The atmosphere for tech investors this week was akin to a rollercoaster ride – exhilarating at times but often culminating in a stomach-churning drop. The tech earnings season kicked off with what can only be described as a series of unfortunate events for shareholders, particularly those following the fortunes of the industry’s Magnificent Seven.

Challenges Amidst Strong Performances

Alphabet Inc. (NASDAQ: GOOGL) managed to dazzle with robust earnings and revenue figures. However, the company’s stumble in the realm of YouTube advertising revenue cast a shadow over an otherwise promising showing, resulting in a turbulent week that left Google’s parent firm reeling.

Missed Expectations and Market Reactions

Tesla Inc. (NASDAQ: TSLA) found itself on the wrong side of the profit forecast, citing slimmer margins due to price reductions in the electric vehicle market and hefty restructuring costs. The delayed unveiling of the much-anticipated Robotaxi only added to the disappointment, leading to a sharp 12.3% decline in share value, marking the worst single-day performance since September 2020.

Market Shifts and Contrasts

The Nasdaq 100 index bore the brunt of these setbacks, marking its second consecutive week in the red for the first time in months, dating back to April.

Contrasting Fortunes Among Mega-Cap Stocks

On the mega-cap front, stalwarts like Ford Motor Company (NYSE: F) and United Parcel Service Inc. (NYSE: UPS) faced significant declines, in stark contrast to the more positive performances of 3M Company (NYSE: MMM) and Bristol-Myers Squibb Company (NYSE: BMY), buoyed by unexpectedly strong earnings reports.

Small-Cap Resilience

While major players stumbled, small-cap stocks continued to outshine their larger counterparts, with the Russell 2000 Index extending its winning streak into a third consecutive week. This upward trajectory was underpinned by a wave of optimism surrounding imminent interest rate cuts.

Economic Landscape

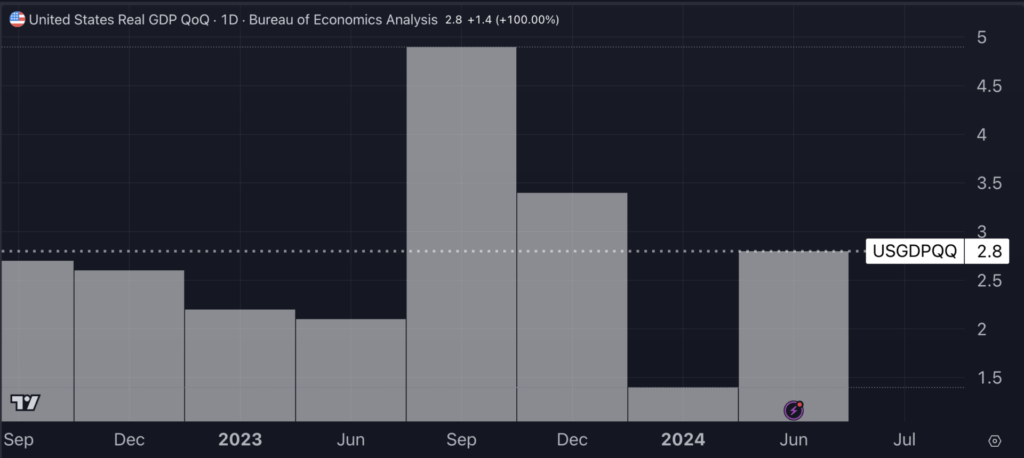

Steering away from the microcosm of individual companies, the broader U.S. economy displayed signs of vigor, with second-quarter growth expanding at an annualized rate of 2.8%. This acceleration from Q1 figures exceeded market expectations, painting a promising picture of economic resilience and momentum.

Insights and Reflections

A deeper analysis provides a glimpse into the intricate dance between market forces and economic indicators, illustrating the delicate balance that underpins investor sentiment and financial performance.

Interpreting Key Developments

As inflation metrics ebb and flow, market participants eagerly await signals from the Federal Reserve, with the current trajectory pointing towards a potential rate cut in the near future. However, the Fed remains cautious, seeking a sustained downward trend before making definitive decisions.

Simultaneously, disruptive forces loom on the horizon, exemplified by OpenAI’s impending launch of SearchGPT, a direct challenge to Google’s search supremacy. This technological showdown promises to reshape the digital landscape and spark intense competition within the tech sphere.

Shifting focus to the housing market, declining mortgage rates have provided relief to prospective homebuyers, falling to levels unseen since February. Yet, despite this favorable environment, demand remains lackluster, raising questions about the broader economic climate and consumer sentiment.

Reflecting on these developments, investors are urged to exercise caution and strategic foresight, navigating the turbulent waters of market volatility with a keen eye on evolving trends and disruptive innovations.

You might have missed…

Charting the course ahead requires a blend of historical context and forward-looking insights, aligning past lessons with future opportunities to craft a robust investment strategy in an increasingly complex and dynamic financial landscape.

Image created using artificial intelligence via Midjourney.