Bitcoin, with its erratic undulations and soaring trajectory, has captivated a devoted following, carving its path as the quintessential cryptocurrency and scaling unprecedented peaks. As it hurtles towards surpassing its own zenith in 2024, the digital darling shows no signs of slowing down.

Bitcoin, the revolutionary frontrunner in the cryptocurrency domain, breached its zenith at an astounding peak of US$68,649.05 on November 10, 2021. Bolstered by the influx of surplus liquidity and burgeoning investor interest, Bitcoin’s value skyrocketed by over 1,200 percent from March 2020 to November 2021 before encountering turbulence in 2022.

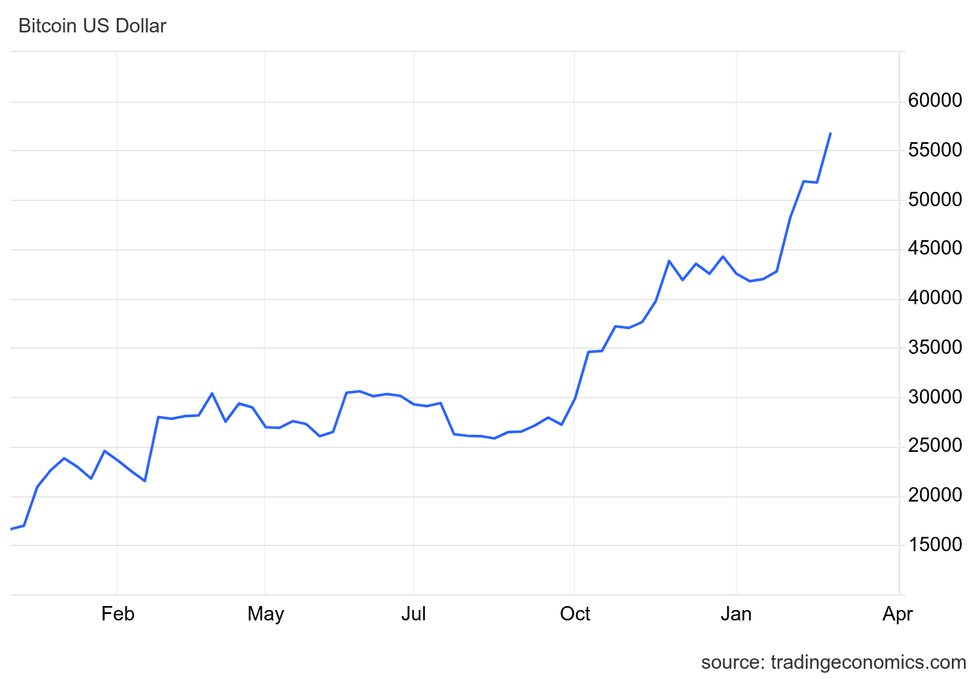

At the onset of 2024, Bitcoin commenced its journey slightly above the US$44,000 threshold and swiftly ascended to an impressive US$61,113 as of February 29, 2024.

Bitcoin’s Genesis: Weathering Storms to Pioneer Cryptocurrency

Conceived in response to the 2008 financial meltdown, Bitcoin withstood tumultuous fluctuations, surging to US$19,650 in 2017 only to languish beneath the US$10,000 mark for years. Unveiled towards the end of 2008 through a seminal white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” authored by the enigmatic Satoshi Nakamoto, the cryptocurrency laid the bedrock for a transformative monetary system.

Empowered by cryptographic security, the decentralized payment network aimed for transparency and censorship resistance, harnessing blockchain technology to forge an indelible ledger deterring double-spending. Bitcoin’s early adopters found allure in its potential to democratize financial control, a tantalizing prospect amidst the global turmoil stemming from the 2008 economic collapse.

The Limited Landscape of Bitcoins

In sharp contrast to traditional currencies that can inflate through printing, the supply of Bitcoins is finite, capped at 21 million. Presently, there exist 19,144,112 Bitcoins in circulation, with roughly 2 million awaiting mining.

This strict cap forms a cornerstone of Bitcoin’s algorithm, engineered to counter inflation by preserving scarcity. A new Bitcoin materializes when a miner employs specialized software to validate a blockchain block. Approximately 900 Bitcoins enter circulation daily, with the protocol automatically halving the issuance after every 210,000 blocks.

Bitcoin’s Resilience During the COVID-19 Storm

Inaugurating its price surge on January 1, 2016, Bitcoin escalated from US$433 to US$959 by year-end, marking a 121 percent appreciation. The subsequent year heralded mainstream acceptance, witnessing a meteoric rise from US$1,035.24 in January to US$18,940.57 in December, propelled by amplified awareness, the advent of new cryptocurrencies, and media spotlight.

While this zenith proved unsustainable, precipitating a descent fueled by Bitcoin’s innate volatility, the digital currency retained a floor above US$3,190, a low it has evaded since then. 2020 emerged as a litmus test for Bitcoin amid financial turmoil, commencing the year at US$6,950.56, plummeting to US$4,841.67 in March — a 30 percent slump.

Rebounding swiftly, Bitcoin capitalized on a buying spree, painting itself as a sanctuary asset akin to gold for the millennial and Gen Z cohort. Ending 2020 at US$29,402.64, Bitcoin leaped 323 percent year-over-year, dwarfing gold’s 38 percent appreciation from March to December.

Revisiting Bitcoin’s Price Pinnacle

2021 saw Bitcoin ascend to an unprecedented high of US$68,649.05 in November, a staggering 98.82 percent surge from January figures. Despite a corrective pullback to US$47,897.16 by year-end, Bitcoin notched a formidable 62 percent annual upswing.

The pinnacle in 2021 was largely attributed to increased risk appetite among investors, coupled with Tesla’s monumental investment of US$1.5 billion in Bitcoin. Tesla’s visionary move to accept Bitcoin as payment for electric vehicles further fueled Bitcoin’s ascension. However, ensuing events led to…

The Journey of Bitcoin: Smashing Expectations and Battling Volatility

Bitcoin and Renewable Energy: An Unconventional Romance

In response to criticism from investors and environmentalists, the electric car maker announced in 2021 its intention to scrutinize the amount of renewable energy used in mining cryptocurrency before allowing customers to purchase cars with it. However, as of September 2023, the enigmatic Elon Musk claimed that renewable energy adoption in the crypto sphere had met adequate thresholds, potentially reigniting the option.

The Rise and Fall of NFTs: A Tale of Digital Assets

Bitcoin rode the wave of increased money printing during the pandemic, attracting capital from investors seeking diversification. The success of the pioneering cryptocurrency amidst the tumultuous markets of 2020 and 2021 spurred interest and investments in other digital assets like non-fungible tokens (NFTs). NFTs, unique crypto assets exchanged digitally, boomed in 2021, hitting a market value of over US$40 billion. Despite a subsequent plummet to US$7.39 billion in November 2023, the NFT market rebounded impressively to US$58.71 billion by February 28, 2024.

Bitcoin’s Rollercoaster Ride: Breaking Records Amid Turbulence

While Bitcoin basked in the limelight, its primary nemesis remained its notorious volatility. The crypto coin’s value plummeted below US$20,000 during a turbulent 2022, sinking further to beneath US$17,500 by year-end. Yet, Bitcoin’s resilience manifested in remarkable price performances in 2023 and 2024.

The Path to Redemption: Bitcoin’s Emergence in 2024

Despite multiple challenges, Bitcoin defiantly weathered the storm in 2023, surging past US$30,000 amidst legal battles in the crypto sector. BlackRock’s pivotal move filing for a Bitcoin exchange-traded fund heralded a rebound, with Bitcoin hitting US$31,500 by July 3. Price stability was short-lived, but the crypto’s resilience shined again, holding above US$25,000 even in September 2023.

Bitcoin’s Next Chapter: A Glimpse into the Future

Chart via TradingEconomics.com.

Bitcoin surged towards the end of 2023, buoyed by institutional investments awaiting potential SEC approval for spot Bitcoin ETFs in early 2024. By mid-November, Bitcoin’s price soared to US$37,885, climbing further to US$42,228 by year-end.

Unlocking Bitcoin’s Potential: Spot ETFs and Beyond

Following the SEC’s green light on 11 spot Bitcoin ETFs, Bitcoin’s value leaped to US$46,620 on January 10, 2024. These ETFs continue to stimulate crypto demand, propelling Bitcoin to a remarkable 42% surge in February, culminating in a closing price of US$61,113 per BTC on the last day of the month.

Unveiling the Mysteries of Bitcoin and Beyond

FAQs for investing in Bitcoin

Decoding the Blockchain Puzzle

A blockchain, a decentralized ledger of cryptocurrency transactions, continuously expands with each block added chronologically. This revolutionary technology is increasingly integrated across various industries, including banking, cybersecurity, and supply chain management, among others.

Embarking on the Bitcoin Buying Journey

Procuring Bitcoin involves utilizing crypto exchange platforms and peer-to-peer trading apps, with digital wallets serving as custodians for the acquired digital assets. Notable platforms include Coinbase Global, CoinSmart Financial, BlockFi, Binance, and Gemini.

Exploring the Boundless Realm of Coinbase

Coinbase Global stands as a secure online crypto exchange facilitating the purchase, sale, and storage of various cryptocurrencies, catering to the needs of discerning investors in the digital asset landscape.

The Impact of Bitcoin on the Banking Industry

Exploring Cryptocurrency and Banking

Cryptocurrencies have emerged as a disruptive force in the financial arena, captivating a younger demographic seeking alternatives to traditional banking systems. With 53 percent of crypto owners falling between the ages of 18 and 34, there is a clear generational shift towards decentralized digital assets, as evident from data provided by Statista.

One of the primary appeals of cryptocurrencies lies in their privacy features and independence from central banks. Moreover, crypto transactions boast swift processing times and minimal associated fees compared to traditional banking methods.

While initially operating on the fringes, cryptocurrencies like Bitcoin have gained mainstream traction, prompting banks to invest in crypto and blockchain ventures to stay relevant in the evolving financial landscape.

Bitcoin Amid Banking Crisis

The recent banking turmoil, marked by the failures of institutions like Silicon Valley Bank and Signature Bank, has triggered a flight to Bitcoin among investors wary of the traditional banking sector’s stability. The acquisition of Credit Suisse by UBS has further fueled apprehensions regarding the banking industry’s resilience.

Despite a lull in banking crisis headlines, analysts warn of lingering issues in the regional banking domain, hinting at potential aftershocks in the near future. Bitcoin, which emerged in the aftermath of the 2008 financial meltdown, faces a volatile journey forward, with regulatory pressures and historical price fluctuations adding layers of uncertainty amidst the ongoing crisis.

The Genesis of Bitcoin Value

The origin of Bitcoin traces back to a modest transaction in late 2009, where 5,050 Bitcoins exchanged hands for a meager US$5.02 via PayPal. This foundational deal pegged the value of 1 Bitcoin at about US$0.001, a humble beginning for the digital currency that would later disrupt the financial world.

Bitcoin as an Investment Avenue

Bitcoin’s ascent in value during 2024 notwithstanding, its notorious volatility remains a cornerstone of the cryptocurrency’s allure. While adept risk-takers have historically reaped gains from the crypto realm, conservative investors wary of substantial risks might seek steadier investment avenues to safeguard their assets.

For those contemplating Bitcoin investments, the dynamic nature of the cryptocurrency market demands careful consideration of the associated risks and rewards, prompting a personalized approach tailored to individual risk appetites.

Cathie Wood’s Bullish Bitcoin Projections

Renowned investor Cathie Wood of ARK Invest espouses a bullish stance on Bitcoin’s future trajectory, envisioning lofty price targets for the digital asset. Wood’s predictions, including a base-case valuation of US$600,000 and a bullish scenario exceeding US$1 million by 2030, underscore her optimism towards Bitcoin’s long-term prospects.

Key Players in the Bitcoin Universe

While Satoshi Nakamoto, the elusive creator of Bitcoin, remains a shadowy figure, analysis of early Bitcoin wallets suggests Nakamoto commands a substantial portion of the existing Bitcoin supply, with holdings surpassing 1 million of the nearly 19.5 million Bitcoins in circulation.

Elon Musk’s Bitcoin Ventures

Elon Musk, the enigmatic figure behind Tesla and Twitter, has left an indelible mark on the crypto landscape through his association with Bitcoin and Dogecoin. Musk’s candid involvement in cryptocurrencies, evident through Tesla’s significant Bitcoin purchase in 2021 and subsequent divestment, underscores his influence on digital asset valuations.

Musk’s personal stake in Bitcoin and Dogecoin, along with SpaceX’s Bitcoin holdings, accentuate his commitment to the crypto sphere, shaping narratives and price trajectories through his social media pronouncements and corporate decisions.

Warren Buffett’s Stance on Bitcoin

Venerated investor Warren Buffett has articulated his skepticism towards cryptocurrencies, asserting his disinterest in owning Bitcoin due to its speculative nature. Buffett’s candid remarks, delivered during annual Berkshire Hathaway shareholders meetings and media interactions, underscore his conservative investment philosophy at odds with the crypto fervor sweeping financial markets.

This insightful narrative sheds light on the interplay between Bitcoin and the banking sector, showcasing the disruptive potential of cryptocurrencies in reshaping traditional financial paradigms.