Nike and Lululemon, two retail giants, despite surpassing expectations for both revenue and profit in their recent quarterly reports, witnessed a decline in their stock prices following softer-than-anticipated guidance.

The question that lingers in the minds of investors is whether now is the opportune moment to seize the downfall in the shares of Nike, currently down 13% year to date, and Lululemon, which has experienced a 20% slump.

Image Source: Zacks Investment Research

Favorable Quarterly Performance

In the latest fiscal quarter, Nike reported an earnings per share of $0.98, reflecting a robust 24% increase from the previous year and surpassing Q3 expectations by an impressive 42%. Quarterly sales stood at $12.42 billion, slightly higher than the previous year, outperforming estimates by 1%. Notably, Nike has outshone earnings forecasts in three out of the last four quarters, with an average earnings surprise of 22.55%.

Image Source: Zacks Investment Research

Strong Show by Lululemon

Lululemon also posted impressive figures, with Q4 earnings climbing 20% to $5.29 per share, beating estimates by 5%. Quarterly sales surged by 15%, reaching $3.2 billion, slightly exceeding expectations. Of note, Lululemon has continuously surpassed earnings projections for 15 consecutive quarters, with an average earnings surprise of 9.68% in the last four quarters.

Image Source: Zacks Investment Research

Weaker Sales Projections

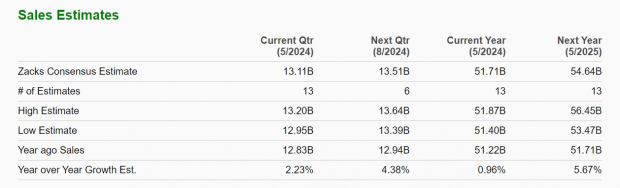

Despite the stellar earnings, both Nike and Lululemon offered conservative revenue guidance. Nike foresees a modest 1% increase in total sales for the fiscal year 2024, with expectations aligned with Zacks estimates. However, the athletic footwear giant anticipates a single-digit revenue decline in the first half of fiscal year 2025 due to ongoing product innovation in what it refers to as a subdued economic climate.

Image Source: Zacks Investment Research

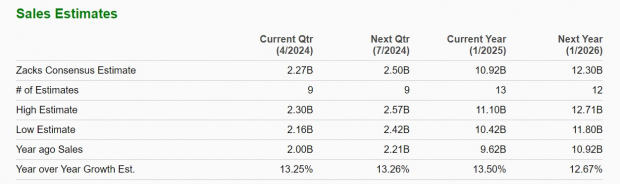

Lululemon attributed its soft revenue guidance for the upcoming first fiscal quarter to a slowdown in consumer demand. The company expects Q1 sales to range from $2.17 billion to $2.2 billion, slightly below Zacks’ $2.27 billion estimate. For the full fiscal year 2025, Lululemon projects total sales to be between $10.7 billion and $10.8 billion, a growth rate between 11-12%, contrasting with Zacks estimates of $10.92 billion or 13% growth.

Image Source: Zacks Investment Research

Outlook on Earnings

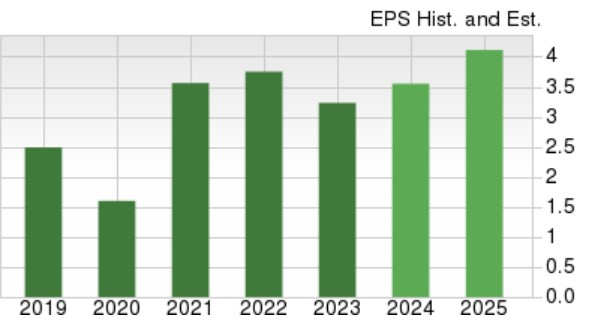

Nike has maintained its full-year net income guidance for FY24, anticipating a 9% rise in earnings per share to $3.54, based on Zacks estimates. Earnings for fiscal year 2025 are projected to leap by 16% to $4.12 per share.

Image Source: Zacks Investment Research

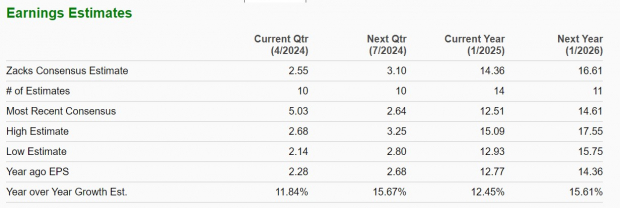

Lululemon expects its earnings per share for Q1 to fall between $2.35 to $2.40, against Zacks’ estimate of $2.55, reflecting 12% growth. Full-year EPS for FY25 is anticipated to range from $14.00 to $14.20, slightly under Zacks’ consensus of $14.36 per share, with growth exceeding 12%. Moreover, FY26 EPS is projected to grow by another 15% to $16.61 per share, as per Zacks estimates.

Image Source: Zacks Investment Research

The Verdict

Although Nike and Lululemon are currently facing challenges in meeting growth expectations, both stocks hold a Zacks Rank #3 (Hold). While short-term uncertainties may affect their growth trajectories, investors with a long-term perspective might find value in holding positions in these key retail players at their present valuations.