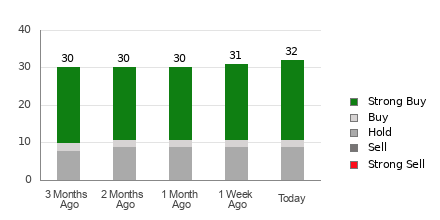

Brokerage Recommendation Trends for Pinterest

The allure of investment recommendations from Wall Street analysts is seductive yet laden with perilous undertones, akin to a shimmering desert oasis concealing treacherous quicksand. Carrying the imprimatur of 33 brokerage firms, Pinterest (PINS) is draped in an average brokerage recommendation (ABR) of 1.61, hanging delicately between the realms of Strong Buy and Buy. While 22 exhort a chorus of Strong Buy, a mere duo sing the less enthusiastic tune of Buy, forming the bedrock of opinion.

The ABR beckons like a Siren’s call, a harbinger of bullish winds, yet heed with caution. A legion of studies has pointed to the inconsequential nature of brokerage pronouncements in the labyrinth of investment decisions. An aura of skepticism envelops these recommendations, shrouded in the vested interests of brokerage firms, bestowing a bias akin to a doting parent.

The Zacks Rank stands aloof, a beacon of analytical rigor amid the murky waters of brokerage biases. Unlike the ABR, the Zacks Rank charts a course based on the constellations of earnings estimate revisions, guiding investors through the celestial dance of stock movements.

The ABR vs. Zacks Rank Distinction

While sharing numerical attire, the ABR and Zacks Rank are twins separated at birth, estranged by their disparate parentages. The former roots in the soil of brokerage opinions, adorned in decimal vestments; the latter, a creature of quantification, shines in whole-numbered glory. Unveiling the chasm between puffery and precision, analysts garland stocks with praise, contrasting starkly with the cold, hard logic of earnings revisions that fuels the Zacks Rank.

Earnings estimates paint a portrait of pessimism for Pinterest, the Zacks Consensus Estimate for the year waning by 0.1% in recent memory to reach $1.43. A symphony of analysts’ whispers foretells dark clouds on the horizon, with a Zacks Rank #4 (Sell) unfurling like a tattered flag in the wind.

Thus, the poise of skepticism courts Pinterest. The prospect of embracing the Buy-equivalent ABR dances on a knife’s edge, beckoning investors to tread cautiously.

Infrastructure Stock Boom to Sweep America

A prophecy looms large across the amber fields of America: an infrastructure renaissance on the horizon. A bipartisan chorus heralds the clarion call of trillions poised to slake the parched earth of neglect. Will fortunes bloom like desert flowers in this epochal revival?

Stocks await their moment in the sun, poised to ride the gusts of economic revival. The symphony of construction and repair crescendos, promising riches for the astute investor. Will you be among the harvesters of this bountiful season?