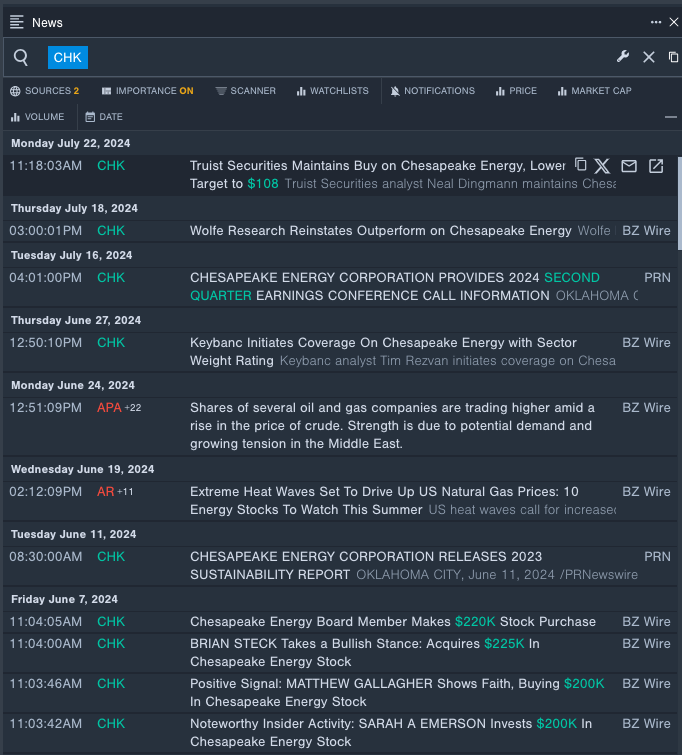

Chesapeake Energy Corp (NASDAQ:CHK)

Investors eyeing oversold stocks have a compelling opportunity in undervalued companies within the energy sector. With the Relative Strength Index (RSI) indicating oversold conditions when below 30, Chesapeake Energy Corp emerges as a prime candidate for potential growth. Recently, the stock witnessed a 4% decline over five days, settling at $77.79 after a 0.5% increase on Friday. An RSI value of 28.39 underscores the stock’s current position, presenting an entry point for discerning investors.

EQT Corp (NYSE:EQT)

Against a backdrop of evolving market dynamics, EQT Corp showcases resilience amidst a 5% decline over five days, culminating in a closing price of $34.31 following a 0.2% drop on Friday. President and CEO Toby Z. Rice’s optimistic outlook after the company’s better-than-expected quarterly results suggests a strategic market positioning. Furthermore, an RSI value of 27.60 highlights EQT’s underappreciated potential, making it a noteworthy prospect for investors seeking growth opportunities.

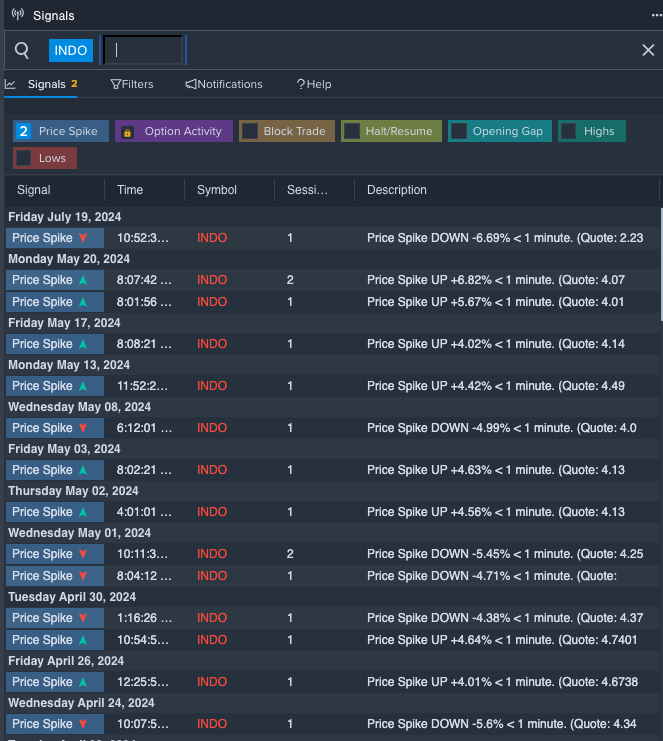

Indonesia Energy Corp Ltd (NYSE:INDO)

Indonesia Energy Corp Ltd recently completed a significant operational update, signaling progress with the recording of new 3D seismic data at its Kruh Block. Despite a 23% dip in stock value over the past month, Friday’s closing price of $2.12 following a 1% gain indicates a potential resurgence. With an RSI value of 23.28, Indonesia Energy Corp Ltd presents an intriguing opportunity for investors seeking to capitalize on undervalued assets with latent growth prospects.

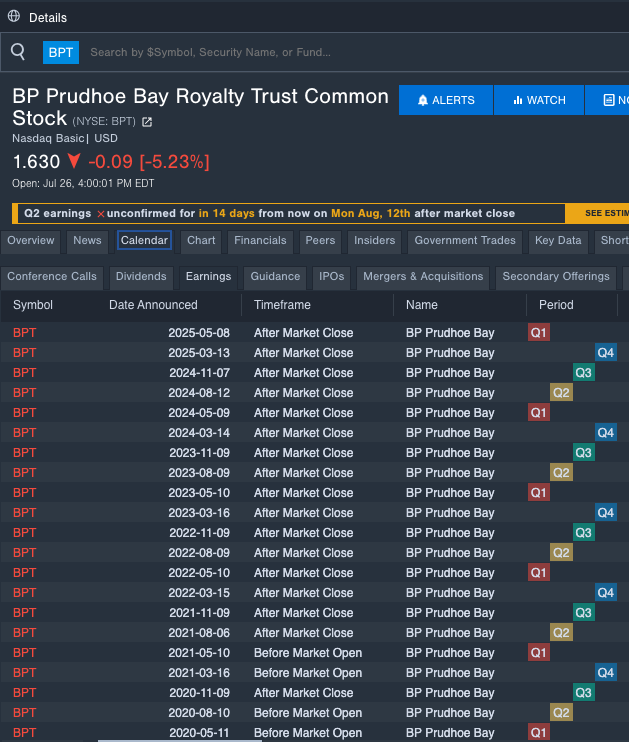

BP Prudhoe Bay Royalty Trust (NYSE:BPT)

Amidst evolving market dynamics, BP Prudhoe Bay Royalty Trust encountered a setback with unitholders forgoing dividends for the last quarter. The stock witnessed a 25% decline over five days, settling at $1.63 after a 5.2% drop on Friday. With an RSI value of 23.92, the trust’s current position underscores both challenges and opportunities. For investors keen on navigating turbulent market conditions, BP Prudhoe Bay Royalty Trust offers a nuanced outlook worth exploring.