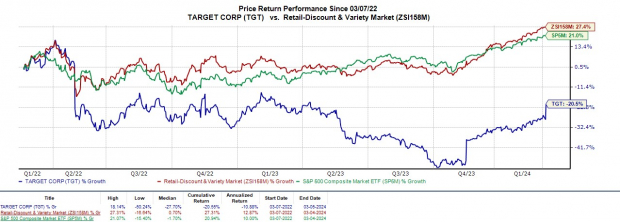

Target TGT headlined Tuesday’s trading session with a remarkable spike of +12% after exceeding fourth-quarter expectations. Despite a +17% surge year-to-date, the stock remains plagued by a -20% dip over the last two years. Nevertheless, CEO Brian Cornell expresses determination to revive the retail giant’s profitability and mojo.

Image Source: Zacks Investment Research

Improved Traffic Trends Boost Q4 Results

Target witnessed another quarter of improved traffic, propelling its post-earnings rally. Consumer shopping behavior increasingly favors Target, with its same-day services experiencing a significant 13.6% sequential increase, now comprising 10% of total sales through in-store pickups, drive-ups, and shipments.

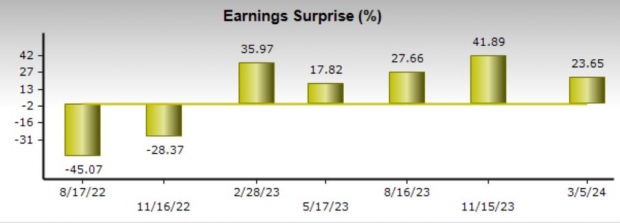

In a year-over-year comparison, Target’s Q4 earnings surged by 57% to $2.98 per share, outperforming the Zacks Consensus by an impressive 23%. Additionally, fourth-quarter revenue of $31.91 billion marked a 2% YoY rise, exceeding estimates of $31.84 billion. Despite a 1% decline in total revenue to $107.4 billion, Target’s annual earnings almost doubled in fiscal 2024 to $8.94 per share.

Image Source: Zacks Investment Research

Favorable EPS Guidance & Outlook

In the first quarter, Target anticipates EPS to range between $1.70-$2.10 per share, aligning with the current Zacks Consensus of $2.07 per share, signaling 1% growth. For the fiscal year 2025, annual EPS projection stands at $8.60-$9.60 per share, echoing Zacks estimates of $9.17 per share, forecasting a 9% growth.

Reasonable Valuation

Target’s current P/E valuation supports the recent rally, with TGT shares trading at 16.4X forward earnings, a favorable discount compared to the Zacks Retail-Discount Stores Industry average of 22.4X. Furthermore, Target’s stock trades below the S&P 500’s 21.4X and Walmart’s 25.3X.

Image Source: Zacks Investment Research

Key Takeaways

Target’s revitalization is evident in its cash flow, more than doubling in FY24 to $8.6 billion. At the moment, Target’s stock boasts a Zacks Rank #2 (Buy), indicating its potential to outperform the broader market in the short term.

Just Released: Zacks Top 10 Stocks for 2024

Hurry now to secure your spot among the elite Zacks Top 10 Stocks for 2024, meticulously picked by Zacks Director of Research, Sheraz Mian. This exclusive portfolio boasts a remarkable track record, tripling the S&P 500’s performance from inception in 2012 through November 2023. With careful analysis and curation, Sheraz has selected the best 10 stocks poised for success in 2024. Be among the first to discover these high-potential stocks!