DocuSign’s Fiscal Performance Preview

DocuSign, Inc. (DOCU) is set to unveil its second-quarter fiscal 2025 results on Sep. 5 post-market closure. Analysts project earnings to reach 80 cents, reflecting a robust 11.1% uptick from the same period last year. Revenue estimates also paint a positive picture, standing at $726.2 million with a 5.6% year-over-year growth expectation. Notably, there haven’t been any recent alterations to analyst predictions.

The company boasts a track record of exceeding earnings forecasts, outperforming the Zacks Consensus Estimate by an average of 15.7% over the past four quarters.

Mixed Earnings Prediction for Q2

Contrary to standard indicators for an earnings beat, DocuSign’s current scenario doesn’t spell out a sure success for the upcoming report. While a favorable Earnings ESP alongside a Zacks Rank #1, #2, or #3 would typically indicate potential, the lack thereof in this instance presents an uncertain outlook. With an Earnings ESP of 0.00% and Zacks Rank #3, DocuSign’s immediate earnings fate remains in limbo.

Focusing on Customer Acquisition for Growth

The key driver behind DocuSign’s predicted Q2 success lies in customer acquisition strategies. Through a blend of existing customer sales escalation and new market penetration, the company anticipates substantial revenue growth. Deploying direct and indirect sales tactics, DocuSign’s efforts are poised to yield significant sales expansions.

Projections indicate an upsurge in subscription revenues to $706.8 million, marking a 5.7% year-over-year rise. Additionally, expectations for professional services and other revenues stand at $19.4 million, reflecting a 5.6% uptick. Enhanced margins are primed to bolster the bottom line during the quarter.

Valuation Insights for DOCU Stock

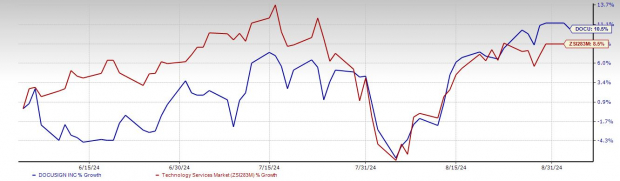

Despite recent gains, DocuSign’s stock remains relatively affordable, appreciating by 10.5% over the past three months. This growth surpasses the 8.5% industry average and the 6.5% uptick in the Zacks S&P 500 composite.

Price Performance Check

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Even with recent growth, DocuSign’s valuation remains reasonable. Presently trading at 26.6X trailing 12-month EV-to-EBITDA, DOCU stands significantly below the industry’s 50.6X average. On a forward 12-month Price/Earnings ratio basis, DocuSign trades at 17.6X forward earnings, well below the industry average of 35X.

Investment Implications for DOCU

DocuSign’s eSignature product continues to serve as a revenue powerhouse, fueling its financial trajectory with heightened demand for electronically signed documents. The company’s recent financial reports underscore a positive performance trend, adhering to strategic goals of product innovation and market alignment. Notably, collaborations with tech giants like Salesforce and Microsoft, along with savvy acquisitions like Lexion, have strengthened DocuSign’s market positioning.

Given the impending earnings release for the second quarter of fiscal 2025, maintaining a hold strategy on DocuSign shares is advised. Moderate projections of an 11.1% earnings boost and 5.6% revenue surge, coupled with a stable analyst outlook, suggest a tempered market response. While DocuSign’s past performance is commendable, the current analytics offer a cautious outlook for a substantial uptick this quarter.

DocuSign’s reasonable stock valuation, robust market standing in the eSignature domain, and strategic partnerships underpin its long-term growth narrative. While future prospects remain encouraging, near-term expectations point to a modest trajectory, prompting a vigilant approach until more definitive performance metrics emerge.

Seeking the Best Investment Moves

Unlocking the full potential of your investment portfolio necessitates sound decisions in stock selection. Embracing a prudent stance toward DocuSign’s shares until post-earnings positioning becomes clearer could unlock optimal gains. The prospect of sustained market performance in the long run, counterbalanced by short-term moderations, warrants a discerning investment strategy.