The Golden Cross: Illuminating Possibilities for VNET

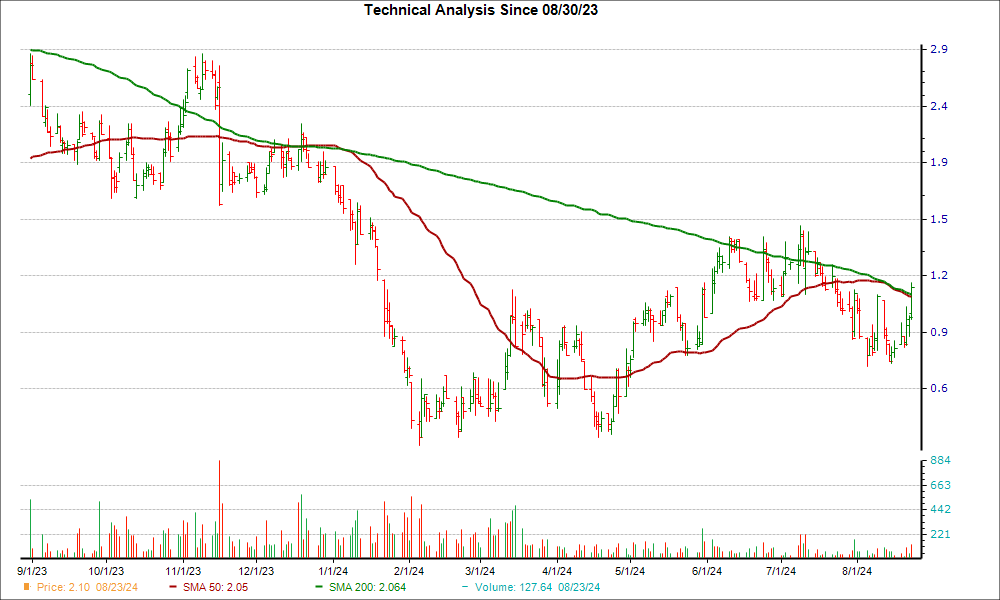

Step into the world of technical analysis, and you’ll find Vnet Group Inc. (NASDAQ:VNET) standing at a pivotal juncture. The company has recently hit a significant level of support, signaling a compelling opportunity. VNET’s 50-day simple moving average has soared above its 200-day simple moving average, marking the emergence of what traders call a “golden cross.”

Decoding the Golden Cross

A golden cross is more than just a fancy term – it’s a beacon of hope for traders eyeing a bullish wave. This technical chart pattern materializes when a stock’s short-term moving average surpasses its long-term moving average. The most prevalent crossover involves the 50-day and the 200-day moving averages, as extended time periods often herald robust breakouts.

The Three-Stage Symphony of Success

The journey of a successful golden cross unfolds in three acts. It commences with the stock hitting a trough in its downward trajectory. Next, the shorter moving average ascends above the longer moving average, heralding a positive shift in trend. The grand finale materializes when the stock upholds its upward trajectory, charting a path to growth.

Golden Cross vs. Death Cross

Contrasting the golden cross is the ominous death cross – a technical omen hinting at bearish price movements on the horizon.

Prospects on the Horizon for VNET

VNET seems poised on the brink of a breakthrough, with a commendable 25.3% surge over the past four weeks. Moreover, the company presently holds a #2 (Buy) on the Zacks Rank.

Brightening Earnings Outlook

Delving into VNET’s earnings forecast deepens the case for an upward trend. In the current quarter, analysts have revised estimates upwards on one occasion, with no downward adjustments in the past 60 days. The Zacks Consensus Estimate has mirrored this positive trajectory.

Outlook: Bright with a Chance of Gains

Propelled by surging earnings forecasts and the auspicious technical indicator, VNET holds promise for investors seeking potential gains in the imminent future.