When investors ponder whether to buy, sell, or hold a stock, the Wall Street analysts shine as beacons of guidance – or so we’re told. The chatter surrounding ratings from these brokerage mavens can sway stock prices one way or another, but do these ratings truly hold weight?

Before we dive into the trustworthiness of brokerage recommendations and their strategic impact, let’s take a gander at the gospel according to the Street’s titans concerning Canoo Inc. (GOEV).

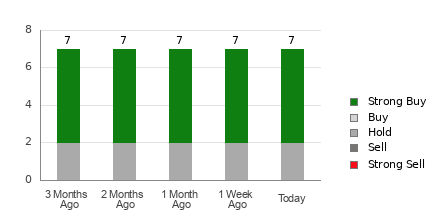

As of now, Canoo sports an average brokerage recommendation (ABR) of 1.57. This ABR, existing on a scale from 1 to 5, is an arithmetic derivative of the actual recommendations – be it Buy, Hold, Sell – emanating from seven brokerage houses. An ABR of 1.57 nestles comfortably between Strong Buy and Buy.

The current ABR entails five Strong Buy recommendations out of seven, amounting to a lion’s share of 71.4% of all endorsements.

Exploring the Evolution of Brokerage Recommendations for GOEV

While the ABR beckons towards embracing Canoo, prudence dictates not tethering one’s investment decisions solely to this index. An extensive array of studies starkly illustrates the tepid success rate of brokerage recommendations in steering investors towards stocks fostering the most promising price elevations.

Curious why? The predisposed interest of brokerage firms in stocks they hoot about oft leads to a conspicuous favorable slant of their analysts in rating such stocks. Our rigorous research spotlights a glaringly discordant ratio wherein for every “Strong Sell” trumpet, there resound five heralds of “Strong Buy”.

For retail investors, the mismatch of interests posits a foggy panorama on the probable trajectory of a stock’s future price trajectory. Consequently, it is judicious to harness these endorsements as conduits to authenticate one’s in-depth analysis or to corroborate a tool renowned for its prescient aptitude in divining stock price gyrations.

Flaunting an externally verified track record, our in-house stock rating arsenal dubbed the Zacks Rank, esteemed for slotting stocks into five clusters from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), stands as a dependable harbinger of a stock’s immediate fiscal reel. Hence, juxtaposing the Zacks Rank with ABR could pave a profitable path in your investment vista.

Decoding ABR against Zacks Rank: A Clash of Concepts

Diverging as east is from west, the Zacks Rank and ABR march to contrasting drumbeats.

The lodestar for concocting ABR pedestals on broker recommendations and typically appears in decimal flairs, say 1.28. In stark contrast, the Zacks Rank finds its mooring in a quantitative model engineered to harness the potency of earnings estimate rejigs, flaunted as whole numbers – 1 to 5.

Broker analysts, tethered to the brokerage realm, perennially clang the cymbals in celebration, proffering ratings more ebullient than their due, courtesy of their hierarchal overlords’ vested interest. This excessive zeal sows more confusion than clarity among investors.

In contradistinction, the Zacks Rank dances to the tune of earnings estimate rejiggers. In this melody, near-term stock price calisthenics share a vigorous tango with the ebbs and flows of earnings estimate trends, as evidenced by cold, hard empirical research.

Add to the potpourri a dash of distinction – each Zacks Rank league is portioned out uniformly across all stocks basking under brokerage analysts’ current-year earnings prophecy. The tool perpetually espouses equilibrium across its five-tier hierarchy.

Another nuanced divergence between ABR and Zacks Rank unveils in the freshness of the cup. ABR, frozen in its tracks, might unknowingly age like fine wine. In stark contrast, brokerage analysts’ ceaseless tinkerings with earnings fortunetelling, swiftly etched into the Zacks Rank catacombs, ensures timely auguries into future stock price expeditions.

Charting Investment Waters: The Case for GOEV

Peering through the prism of earnings estimate acrobatics for Canoo, the Zacks Consensus Estimate for the prevailing year retains an unflinching stance at -$3.72 over the bygone month.

The analysts’ stoic stance meandering around the company’s bottom-line prospects, mirrored through an unaltered consensus, might furnish Canoo a ticket to parallel the broader market course in the immediate horizon.

A tinkering with the consensus estimate, coupled with three more trysts entwined with earnings conjectures, ushers a Zacks Rank #3 (Hold) for Canoo. For the grand list of contemporary Zacks Rank #1 (Strong Buy) peddlers, consult here.

Thus, exercising a degree of caution with the Buy-matching ABR for Canoo could be a prudent maneuver.

Verdict

Steer clear of heeding the siren call of brokerage analysts at face value. Dive deeper into the analysis trenches armed with a multi-disciplinary arsenal like Zacks Rank to sift the nuggets of wisdom from the cacophony of industry buzz.