Advancement and development in artificial intelligence (AI) has remained a headline topic in 2024 and will likely continue for the foreseeable future. The obvious reason for the AI buzz is of course attributed to its ability to optimize and accelerate production.

Artificial intelligence is being used by businesses in a variety of ways to improve efficiencies, save time, and decrease costs. The economies of scale that AI powers is also why it is considered one of the most groundbreaking technologies in modern history.

Dell & Hewlett-Packard’s Role in AI Revolution

One of the reasons Nvidia has been so successful in terms of its AI-powering capabilities is because of its partnerships with Dell Technologies DELL and Hewlett Packard Enterprise HPE. Using Nvidia’s AI chips, Dell and Hewlett-Packard have advanced the magnitude of IT solutions and integrated systems extending to servers, storage, data security and management.

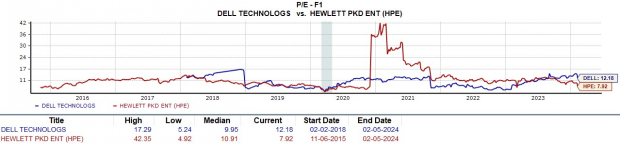

With AI revamping Dell and Hewlett-Packard, their top and bottom lines should be secure making them two of the more intriguing value stocks to consider in the tech sector. Both sport an “A” Zacks Style Scores grade for Value with Dell’s stock trading at 12.1X forward earnings and Hewlett-Packard shares at just 7.9X.

Furthermore, Dell has now surpassed earnings expectations for seven consecutive quarters with Hewlett-Packard topping EPS estimates in its last four quarterly reports. Dell’s stock currently covets a Zacks Rank #1 (Strong Buy) and will be reporting its fourth quarter earnings for fiscal 2023 at the end of the month, with Hewlett-Packard sporting a Zacks Rank #2 (Buy) and set to release Q1 results for FY24 in early March.

Image Source: Zacks Investment Research

Palantir’s Surge After AI Boost Revenue

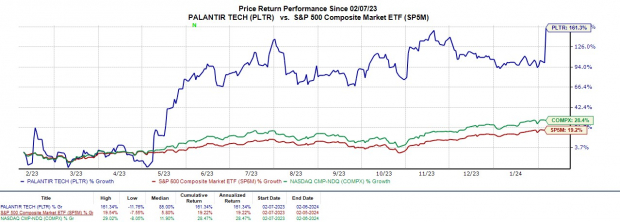

Reporting its Q4 results after hours on Monday, Palantir Technologies PLTR is certainly a company with AI capabilities that will be on more investors’ radars. Palantir’s stock popped +30% in today’s trading session to $21 a share as demand for its AI Platform (AIP) led to Q4 sales rising 19% to $608.35 million.

Image Source: Zacks Investment Research

To that point, Palantir has started to prove that demand for its AIP is very real and driven by its machine learning capabilities or Large Language Model (LLM) which is an AI algorithm that employs neural network techniques with an extensive number of parameters to process and understand human languages and text.

These LLMs can be critical to building Palantir’s software that assists in counterterrorism investigations and operations. Palantir’s U.S. commercial revenue was up 40% and the U.S. government has been one of its main clients due to the company’s advancement in defense intelligence.

Palantir reported Q4 net income of $93.4 million which more than tripled from $30.9 million a year ago. Earnings of $0.08 a share came in line with the Zacks Consensus and doubled from $0.04 a share in the prior-year quarter.

Image Source: Zacks Investment Research

Bottom Line

With Dell’s stock still under $100 and Hewlett-Packard and Palantir shares trading under $25, these are three of the more affordable and promising “AI” stocks to consider. They should also be viable investments for 2024 and beyond as the AI revolution continues to accelerate.