As investors ponder the fate of their portfolios, whispers from Wall Street analysts echo loudly. The current whispers surrounding Cameco (CCJ) paint a picture of optimism. But is there substance behind the facade?

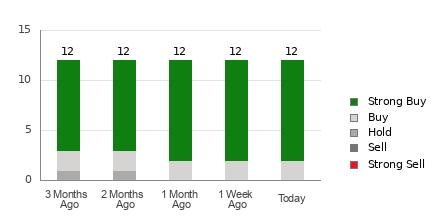

Embarking on this journey, we uncover that Cameco boasts an Average Brokerage Recommendation (ABR) of 1.17, indicating a bullish sentiment. This figure falls between a Strong Buy and a Buy, testimony to the vote of confidence lent by the 12 brokerage firms under scrutiny.

Delving deeper, we find that the majority of recommendations, 83.3%, stand at Strong Buy, while the rest occupy the Buy category. Such favorable ratings, however, need cautious navigation in the turbulent waters of the stock market.

Unveiling the Trending Brokerage Recommendations for CCJ

While the ABR points towards a green light for Cameco, prudence suggests using this information as a complement rather than a compass. Brokerage analysts, biased by their affiliations, often sport rose-tinted glasses, skewing their recommendations.

But fear not! The Zacks Rank saunters in as a guiding light, segregating stocks into five tiers of promise. An enclave of numerals from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) ushers in evidential support for making a judicious investment choice.

Decoding the Distinction Between Zacks Rank and ABR

Despite both Zacks Rank and ABR parading within the confines of a 1-5 scale, they tiptoe on divergent paths. ABR, molded by brokerage whims, dances with decimals, while the Zacks Rank, a quantitative maven, marches in whole numbers, guided by the winds of earnings estimate revisions.

History whispers tales of the brokerage clan’s propensity for over-exuberance in recommendations. In contrast, the Zacks Rank finds solace in the symphony of earnings estimate revisions, a melody that often foreshadows stock price movements.

As the sun sets on the ABR, its timeliness wanes, offering stale insights. Yet, the Zacks Rank, a creature of constant motion, mirrors analysts’ flurried dance with swift updates, a fresco of vigor in predicting future stock trajectories.

Is CCJ Worthy of Your Investment?

In the realm of earnings estimate revisions, a harmonious chorus fills the air for Cameco, with the Zacks Consensus Estimate holding steady at $1.07 for the current year. This stability in the face of upheaval might bode well for Cameco’s alignment with broader market rhythms in the days to come.

An unchanged consensus estimate, coupled with assorted factors influencing earnings estimates, manifests a Zacks Rank #3 (Hold) for Cameco. A delicate dance with caution might be prudent in this scenario, considering the fervor surrounding the Buy-equivalent ABR for Cameco.