Before making investment decisions, savvy investors often glance at Wall Street analysts’ recommendations to gauge potential opportunities. But are these pronouncements mere market noise or worthy of attention?

Let’s delve into the sentiments echoed by Wall Street heavyweights regarding Allstate (ALL) and unpack the essence of brokerage recommendations and how they can be wielded to an investor’s advantage.

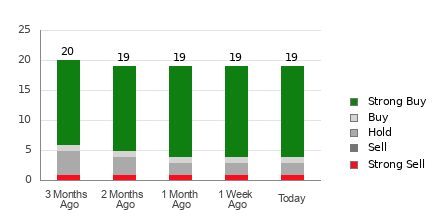

Presently, Allstate boasts an average brokerage recommendation (ABR) of 1.47, placed on a 1 to 5 scale (ranging from Strong Buy to Strong Sell) based on endorsements from 19 brokerage entities. A 1.47 ABR marks a position somewhere between Strong Buy and Buy.

Out of the 19 commendations that contribute to the current ABR, 15 are Strong Buy and one is Buy, constituting 79% and 5.3% of the total recommendations, respectively.

Insights on Brokerage Recommendations for ALL

Although the ABR advocates for investing in Allstate, it’s unwise to base investment decisions solely on this data. Various studies exhibit the limited efficacy of brokerage suggestions in identifying stocks with optimal price surge potential.

Curious as to why? The favorable bias of analysts employed by brokerage firms towards stocks they cover often leads to excessive optimism in their ratings. Our analysis indicates that for each “Strong Sell” endorsement, brokerage firms issue five “Strong Buy” recommendations.

Thus, their inclinations might not consistently align with those of individual investors, offering scant insight into a stock’s potential trajectory. Hence, this data might best serve as a validation tool for individual research or as a complement to a proven indicator for predicting stock price movements.

For instance, the Zacks Rank, our internally vetted stock rating mechanism, classifies stocks into five categories from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), serving as a reliable gauge for a stock’s forthcoming price performance. Validating the ABR through the Zacks Rank could be a judicious way to navigate investment choices.

Distinctive Traits of Zacks Rank Compared to ABR

While both ABR and Zacks Rank are denoted on a 1-5 scale, their evaluation metrics differ fundamentally.

The ABR hinges solely on brokerage recommendations and is typically represented with decimals (e.g., 1.28). Conversely, the Zacks Rank operates as a quantifiable model enabling investors to leverage earnings estimate revisions, presented as whole numbers ranging between 1 and 5.

Historically and presently, analysts under brokerage firms often display an overly optimistic bias in their recommendations due to their institutional interests. In contrast, earnings estimate revisions constitute the crux of the Zacks Rank, showcasing a robust correlation between estimate trends and short-term stock price fluctuations.

Furthermore, the different Zacks Rank grades are uniformly applied across all stocks for which brokerage analysts provide earnings forecasts. This approach ensures equitable representation within the five ranks.

An additional notable discrepancy between ABR and Zacks Rank pertains to currency. The ABR might lack real-time updates, but Zacks Rank adjusts swiftly to reflect analysts’ estimate revisions, remaining prompt in signaling future price shifts.

Is ALL a Lucrative Bet?

Regarding earnings estimate revisions for Allstate, the Zacks Consensus Estimate for the ongoing year has surged by 11.8% in the past month to $14.99.

The collective optimism of analysts concerning the firm’s earnings outlook, as evidenced by unanimous upward revisions in EPS estimates, could propel the stock to ascend in the near term.

Driven by the substantial consensus estimate alteration and other indicative factors tied to earnings projections, Allstate has clinched a Zacks Rank #1 (Strong Buy). Explore the comprehensive roster of current Zacks Rank #1 (Strong Buy) stocks here.

Therefore, the Buy-equivalent ABR for Allstate could serve as a prudent compass for investors.

Enhance Your Bitcoin Investment Insights

Zacks Investment Research presents a Special Report to aid you in capitalizing on substantial returns from Bitcoin, the premier decentralized currency.

While future outcomes are uncertain, Bitcoin has yielded remarkable returns in prior presidential election years: 2012 +272.4%, 2016 +161.1%, 2020 +302.8%.

Zacks foresees another significant upsurge. Access Bitcoin: A Tumultuous Yet Resilient History now.

Access the Free Stock Analysis Report on The Allstate Corporation (ALL)