Amid market turbulence, investors often seek refuge in dividend-yielding stocks. These stalwart companies, flaunting robust cash flows, generously reward shareholders with bountiful dividend payouts. Such stocks are viewed as a beacon of stability in choppy waters, providing a shield against market volatility.

For those eager to glean insights into analysts’ top picks, a visit to Benzinga’s Analyst Stock Ratings page is in order. There, an extensive array of analyst ratings awaits, allowing traders to peruse through the assessments of Wall Street’s most accurate forecasters.

Let’s shine a spotlight on the assessments of these astute analysts and their top picks in the consumer staples sector.

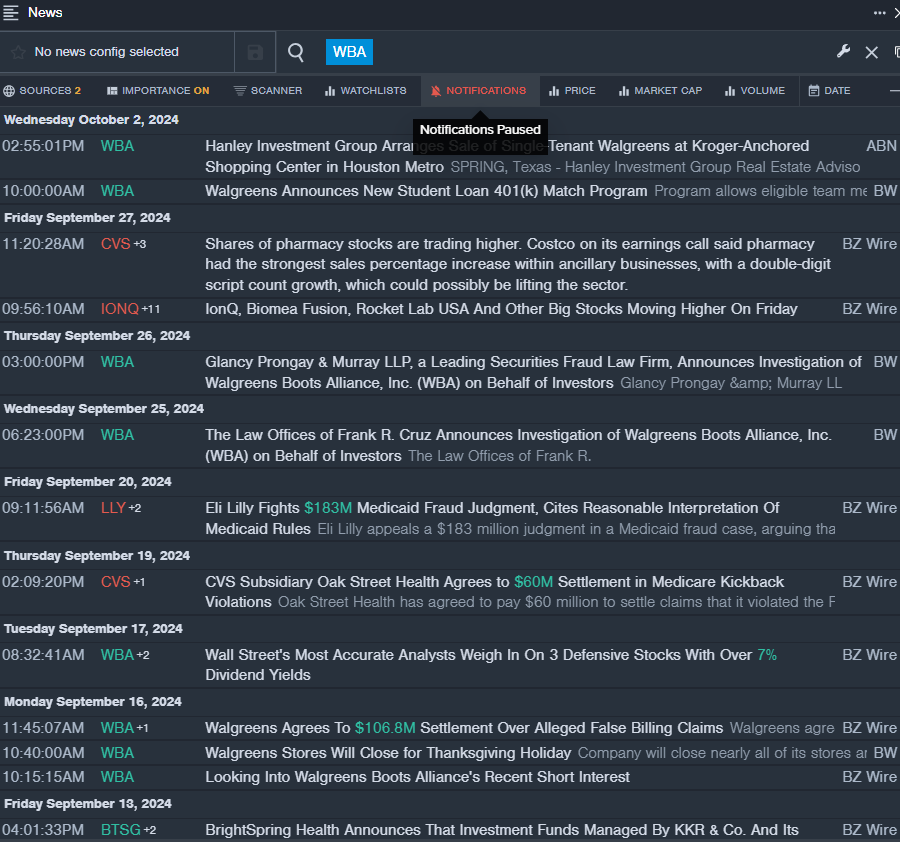

Walgreens Boots Alliance, Inc. (NASDAQ:WBA)

- Dividend Yield: 11.49%

- UBS analyst Kevin Caliendo opted to maintain a Neutral rating but slashed the price target from $17 to $12 on July 3. Impressively, this analyst boasts a solid accuracy rate of 75%.

- RBC Capital analyst Ben Hendrix echoed a similar sentiment by maintaining a Sector Perform rating while reducing the price target from $22 to $13 on July 2. With a respectable accuracy rate of 73%, this analyst’s insights are not to be taken lightly.

- Recent News: Walgreens Boots Alliance made headlines on Sept. 13 by agreeing to a $106.8 million settlement to resolve allegations of submitting false claims to government healthcare programs, an action that contravened the False Claims Act and state regulations.

- For the latest news on Walgreens Boots Alliance, alert Benzinga Pro’s real-time newsfeed stands vigilant, ensuring investors stay informed.

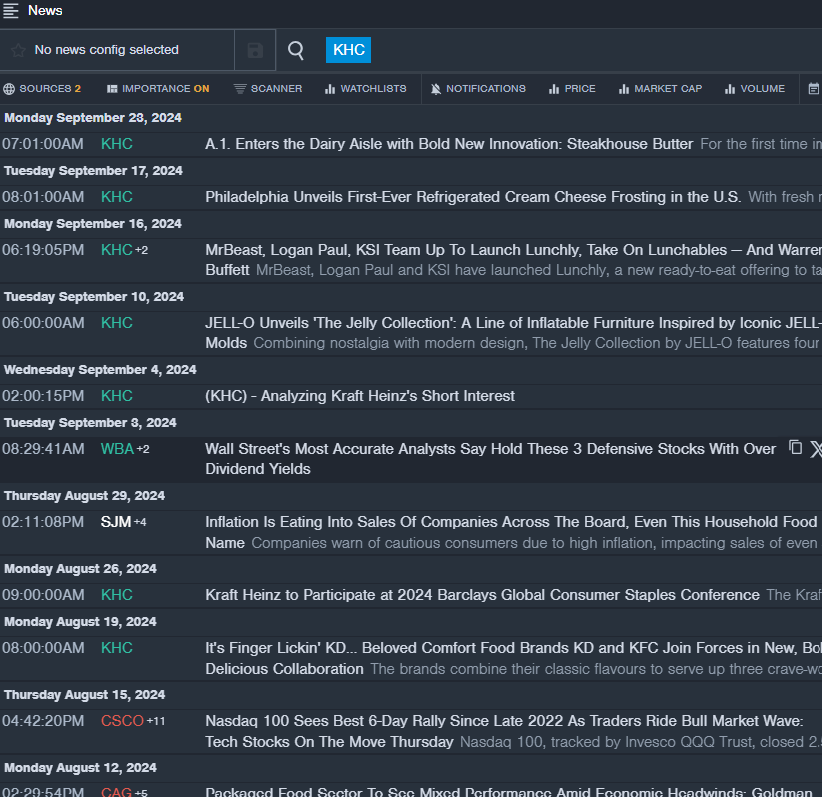

The Kraft Heinz Company (NASDAQ:KHC)

- Dividend Yield: 4.66%

- Wells Fargo analyst Chris Carey chose to uphold an Equal-Weight rating while bumping up the price target from $34 to $35 on Aug. 1. With a track record of 63% accuracy, this analyst brings a pragmatic perspective to the evaluation.

- B of A Securities analyst Bryan Spillane echoed a bullish sentiment by maintaining a Buy rating and modestly reducing the price target from $42 to $38 on July 10. Boasting a commendable accuracy rate of 64%, this analyst’s guidance is valued by many in the investment community.

- Recent News: On July 31, The Kraft Heinz Company surpassed expectations, reporting better-than-expected second-quarter adjusted EPS results, sending a positive ripple through the market.

- Stay up-to-date on The Kraft Heinz Company’s latest developments by leveraging Benzinga Pro’s real-time newsfeed, ensuring you’re always in the know.

Philip Morris International Inc. (NYSE:PM)

- Dividend Yield: 4.52%

- Goldman Sachs analyst Bonnie Herzog reiterated a Buy rating and adjusted the price target from $126 to $140 on Sept. 26. With an impressive accuracy rate of 71%, this analyst’s forecasts hold substantial weight in the financial realm.

- Barclays analyst Gaurav Jain adopted an Overweight rating and elevated the price target from $130 to $145 on Sept. 9. Garnering a commendable accuracy rate of 66%, this analyst’s insights offer valuable guidance to investors.

- Recent News: Anticipation is high as Philip Morris International gears up to unveil its results for the fiscal third quarter on Oct. 22, a report that is bound to reverberate within the investing community.

- Gain a competitive edge by utilizing Benzinga Pro’s charting tool, essential for detecting trends and optimizing your investment decisions.

Read More: Market News and Data brought to you by Benzinga APIs