Investors searching for diamonds in the rough amidst a turbulent market may find solace in oversold stocks in the consumer staples sector. These stocks, often unfairly neglected, present an enticing proposition to savvy traders looking to seize opportunities amidst the chaos.

An insightful indicator, the Relative Strength Index (RSI), has emerged as a beacon of hope for discerning investors. By comparing a stock’s strength during upward and downward price movements, the RSI offers a glimpse into a stock’s short-term performance potential. When the RSI drops below 30, suggesting oversold conditions, market analysts pay attention.

Let’s delve into the stories of three hidden gems, poised to soar in the coming month.

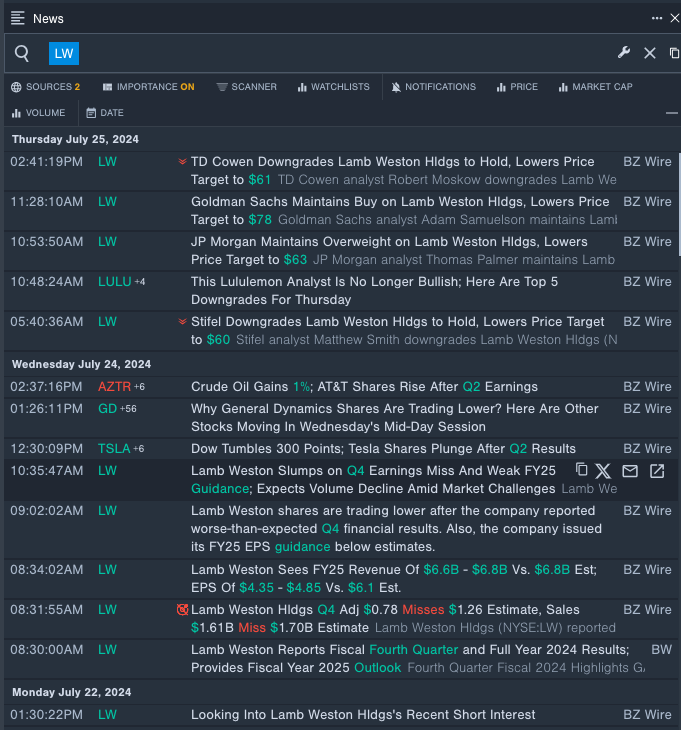

Lamb Weston Holdings Inc – LW

- In a recent twist of fate, Lamb Weston reported disappointing fourth-quarter financial results and provided a cautious outlook for its fiscal year 2025 earnings per share. The turbulent operating environment, marred by global restaurant traffic slowdowns and dampened frozen potato demand, cast a shadow over the company’s future. Consequently, the stock plummeted by approximately 33% in a mere five days, hitting a 52-week low of $52.99, leaving investors in a state of shock.

- RSI Value: 15.59

- LW Price Action: Lamb Weston’s shares tumbled by 6% to close at $53.01 on Thursday, adding to the woes of jittery shareholders.

- An illustration of the swift downfall of Lamb Weston can be observed in the chart below:

Boston Beer Company Inc – SAM

- Similarly, the iconic Boston Beer Company faced a setback with its second-quarter financial results falling below investor expectations. Despite promising signs of gross margin expansion and robust cash flow generation, the company had to navigate through challenging times. The stock witnessed an 11% decline over the past month, hitting a 52-week low of $254.40, leaving stakeholders in a state of trepidation.

- RSI Value: 24.15

- SAM Price Action: Boston Beer’s shares dipped marginally by 0.5% to conclude at $270.52 on Thursday, painting a somber picture for concerned investors.

- An evocative depiction of Boston Beer Company’s rollercoaster ride can be grasped from the chart presented below:

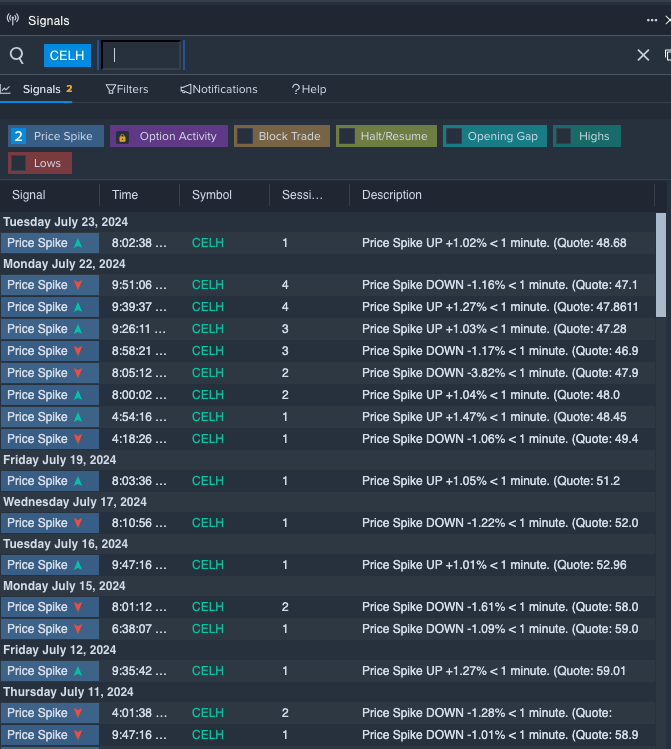

Celsius Holdings, Inc – CELH

- The narrative continues with Celsius Holdings, Inc., where B. Riley Securities upheld a Buy rating for the stock but revised its price target downwards from $110 to $80. A downward spiral saw the stock lose approximately 18% of its value over the past month, striking a 52-week low of $44.70, igniting concerns among shareholders.

- RSI Value: 29.12

- CELH Price Action: On a brighter note, Celsius Holdings registered a modest 1.7% gain to finish at $46.40 on Thursday, shedding light on a potential turnaround for hopeful investors.

- The intriguing tale of Celsius Holdings, Inc.’s tumultuous journey is encapsulated in the chart below:

Investors, brace yourself for a wild ride as these underdogs endeavor to rise from the ashes of adversity. While the road ahead may be fraught with challenges, the allure of a phoenix-like resurgence beckons those bold enough to venture forth into the tempest of the market.

Read Next: