Opportunity Amidst Oversold Stocks

Investors eyeing the communication services sector have a chance to snap up undervalued companies with stocks that are deemed oversold. The Relative Strength Index (RSI) serves as a key indicator, providing insights into a stock’s strength during up and down market movements. When the RSI dips below the 30 marks, it signifies that an asset may be oversold, as reported by Benzinga Pro.

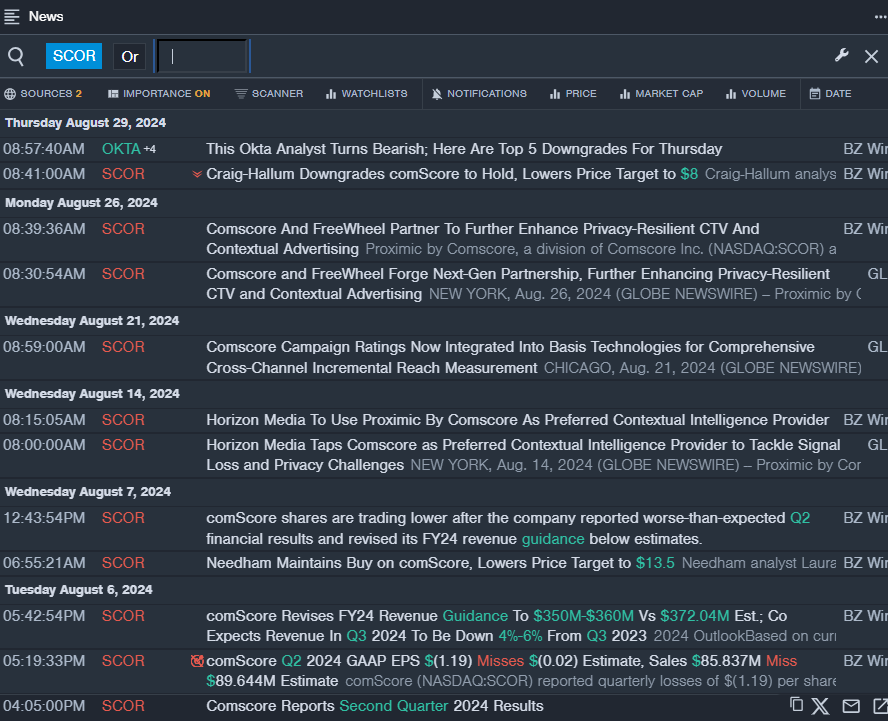

comScore Inc (NASDAQ:SCOR)

- Recently, comScore Inc released second-quarter financial results that failed to meet expectations, leading to a downward revision in its FY24 revenue forecast. Despite the setback, Jon Carpenter, the CEO of Comscore, remains optimistic about the company’s strategic shift towards delivering comprehensive omnichannel measurement solutions. With a stock plummet of approximately 45% over the past month and hitting a 52-week low of $6.41, comScore’s RSI stands at 28.03. On a positive note, the company’s stock rose by 2.3% to close at $7.17 on Friday.

SPAR Group Inc (NASDAQ:SGRP)

- SPAR Group Inc recently surpassed expectations with its quarterly sales report. Mike Matacunas, the President and CEO, highlighted the company’s focus on streamlining operations and driving growth in key regions. Notably, the company observed a revenue surge of 37% in the ongoing U.S. business and 14% in Canada. Despite a 20% decline in its stock value over the last month and achieving a 52-week low of $0.70, SPAR Group’s RSI currently stands at 25.61. The stock closed at $1.45 on Friday.

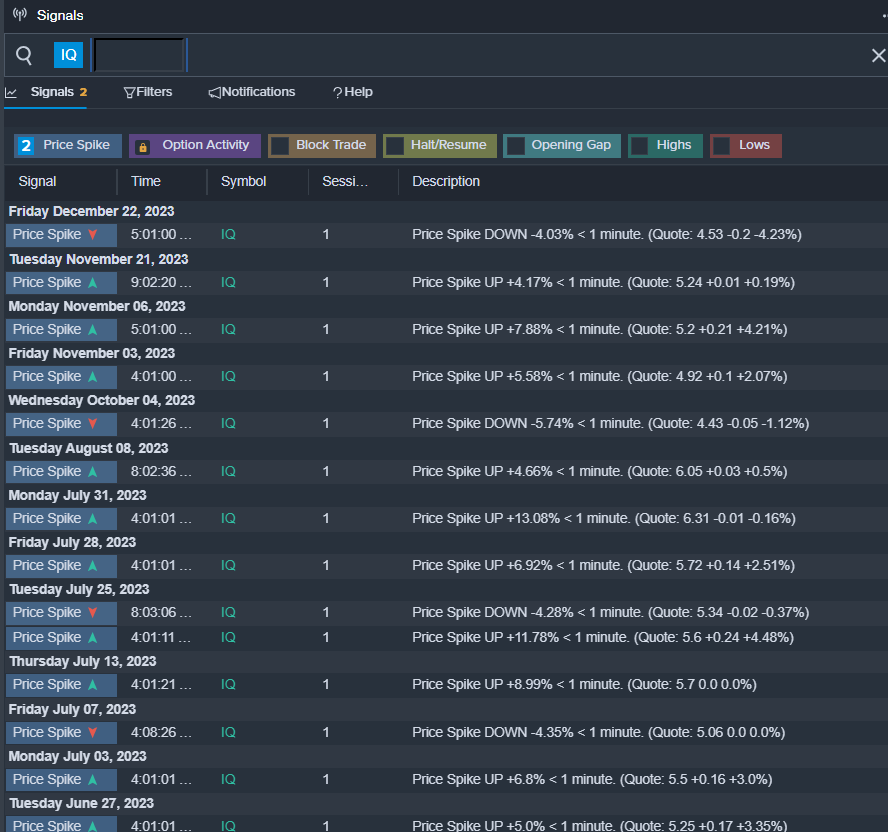

IQIYI Inc – ADR (NASDAQ:IQ)

- Goldman Sachs analyst Lincoln Kong recently downgraded iQIYI from Buy to Neutral and set a price target of $2.8. As a result, iQIYI’s shares witnessed a 31% decline over the past month, reaching a 52-week low of $2.08. With an RSI value of 26.24, the stock closed at $2.15 on Friday, marking a 4% decrease. Investors are keeping a close watch on potential developments in IQ shares, as indicated by Benzinga Pro’s signals feature.

Read More: