- Investors often succumb to fear-driven predictions, undermining their long-term financial goals.

- Historical trends show that bullish strategies consistently outperform bearish forecasts.

- Understanding market cycles is key to navigating inevitable corrections and achieving success.

In the investment world, a popular saying goes, “Bearish people look smarter, but bullish people make money.” This adage rings especially true when we examine long-term stock market performance.

Historical data, whether referencing the or , reveals a consistent trend: over 16 years or more, the returns have always been positive.

Despite this evidence, many investors unwittingly sabotage their portfolios by heeding the doom prophets who, year after year, forecast impending catastrophes.

While these naysayers occasionally hit the mark, their success rate is akin to a broken clock—correct only twice a day.

These voices of doom resurfaced at the beginning of the current year, prompting us to reflect on predictions from three prominent figures in this realm:

1. Jeremy Grantham, who ‘rang the alarm’ on an ‘everything bubble’

2. Harry Dent (not the one from Batman), who called the ‘crash of a lifetime in 2024’

3. John Hussman

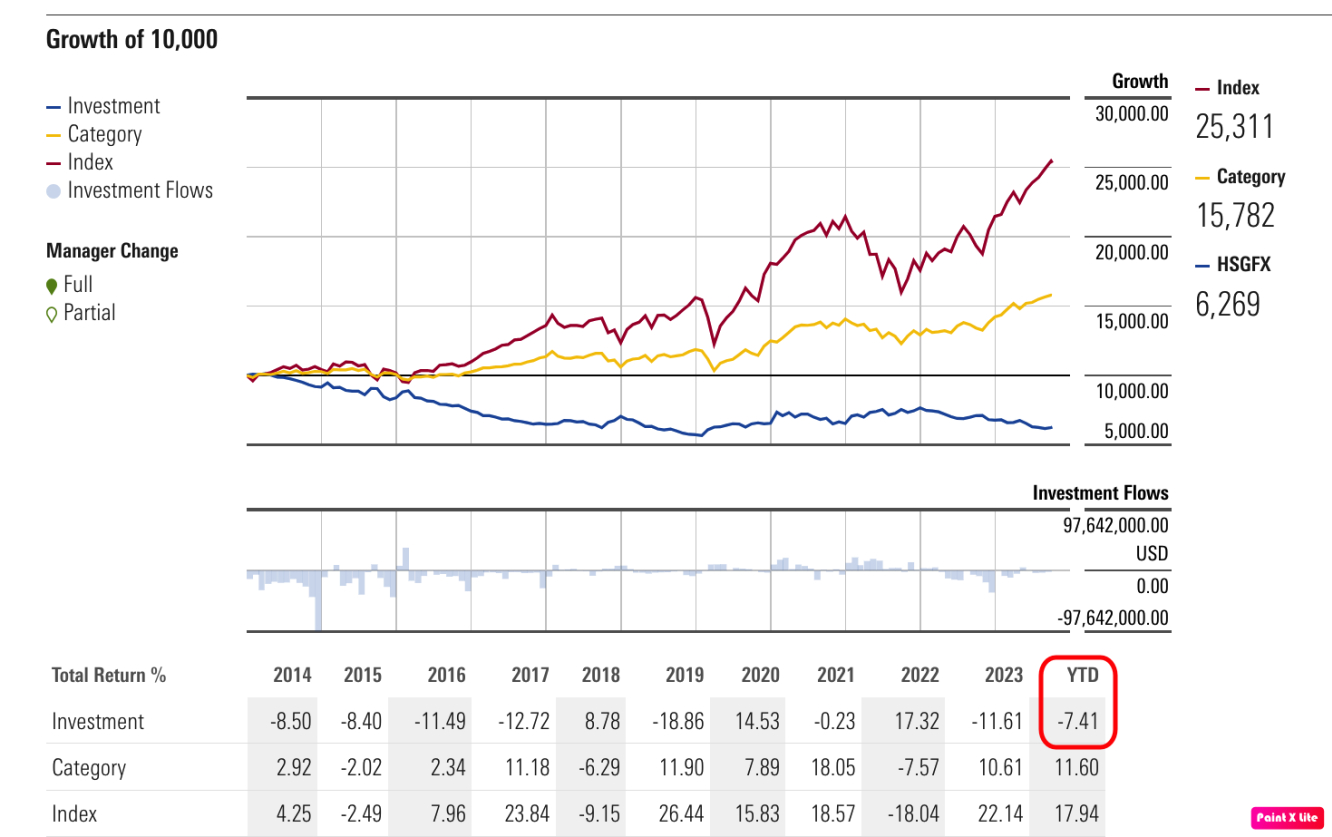

Finally, consider John Hussman. Over the past decade, his catastrophic predictions have led to an impressive -38% return.

This year, while the stock market has gained about 20%, his fund is down 7.41%. In short, betting on market collapses has proven to be a poor strategy for long-term success.

Why Do These Prophets Persist Despite Woeful Forecasts?

The answer lies in human nature and the media’s appetite for sensationalism. Headlines that stoke fear inevitably draw more attention. Consider these two headlines:

- “S&P 500 Up 20.5% Since Start of Year—Here’s Why!”

- “S&P 500 Faces 30% Collapse—Here’s Why!”

It’s clear which one grabs your interest. The second one sells better, drives more clicks, and generates higher revenue, fueling a cycle where fear reigns supreme.

Unfortunately, this fixation on pessimism can cause investors to miss out on one of history’s most lucrative bull markets. Those who cling to the predictions of these “experts” risk losing sight of their financial goals and letting inflation erode their savings.

Strategic Steps Towards Enlightened Investing

It’s important to recognize that bear markets occur statistically once every four years, making them a norm rather than an anomaly.

In years like 2022, when markets falter, the doom prophets reclaim credibility, declaring, “I was right!” But if they had remained consistently bullish, they would have been correct three out of four years. The logic simply escapes me.

In conclusion, steer clear of these characters and their fear-inducing narratives. What truly matters is understanding market history, recognizing statistical patterns, and devising a solid investment strategy.

Yes, challenging periods will arise—markets are currently priced higher than usual, and corrections are inevitable.

However, if you fail to harness the market’s natural ebb and flow, you’ll continue to fall prey to fear. Embrace the journey, and let time work in your favor.