Earnings season continues to move rapidly, with this week by far reflecting the busiest yet. So far, the performance has been decent, but recent tariff talks have caused analysts to downwardly revise their earnings expectations for the current (Q2) and coming periods.

This week, we’ll hear from entertainment titan Disney DIS. Disney has assets that span movies, television shows, and theme parks.

But how does the company shape up heading into its earnings release, particularly on the streaming side? We can use streaming results from Netflix NFLX as a small read-through on the level of demand among consumers. Let’s take a closer look.

Netflix Impresses

Strong results have led to NFLX’s surge over the past year, with the reaffirmation of FY25 guidance in its latest print going a long way in alleviating investors. Up 90% over the past year, the stock has been a massive bright spot, with its run seemingly being ignored by many amid the AI frenzy.

Image Source: Zacks Investment Research

Continued subscriber growth has overall been the name of the game for Netflix, with the company reporting a negative subscriber growth rate just once over its last 12 quarters. The ad-supported tiers were a big surprise to consumers initially given Netflix’s popularity for being ad-free, but the success of the implementation is notable.

A big crackdown on password sharing, though initially met with blowback among subscribers, has also unlocked many obvious benefits as the company looks to capture revenue from viewers who were potentially watching without an individual subscription.

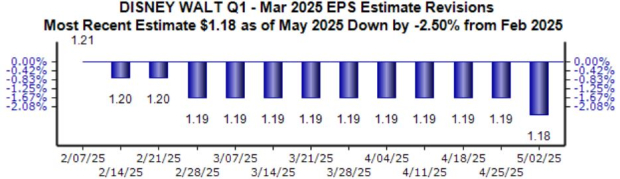

Disney Outlook Remains Bearish

Analysts haven’t been bullish for Disney’s quarter to be reported, with the current $1.18 Zacks Consensus EPS estimate down roughly 3% since the beginning of February. The value suggests a 3% pullback YoY, whereas sales are expected to grow 5% to $23.1 billion.

Image Source: Zacks Investment Research

The company exited its latest period with 174 million Disney+ Core and Hulu subscriptions, and more than 120 million Disney+ Core paid subscribers, which reflected an increase of 4.4 million over the prior quarter.

So while the company has seen overall subscriber growth, the pace relative to NFLX is much lower, likely a reflection of NFLX’s successful business implementations that got them back on track to subscriber growth.

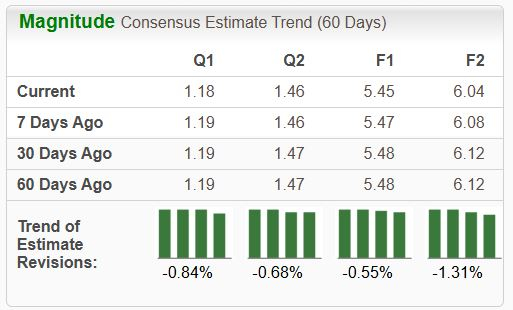

The broader revisions picture for Disney also remains bearish, with the stock sporting a Zacks Rank #4 (Sell) due to negative revisions across the board.

Image Source: Zacks Investment Research

Bottom Line

We’ve got a big-time entertainment giant on the reporting docket this week – Disney DIS. A peer concerning streaming, Netflix NFLX, posted notably strong results, reporting great growth overall.

Analysts haven’t been bullish regarding Disney’s earnings outlook, with the current Zacks Consensus EPS estimate seeing negative revisions since February. Its current Zacks Rank #4 (Sell) rating also reflects a broader negative revisions picture overall. Investors should watch for positive earnings estimate revisions post-earnings if commentary supports them, which would reflect a meaningful change in sentiment overall.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).