As investors navigated the tumultuous waves of the market earlier in the week, a sense of cautious optimism pervaded. However, the tides shifted dramatically on Friday (August 23) afternoon after a momentous declaration from US Federal Reserve Chair Jerome Powell.

Powell’s discourse at Jackson Hole resonated across the financial landscape as he hinted at readiness for interest rate reductions, stirring excitement and new possibilities in the air.

Simultaneously, the crypto markets experienced a burst of activity, shattering the confines of a prolonged pricing stalemate. In a parallel narrative, Waymo unveiled an upgraded iteration of its self-driving technology, constituting yet another stride in a recent succession of triumphs.

For a comprehensive overview of the developments unfolding in the tech realm, trust the Investing News Network’s digest.

1. Markets Embrace Speculation as Rate Cuts Loom Large

The commencement of the week was marked by a tentative start for stock markets, with the S&P 500 (INDEXSP:.INX) and Nasdaq Composite (INDEXNASDAQ:.IXIC) commencing below the prior week’s close on Monday (August 19). However, they swiftly turned the tide, securing their eighth consecutive day of gains alongside the S&P/TSX Composite Index (INDEXTSI:OSPTX).

The Russell 2000 Index (INDEXRUSSELL:RUT) surged by 1.1 percent on the same day, hinting at the underlying resilience of the markets.

Transaction activity remained cautious during the week, leaving the major indexes relatively unmoved by Tuesday (August 20) morning as investors awaited fresh inflation data. Wednesday (August 21) heralded the disclosure of US non-farm payroll benchmark revisions and the minutes from July’s Federal Reserve meeting.

The data released by the Bureau of Labor Statistics revealed a moderated job growth compared to prior estimates, even as the labor market exhibited signs of expansion. Furthermore, the minutes from the Fed meeting indicated a contemplation of a quarter percentage point rate cut in response to dwindling inflation and escalating unemployment, setting the stage for a potential rate cut in September.

This revelation infused the indexes with fresh vigor, propelling the Russell 2000 to the forefront with a gain of over 1 percentage point, culminating at 2,170.32 at closing.

The market’s upward trajectory persisted into Thursday (August 22) morning, with all indices except for the S&P/TSX Composite opening above the preceding day’s closure. Economic indicators pointed to a decline in the US manufacturing PMI to 48 in August from 49.6 in July, falling short of expectations.

Conversely, initial jobless claims for the week ended on August 17 registered a slight uptick compared to the previous week, rising by 4,000 to 232,000.

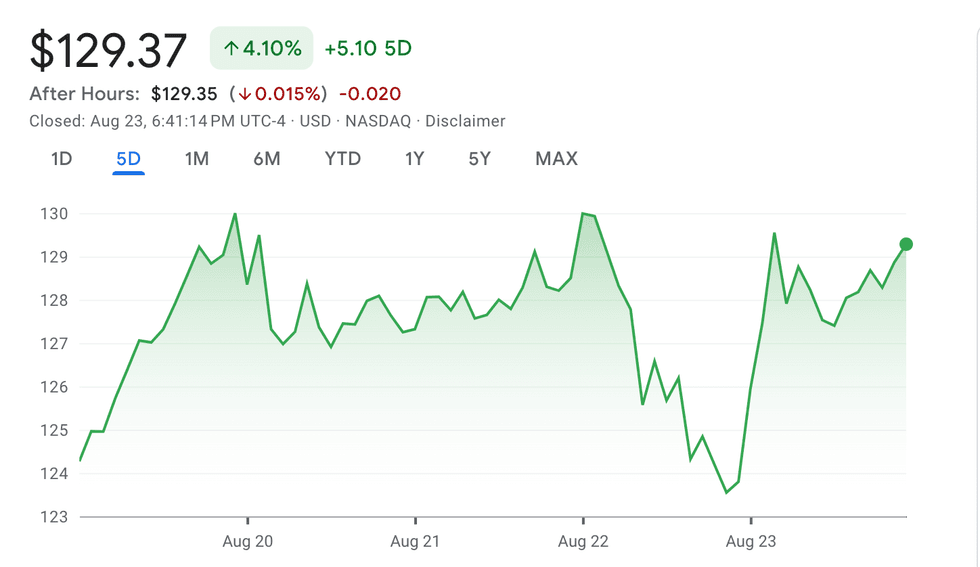

Chart via Google Finance.

NVIDIA performance, August 19 to August 23, 2024.

The stock market witnessed a midday retreat on Thursday, spearheaded by the unavoidable ramifications of the upsurge in economic speculation.

Diving into the Latest Market Swings and Political Intrigue

An Uncertain Market Terrain

Investors in the tech sector saw NVIDIA (NASDAQ:NVDA) experience a tumultuous week as its stock price tumbled by 4.77 percent in response to market gyrations. However, optimism made a comeback on Friday morning as Jerome Powell, during the Kansas City Fed’s annual economic conference in Jackson Hole, Wyoming, hinted at an impending rate cut without specifying the magnitude. He cryptically remarked, “The time has come for policy to adjust,” signaling potential changes based on forthcoming data and risk considerations.

The market roared back to life, with all major indexes witnessing a surge in response to Powell’s words. Particularly, the Russell 2000 index stood out, climbing over 3 percent midday, reflecting a broader trend of growing interest in mid-cap stocks fueled by positive Federal Reserve data over recent months.

Wrapping up the week on a high note, all four major indexes closed with gains exceeding 1 percent, with the Russell 2000 leading the charge with a remarkable surge of over 3 percent, leaving investors cautiously optimistic about the unpredictable market landscape.

Bitcoin’s Rollercoaster Ride

The cryptocurrency world witnessed Bitcoin’s price rollercoaster, dipping below US$58,000 in early week trading before recovering to breach the US$61,000 mark. A subsequent sharp pullback on Tuesday, aligned with a decline in US stock indexes, raised concerns. K33 analysts highlighted the lowest seven-day average annualized funding rate since March 2023, hinting at increased short bets and the looming possibility of a squeeze.

Bitcoin’s price oscillated further throughout the week, hovering in the US$59,000 range before eventually breaking above US$60,000 and then US$61,000. Despite recent data signaling a slight drop in Bitcoin demand, institutional investors continued accumulating tokens, with a notable 14 percent uptick in those holding Bitcoin ETFs in Q2 versus Q1, underscoring sustained interest among major market players.

Amidst concerns raised by Fairlead Strategies about a potential downturn in Bitcoin’s future based on technical indicators, the crypto market surged following positive economic cues. The anticipation of an imminent rate cut in September, solidified by Powell’s address, propelled Bitcoin above US$64,000 by week’s end, with Ether also enjoying a significant boost, trading above US$2,770.

Political Quandaries and Crypto Exclusions

Prior to the Democratic National Convention, the unveiling of the party’s 2024 platform triggered interest and scrutiny. While covering various issues including economic policy and social justice, the absence of Vice President Kamala Harris’s stance on cryptocurrency and web3 infrastructure raised eyebrows within the crypto community.

Speculation runs wild as stakeholders ponder whether Harris could prove more crypto-friendly than the current administration, given her silence on decentralized finance regulation and taxation matters. The platform’s mention of “Biden’s second term” further fueled intense speculation, leaving observers eagerly waiting for potential policy shifts amidst the complex interplay of markets and political narratives.

Insights into Financial Developments Shaping the Market

Surging Ahead: The Latest in Crypto Campaign Strategies

Just before President Joe Biden exited the 2024 presidential race, Vice President Kamala Harris emerged as a prominent figure with potential shifts in views on cryptocurrency and web3 infrastructure becoming evident in the campaign. Recent statements from her senior adviser for policy, Brian Nelson, revealed Harris’ willingness to support measures that foster the growth of emerging technologies.

A notable transition in the crypto-driven political landscape was the marked difference in approach between the Democratic and Republican candidates. While Donald Trump’s embrace of Bitcoin initially provided an advantage with crypto-focused audiences, recent developments have seen a shift in momentum.

On the crypto-betting platform Polymarket, a see-saw battle between the two contenders unfolded, where Harris briefly surged ahead only to be overtaken by Trump in a surprising turn of events. Decrypt, a crypto media outlet, speculated that the absence of a clear stance on cryptocurrency in the Democratic Party’s platform might have contributed to this dynamic shift.

Next Level Autonomy: Waymo’s Cutting-Edge Driver Technology

Waymo, a subsidiary of Alphabet, raised the stakes in autonomous driving technology by unveiling its latest innovation, the 6th Generation Waymo Driver. The upgraded system, introduced on Monday, promises enhanced capabilities and cost-effectiveness compared to its predecessor.

The 6th Generation Waymo Driver boasts an increased range of vision up to 500 meters, improved resilience to adverse weather conditions, and advanced sensor technology for superior navigation. Waymo CEO Tekedra Mawakana highlighted the exponential growth in the company’s Waymo One robotaxi service, now exceeding 100,000 rides per week, reflecting a twofold increase since May.

Having evolved from a self-driving project in 2009 to a commercial service provider spanning several states, Waymo’s partnership with Uber in 2023 underscored its commitment to innovation. Alphabet’s substantial investment of US$5 billion in Waymo, as disclosed in a recent earnings call, further solidified its position as a pioneering force in the autonomous vehicle industry.

AMD’s Strategic Move: Fostering AI Capabilities with ZT Systems Acquisition

Advanced Micro Devices (AMD) announced its strategic acquisition of ZT Systems, a specialist in server and network equipment development, marking a significant step in bolstering its data center artificial intelligence (AI) capacities. The deal, valued at US$4.9 billion, is a pivotal component of AMD’s long-term AI strategy.

AMD’s Chair and CEO Dr. Lisa Su emphasized the company’s commitment to delivering cutting-edge AI solutions that can be swiftly deployed across cloud and enterprise segments through the acquisition of ZT Systems. The transaction, structured with a mix of cash and stock, signifies AMD’s foray into the burgeoning realm of AI technologies.

AMD’s stock witnessed a surge of 4.66 percent following the announcement, reaching a peak of US$161.57 during the week’s trading sessions. The week concluded on a positive note, with AMD’s share price settling at US$154.97, reflecting a 4.46 percent increase over the week.