Readers of a certain age will recall President Ronald Reagan launching one of the most ambitious military buildups in American history.

In a bid to overwhelm the Soviet Union, Reagan doubled the U.S. military’s budget from under $150 billion in 1980 to over $300 billion by 1985. The government invested heavily in B-1 bombers, MX missiles and an expanded Navy fleet. The Strategic Defense Initiative (SDI), dubbed “Star Wars” by critics, aimed to create a space-based missile defense system.

The 40th president believed that peace could only be achieved through strength, and history proved him right. The Americans outspent and out-innovated the Soviets… and ultimately outlasted them.

NATO Agrees to Increase Defense Spending

Today, we’re seeing Regan’s strategy play out on the international stage. At the NATO summit in The Hague last week, the 32-member alliance agreed to boost defense spending to 5% of GDP by 2035, with a floor of 3.5% earmarked for “core military needs.” That’s more than double the previous 2% target set back in 2014.

NATO Secretary-General Mark Rutte credited President Donald Trump with pushing allies to commit to a higher spending level. “This would not have happened” without Trump, Rutte said.

Trump echoed Reagan’s “peace through strength” energy in his own remarks: “It’s vital that this additional money be spent on very serious military hardware… and hopefully that hardware is going to be made in America because we have the best hardware in the world.”

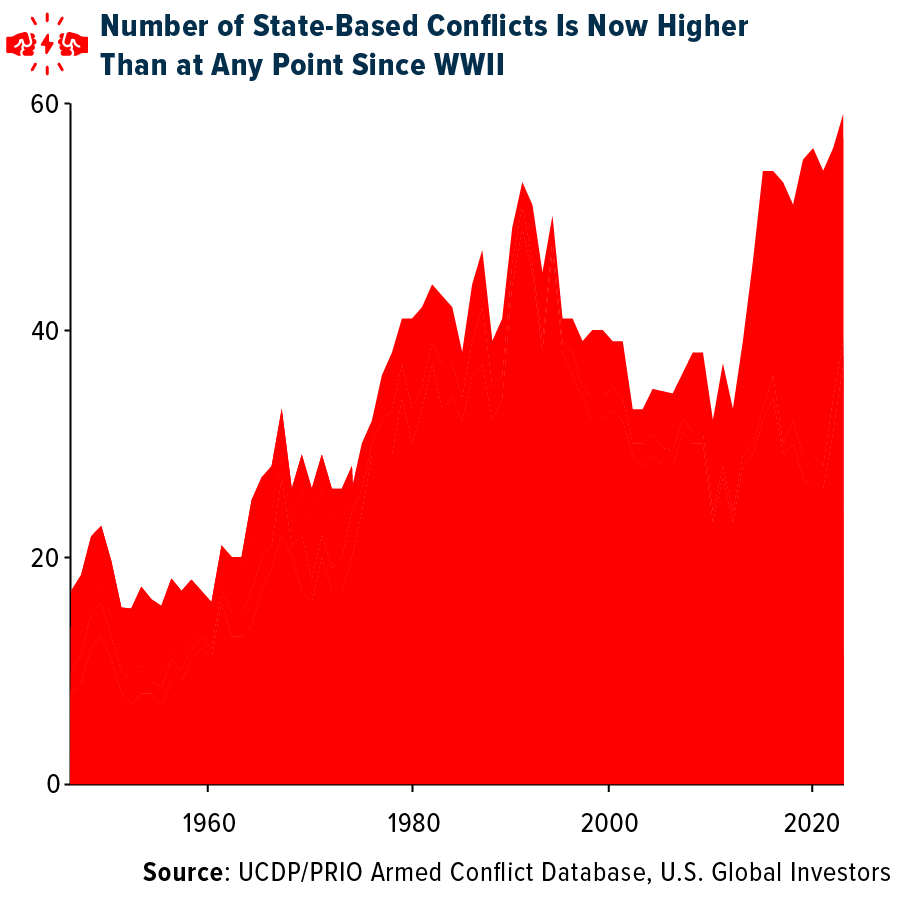

Growing Number of Conflicts Across the Globe

It’s not difficult to see why this spending spree is happening now. The world is getting more dangerous. According to the 2025 Global Peace Index, there are 59 active state-based conflicts globally, the highest number since World War II.

Ranked as this year’s least peaceful country, Russia remains an active military threat, with its war in Ukraine extending into a third year and showing few signs of resolution.

China is executing a “massive” military expansion, according to NATO, including advanced missile systems and naval expansion in the South China Sea.

And as you know, Iran recently retaliated against U.S. airstrikes with missile attacks on Al Udeid Air Base in Qatar, raising tensions in the Middle East.

NATO Allies Moving Fast

Some NATO countries aren’t waiting until 2035 to act. Poland is already spending over 4% of its GDP on defense, the highest rate among all other members.

Germany has pledged to reach 3.5% by 2029, even changing its constitutional debt rules to make it possible.

The UK just ordered a dozen nuclear-capable F-35A fighter jets, marking its biggest nuclear deterrent upgrade since the Cold War.

Here in the U.S., President Trump has proposed an $893 billion defense budget for 2026 that favors drones and smart missiles, while reducing some legacy investments such as warships and fighter jets. He appears to be focused on high-tech, cost-effective equipment, modeled in part after Ukraine’s recent successes with drones on the battlefield.

Defense a “Dynamic Growth Industry”?

Defense has long been considered a “value sector”—slow and steady, backed by government contracts. That narrative could be changing.

According to analysts at Stifel, we’re entering a new cycle where defense is a “dynamic growth industry.” We’re now in an arms race driven not just by tanks and jets, but also AI, cyber, space and next-gen missiles.

Consider that U.S. defense budgets remain near record highs. Defense spending in Europe rose 17% year-over-year to $693 billion in 2024, before the new 5% NATO target became a reality.

Despite this, Europe is still overly reliant on American hardware and production capacity, according to findings by the Kiel Institute.

That, too, could spell opportunity. American defense companies—especially those focused on drones, missile systems, cybersecurity and space-based tech—stand to benefit the most from this multi-decade rearmament cycle.

For investors, I believe this marks the beginning of a long-term secular shift.

****

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.