Delving into the realm of stock investments, one often turns to the gospel of Wall Street analysts for guidance. Their proclamations can sway market tides, but can they be trusted as the ultimate compass in the tempestuous sea of trading decisions?

Before setting sail, let’s uncover the sentiments of the elite Wall Street mavens toward the coveted Alibaba (BABA).

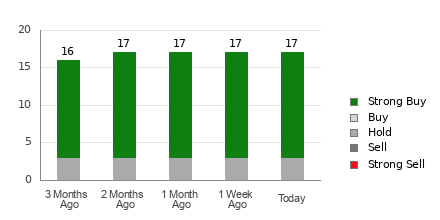

Alibaba currently stands adorned with an average brokerage recommendation (ABR) of 1.35 on a scale from 1 to 5 (ranging from Strong Buy to Strong Sell). This metric crystallizes the amalgamated endorsements of 17 brokerage firms into a tantalizing narrative of buy-side fervor.

Scrutinizing the 17 voices that compose this Sirens’ song, 14 chant the hymn of Strong Buy – a resounding chorus commanding a remarkable 82.4% of the symphony.

Unearthing Trends in Brokerage Recommendations for BABA

While the mystical ABR chant beckons the investors to Alibaba’s shores, tread not blindly in its echoic cadence. The obscured lighthouse of empirical wisdom has shone little light on the path of brokerage recommendations, unearthing meager success in prophesying the zenith of stock prices.

Why this opacity, you ask? The allegiances of brokerage firms to the stocks they foster gives rise to a chivalrous bias among their analysts, who, for every cry of “Sell,” raise five banners of “Buy.” The harbingers’ interests entwined not with retail traders, often evade revealing the true trajectory plotted in the stars of stock prices. Ergo, perhaps view this information as a herald to corroborate your own inquiries or another divination of proven efficacy in predicting the destiny of a stock.

With an aura of certainty enveloping its aura, the Zacks Rank, our heraldic stock rating apparatus, stakes claim to a kingdom divided into five territories from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), a reliable oracle foreseeing a stock’s near-term fates. Thus, coupling the Zacks Rank with ABR may forge a path toward profitable investment realms.

Discerning Zacks Rank from ABR

Though both Zacks Rank and ABR frolic in the same scale from 1 to 5, they are akin to twilight and dawn.

Where ABR resonates with brokerage endorsements in an arithmetic serenade, its decimal notes reveal the harmony between bullish and bearish. Conversely, the Zacks Rank conducts a symphony of quantitative principles, illuminating the cosmos of earnings estimate revisions in whole numbers that echo its melody from 1 to 5.

The bards of brokerage firms, bedazzled in optimism, frequently steer their narrative toward the sunlit plains of High Ratings, adorning stocks with halos brighter than their tale sanctions. Their bias, akin to will-o’-the-wisps in a murky marsh, often lead the unsuspecting astray more than guiding them.

Contrarily, the Zacks Rank traverses cosmos of earnings revisions. Thus, where stars align with earnings estimate trends, the wheels of stock prices are oft set in motion.

A divergence lies in the freshness of the ABR and Zacks Rank. While ABR’s scent may turn stale, the Zacks Rank, akin to the perennial Phoenix, burgeons anew as it captures analysts’ constant metamorphoses of earnings forecasts, rendering it a timely clairvoyant of stock prices yet to be unveiled.

Is BABA a Treasure Trove or a Fool’s Gold?

In the realm of Alibaba’s earnings estimate metamorphoses, the Zacks Consensus Estimate for the current year witnesses a minuscule dip of 0.1%, descending to $8.20 in the span of a lunar cycle.

The contemplations of analysts, veiled in skepticism toward Alibaba’s earnings oracle, paint a tapestry of descending EPS prophecies, ushering forth unity in their declination. A Zacks Rank #4 (Sell) now graces Alibaba’s gate, based on profound insights into the whispers of earning estimates, consummating in a stock that may be set to tread the thorn-laden path in the moons ahead. Curious souls may seek the full almanac of Zacks Rank #1 (Strong Buy) vocations here.

Hence, as you weigh Alibaba’s journey, it’s prudent to savor the ABR’s sweetness with discerning spirit.

Resources – Anchors and Prophetic Winds

The quest for clean hydrogen energy anticipated to burgeon to $500 billion by 2030 and quinquuple by 2050 beckons. While no certitudes whisper in the winds, three shadows now dance on the horizon, ready to usurp the throne.

For the astute, Zacks Investment Research extends an urgent field guide, unriddling these ascendant specters poised to reign. Gaze upon Hydrogen Energy: 3 Industrial Giants to Ride the Next Renewable Energy Wave.

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Embark on a voyage to enlightenment on Zacks.com. Sail forth.