Tesla Inc TSLA CEO Elon Musk has emphatically denied purportedly gifting a Cybertruck to Russian figure Ramzan Kadyrov. However, questions persist as to how the Chechen leader, an ally to Russian President Vladimir Putin, acquired the futuristic vehicle when its production remains centered in the United States.

The Denial: Musk’s response to author Seth Abramson was terse and unequivocal, dismissing notions of a Cybertruck donation to a Russian general as ludicrous.

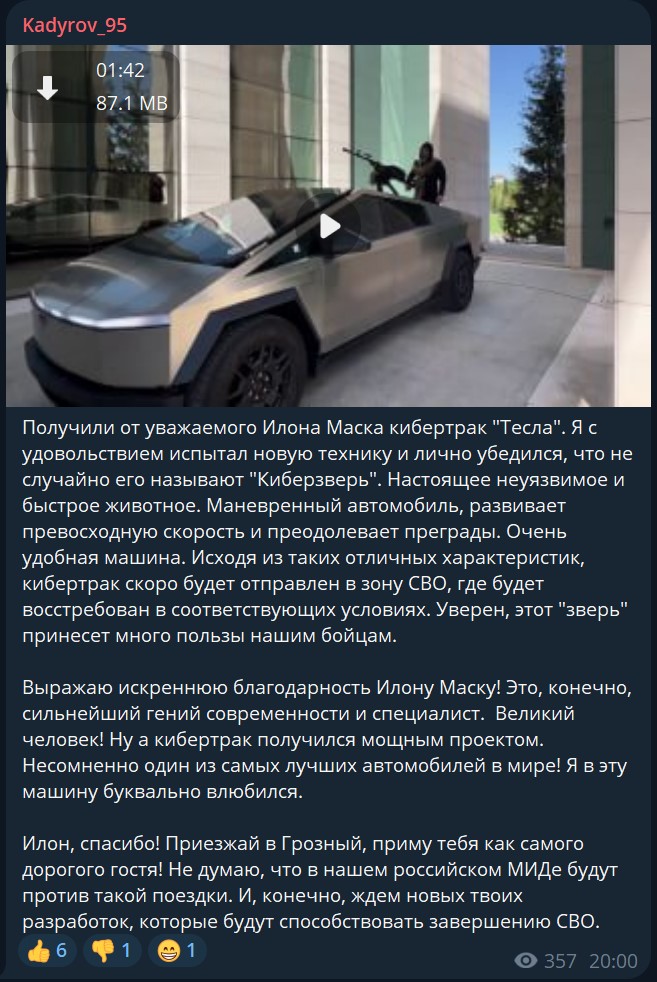

These allegations surfaced after Kadyrov, also a colonel general in the Russian military, shared a video of himself navigating the Cybertruck, complete with a mounted machine gun, on messaging app Telegram.

Kadyrov extrapolated on the Cybertruck’s potential utility, insinuating deployment within the Russia-Ukraine conflict zone. The leader extended an invitation to Musk to visit Chechnya, lauding Tesla’s founder as a “strongest genius” and a “great man.”

Theoretical benefits aside, questions surrounding the Cybertruck’s accessibility to figures like Kadyrov remain unanswered, despite the CEO’s disavowal of any donation.

While Tesla’s Cybertruck is renowned for its durability and toughness, featuring shatter-resistant windows touted to withstand high-velocity baseball impacts, the model has mainly been limited to U.S. markets. Plans for international distribution, beyond Canada, remain uncertain.

The vehicle’s promotional events showcased its robust engineering through bulletproof testing, displaying its resilience against various firearms. Musk’s denial notwithstanding, the circumstances surrounding the Cybertruck’s appearance in Kadyrov’s hands remain a subject of speculation within the investor community.

Market News and Data brought to you by Benzinga APIs