U.S. legacy automaker General Motors GM is adjusting production at its Detroit Factory Zero plant. It is scaling back shifts for two EV models to align its output with demand. The company will temporarily cut one shift each for the GMC Hummer EV and Cadillac Escalade IQ from Sept. 2 to Oct 6. While production of the Chevrolet Silverado EV and GMC Sierra EV pickups continues, the slowdown reflects weaker-than-expected U.S. demand for EVs.

Impacted workers will face temporary layoffs but remain eligible for subpay and benefits under GM’s agreement with the United Auto Workers. The shift cuts highlight a tough reality— EV adoption in the United States is not keeping pace with earlier industry optimism.

When General Motors set aggressive EV targets four years ago, federal incentives and supportive regulations under the Biden administration encouraged automakers to double down on electrification. Today, the landscape is very different. The Trump administration has rolled back emissions rules, ended EV purchase incentives and imposed high tariffs — moves that make it harder for automakers like GM to hit earlier production and sales goals.

The company has already been adjusting its EV plans. In April, General Motors temporarily slashed 200 jobs at Factory Zero. In June, it announced $4 billion in spending for mostly gasoline-powered vehicles, signaling that it isn’t going all-in on EVs just yet. Last month, it delayed a second electric truck plant and the Buick brand’s first EV by six months, pushing its earlier target of 1 million North American EVs by 2025 further out of reach.

CFO Paul Jacobson expects production and wholesale volumes of 200,000 to 250,000 EVs in North America this year, with profitability on a contribution-margin basis once output reaches 200,000 units in the fourth quarter. GM wholesaled about 75,000 EVs in the first half, so it has ground to cover.

Other Auto Giants Altering EV Plans

Ford F is also facing similar challenges as it balances EV investment with demand realities. Ford scaled back EV production last year, reducing its Rouge Electric Vehicle Center in Dearborn—where the F-150 Lightning is built—to a single shift, and scrapping plans for an all-electric three-row SUV at its Oakville Assembly Complex in Ontario. At the same time, Ford continues to lean on its hybrid truck lineup to protect margins. This cautious approach reflects the same recalibration GM is making, showing that even legacy leaders must pace their EV rollouts carefully.

Toyota TM has also delayed U.S. production of its planned electric SUV to 2028, a year later than expected, shifting manufacturing to its Kentucky plant. The move allows Toyota to boost output of the high-demand Grand Highlander, offered in gasoline and hybrid versions. With U.S. EV demand softening and federal tax credits ending, Toyota’s delay highlights its cautious strategy of prioritizing hybrids.

The Zacks Rundown for General Motors

Shares of GM have gained around 10% year to date against the industry’s decline of 13%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

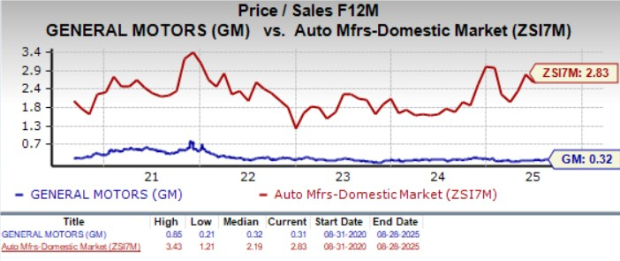

From a valuation standpoint, GM trades at a forward price-to-sales ratio of 0.32, below the industry average. It carries a Value Score of A.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Take a look at how General Motors’ EPS estimates have been revised over the past 90 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

GM currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don’t build. It’s uniquely positioned to take advantage of the next growth stage of this market. And it’s just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>

Ford Motor Company (F) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).