Before diving into the tumultuous waters of the stock market, investors often seek solace in the recommendations of revered Wall Street analysts. These prophets of profit conjure opinions that can sway the mightiest of investment ships, like the fabled IonQ vessel, listed under the ticker IONQ.

The Enigma of Brokerage Recommendations for IonQ

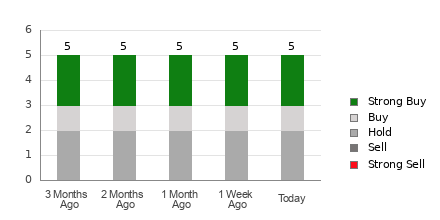

While the harmonious chorus of brokerages might sing tunes of Buy for IonQ, crossing the stormy seas of investment based solely on their calls can be akin to sailing blindly towards jagged rocks. Studies echo a cautionary tale – brokerage recommendations often masquerade as guiding lights but lead investors astray.

Curious minds may ponder – why the caution? The symbiotic dance between brokerage firms and stocks they cover casts a shadow of bias, with analyst recommendations donning rose-tinted glasses. An ominous revelation surfaces – for every whisper of “Strong Sell,” a resounding choir of “Strong Buy” envelops the airwaves.

In essence, the compass points north for brokerage interests, seldom mirroring the true north of retail investors’ fortunes. Thus, these recommendations might serve as validation tools, steering you to calmer seas of your own research or towards beacons like the heralded Zacks Rank, a guiding star in the tempest of the market.

Navigating the Tides: Zacks Rank vs. ABR

Distinct as day and night, the Zacks Rank and Average Brokerage Rating (ABR) may swim in the same waters but are creatures apart.

While brokerage recommendations meld to craft the ABR, veiled in decimal mystique, the Zacks Rank waltzes to a different tune – powered by earnings estimates, cast in whole numbers from 1 to 5.

Brokerage analysts, puppets to the institutions’ whims, often dress stocks in brighter hues than their fabric merits, confounding investors more than guiding. In contrast, the Zacks Rank twirls with earnings winds, tethering near-term stock movements to the eddies of estimate revisions, a dance verified by truth.

Moreover, while the ABR may age like fine wine, the Zacks Rank boasts youth, quick to embrace the winds of change as analysts adjust their sails, always in tune with the market’s rhythm.

Determining the Course: Should IonQ be Anchored or Adrift?

Peering into the crystal ball of earnings estimates for IonQ, the Zacks Consensus Estimate for the current year stands unmoved at -$0.84, a beacon of stability amidst the tempestuous seas.

Analysts, like seers of old, hold steady in their prophecy of IonQ’s fortunes, reflected in a unanimous street call of Hold, denoted by the Zacks Rank of #3. Prudence then warns, a cautious eye should be cast upon the siren’s song of Buy-equivalent ABR for IonQ.

To sail further into this investment saga, heed the call here.

© 2024 Benzinga.com. Benzinga, not a sage of investments, wanders these realms. All rights loosed to the tides of time.