opportunity. Current shareholders should maintain their positions given the company’s solid execution, expanding product portfolio and strong financial metrics. For potential investors, Datadog’s combination of robust growth, market leadership and strategic positioning in AI makes it a compelling buy, particularly for those seeking exposure to the cloud computing and AI observability sectors.

DDOG stock currently carries a Zacks Rank #2 (Buy) and has a Growth Score of A, a combination that indicates a good investment opportunity, per the Zacks proprietary quantitative model. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report